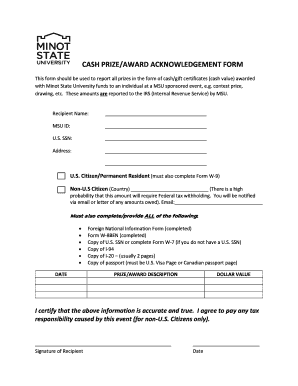

This Form Should Be Used to Report All Prizes in the Form of Cashgift Certificates Cash Value Awarded

Understanding the cash acknowledgement form

The cash acknowledgement form is a crucial document used to report all prizes awarded in the form of cash or gift certificates. This form serves as an official record, ensuring transparency and compliance with tax regulations. By documenting the cash value of prizes, organizations can maintain accurate financial records and fulfill their reporting obligations to the Internal Revenue Service (IRS). It is essential for both the issuer and the recipient to understand the implications of this form, especially regarding tax liabilities and potential reporting requirements.

Steps to complete the cash acknowledgement form

Completing the cash acknowledgement form involves several straightforward steps. First, gather all necessary information, including the recipient's name, address, and the amount of cash or gift certificate being awarded. Next, accurately fill out the form, ensuring that all details are correct to avoid any issues with tax reporting. Once completed, both the issuer and the recipient should sign the form to validate the transaction. Finally, retain a copy for your records and submit the original to the appropriate tax authority if required.

Legal use of the cash acknowledgement form

The cash acknowledgement form is legally binding when filled out correctly and signed by both parties involved. It serves as proof of the transaction, which can be important for tax purposes. To ensure its legal standing, the form must comply with relevant laws, including IRS guidelines regarding the reporting of income. Both issuers and recipients should be aware of their responsibilities under tax law to avoid penalties or audits related to unreported income.

IRS guidelines for the cash acknowledgement form

The IRS has specific guidelines regarding the reporting of cash prizes and awards. Generally, any cash prize exceeding a certain threshold must be reported as income by the recipient. The cash acknowledgement form helps facilitate this process by providing a clear record of the award. It is advisable for recipients to consult IRS publications or a tax professional to understand their obligations and ensure compliance with all reporting requirements.

Examples of using the cash acknowledgement form

Organizations often use the cash acknowledgement form in various scenarios, such as awarding cash prizes for contests, employee bonuses, or scholarship funds. For instance, a university may issue a cash prize to a student for winning an academic competition. In this case, the university would complete the cash acknowledgement form, providing the necessary details about the award and ensuring that the student understands their tax obligations. Such examples illustrate the form's versatility and importance in maintaining proper financial documentation.

Filing deadlines and important dates

It is crucial to be aware of filing deadlines associated with the cash acknowledgement form. Typically, forms must be submitted to the IRS by a specific date following the award of the cash prize. Organizations should keep track of these deadlines to ensure compliance and avoid any potential penalties. Recipients should also be mindful of when they need to report the income on their tax returns, which may differ based on individual circumstances.

Quick guide on how to complete this form should be used to report all prizes in the form of cashgift certificates cash value awarded

Effortlessly Prepare This Form Should Be Used To Report All Prizes In The Form Of Cashgift Certificates cash Value Awarded on Any Device

Digital document management has become increasingly popular among organizations and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely keep it online. airSlate SignNow equips you with all the tools needed to create, edit, and electronically sign your documents quickly without any delays. Manage This Form Should Be Used To Report All Prizes In The Form Of Cashgift Certificates cash Value Awarded using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to edit and electronically sign This Form Should Be Used To Report All Prizes In The Form Of Cashgift Certificates cash Value Awarded with ease

- Obtain This Form Should Be Used To Report All Prizes In The Form Of Cashgift Certificates cash Value Awarded and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature with the Sign feature, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device. Modify and electronically sign This Form Should Be Used To Report All Prizes In The Form Of Cashgift Certificates cash Value Awarded and ensure seamless communication at every stage of the document preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the this form should be used to report all prizes in the form of cashgift certificates cash value awarded

How to make an electronic signature for your PDF file in the online mode

How to make an electronic signature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

The way to create an eSignature from your smartphone

The best way to generate an electronic signature for a PDF file on iOS devices

The way to create an eSignature for a PDF file on Android

People also ask

-

What is a cash acknowledgement form?

A cash acknowledgement form is a document that recognizes the receipt of cash, providing a formal record for both the giver and receiver. This form can be crucial for businesses to maintain accurate financial records and ensure transparency in transactions.

-

How can airSlate SignNow assist with cash acknowledgement forms?

airSlate SignNow allows users to create, send, and electronically sign cash acknowledgement forms quickly and conveniently. With its intuitive interface and advanced features, businesses can streamline their cash handling processes while ensuring compliance and security.

-

What are the pricing options for using airSlate SignNow for cash acknowledgement forms?

airSlate SignNow offers flexible pricing plans designed to meet different business needs. Users can select from various subscription levels, ensuring access to essential features for managing cash acknowledgement forms without compromising on quality or service.

-

Are there any specific features for managing cash acknowledgement forms with airSlate SignNow?

Yes, airSlate SignNow includes features such as templates, workflows, and document tracking specifically tailored for cash acknowledgement forms. These tools enhance efficiency, reduce errors, and provide visibility into cash transactions.

-

Can I integrate airSlate SignNow with my existing systems for cash acknowledgement forms?

Absolutely! airSlate SignNow offers integrations with various platforms, enabling seamless management of cash acknowledgement forms alongside your existing workflows. This enhances productivity and ensures all documents are kept in one centralized location.

-

What benefits do I get by using airSlate SignNow for cash acknowledgement forms?

Using airSlate SignNow for cash acknowledgement forms provides numerous benefits, including increased efficiency, reduced paper usage, and faster processing times. Additionally, businesses can enhance compliance and security related to financial transactions.

-

Is it easy to create a cash acknowledgement form using airSlate SignNow?

Yes, creating a cash acknowledgement form in airSlate SignNow is straightforward. Users can utilize customizable templates and an easy-to-navigate interface to design their forms according to specific business requirements.

Get more for This Form Should Be Used To Report All Prizes In The Form Of Cashgift Certificates cash Value Awarded

- Arizona state university update form

- Asu application 16148269 form

- Verification worksheet for dependent student 2019 2020 form

- Student income verification form

- The university of hawaii at manoa application tips sheet form

- Master of science in athletic training msatuniversity of la form

- Student contact information template

- 2015 2016 certificate of proficiency worksheet addiction form

Find out other This Form Should Be Used To Report All Prizes In The Form Of Cashgift Certificates cash Value Awarded

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement