COVERDELL ESA WITHDRAWAL INSTRUCTION FORM 2506E Sfpcu

What is the COVERDELL ESA WITHDRAWAL INSTRUCTION FORM 2506E Sfpcu

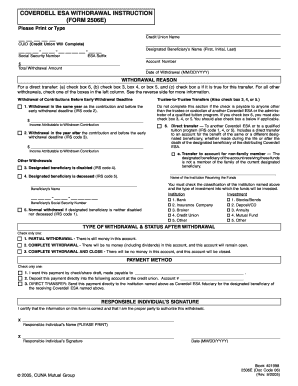

The COVERDELL ESA WITHDRAWAL INSTRUCTION FORM 2506E Sfpcu is a specific document used to facilitate withdrawals from a Coverdell Education Savings Account (ESA). This form is essential for account holders who wish to withdraw funds for qualified educational expenses. The Coverdell ESA allows families to save for education-related costs, and this form provides the necessary instructions and authorizations to ensure that withdrawals are processed correctly and in compliance with IRS regulations.

Steps to complete the COVERDELL ESA WITHDRAWAL INSTRUCTION FORM 2506E Sfpcu

Completing the COVERDELL ESA WITHDRAWAL INSTRUCTION FORM 2506E Sfpcu involves several key steps:

- Begin by filling out your personal information, including your name, address, and account number.

- Specify the amount you wish to withdraw and the purpose of the withdrawal, ensuring it aligns with qualified educational expenses.

- Provide the recipient's information if the funds are to be sent directly to an educational institution or another party.

- Review the form for accuracy and completeness, as any errors may delay processing.

- Sign and date the form to authorize the withdrawal.

Legal use of the COVERDELL ESA WITHDRAWAL INSTRUCTION FORM 2506E Sfpcu

The legal use of the COVERDELL ESA WITHDRAWAL INSTRUCTION FORM 2506E Sfpcu is governed by IRS regulations regarding education savings accounts. To ensure compliance, the form must be completed accurately and submitted according to the specific guidelines outlined by the financial institution managing the account. Using this form legally allows account holders to withdraw funds without incurring penalties, provided the withdrawals are for qualified education expenses.

How to obtain the COVERDELL ESA WITHDRAWAL INSTRUCTION FORM 2506E Sfpcu

The COVERDELL ESA WITHDRAWAL INSTRUCTION FORM 2506E Sfpcu can typically be obtained directly from the financial institution that holds the Coverdell ESA. Many institutions provide the form online through their customer service portals, allowing users to download and print it. Alternatively, account holders may request a physical copy by contacting customer service or visiting a local branch.

Key elements of the COVERDELL ESA WITHDRAWAL INSTRUCTION FORM 2506E Sfpcu

Several key elements are essential to the COVERDELL ESA WITHDRAWAL INSTRUCTION FORM 2506E Sfpcu:

- Account Holder Information: Personal details of the account holder, including contact information.

- Withdrawal Amount: The specific amount being requested for withdrawal.

- Purpose of Withdrawal: A clear indication of how the withdrawn funds will be used, ensuring they meet the criteria for qualified expenses.

- Signature: The account holder's signature and date, which validate the request.

Form Submission Methods (Online / Mail / In-Person)

The COVERDELL ESA WITHDRAWAL INSTRUCTION FORM 2506E Sfpcu can be submitted through various methods depending on the policies of the financial institution. Common submission methods include:

- Online Submission: Many institutions allow users to submit the form electronically through their secure online portals.

- Mail: The completed form can be printed and mailed to the designated address provided by the financial institution.

- In-Person: Account holders may also have the option to deliver the form in person at a local branch.

Quick guide on how to complete coverdell esa withdrawal instruction form 2506e sfpcu

Complete COVERDELL ESA WITHDRAWAL INSTRUCTION FORM 2506E Sfpcu effortlessly on any device

Managing documents online has become increasingly popular among organizations and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, enabling you to find the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Handle COVERDELL ESA WITHDRAWAL INSTRUCTION FORM 2506E Sfpcu on any platform using airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign COVERDELL ESA WITHDRAWAL INSTRUCTION FORM 2506E Sfpcu with ease

- Obtain COVERDELL ESA WITHDRAWAL INSTRUCTION FORM 2506E Sfpcu and click on Get Form to initiate the process.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you prefer to share your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign COVERDELL ESA WITHDRAWAL INSTRUCTION FORM 2506E Sfpcu and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the coverdell esa withdrawal instruction form 2506e sfpcu

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the COVERDELL ESA WITHDRAWAL INSTRUCTION FORM 2506E Sfpcu?

The COVERDELL ESA WITHDRAWAL INSTRUCTION FORM 2506E Sfpcu is a specific document that allows account holders to formally request withdrawals from their Coverdell Education Savings Accounts. It ensures compliance with IRS regulations and helps streamline your withdrawal process, making it easier to access your funds for educational expenses.

-

How can I obtain the COVERDELL ESA WITHDRAWAL INSTRUCTION FORM 2506E Sfpcu?

You can easily obtain the COVERDELL ESA WITHDRAWAL INSTRUCTION FORM 2506E Sfpcu through the airSlate SignNow platform. Simply visit our website, log in to your account, and navigate to the forms section to access the document and other related resources.

-

Is there a fee associated with using the COVERDELL ESA WITHDRAWAL INSTRUCTION FORM 2506E Sfpcu?

Using the airSlate SignNow platform to manage your COVERDELL ESA WITHDRAWAL INSTRUCTION FORM 2506E Sfpcu is cost-effective. While there may be fees associated with certain services, accessing and submitting the form is generally straightforward, often included in your subscription plan.

-

What features does airSlate SignNow offer for the COVERDELL ESA WITHDRAWAL INSTRUCTION FORM 2506E Sfpcu?

airSlate SignNow offers several features for the COVERDELL ESA WITHDRAWAL INSTRUCTION FORM 2506E Sfpcu, including electronic signatures, document tracking, and secure storage. These tools help ensure that your form is processed quickly and securely, enhancing your overall experience.

-

What are the benefits of using airSlate SignNow for my COVERDELL ESA WITHDRAWAL INSTRUCTION FORM 2506E Sfpcu?

By using airSlate SignNow for your COVERDELL ESA WITHDRAWAL INSTRUCTION FORM 2506E Sfpcu, you benefit from a user-friendly interface, fast processing times, and robust security features. This not only saves you time but also gives you peace of mind knowing that your financial information is safeguarded.

-

Can I integrate airSlate SignNow with other software for the COVERDELL ESA WITHDRAWAL INSTRUCTION FORM 2506E Sfpcu?

Yes, airSlate SignNow allows for integrations with various software solutions, making it easy to incorporate the COVERDELL ESA WITHDRAWAL INSTRUCTION FORM 2506E Sfpcu into your existing workflows. This flexibility enhances productivity and can improve the overall management of your educational savings.

-

What should I do if I have questions about the COVERDELL ESA WITHDRAWAL INSTRUCTION FORM 2506E Sfpcu?

If you have any questions about the COVERDELL ESA WITHDRAWAL INSTRUCTION FORM 2506E Sfpcu, you can signNow out to our customer support team. They are equipped to provide you with detailed answers and guidance to ensure you understand the process fully.

Get more for COVERDELL ESA WITHDRAWAL INSTRUCTION FORM 2506E Sfpcu

Find out other COVERDELL ESA WITHDRAWAL INSTRUCTION FORM 2506E Sfpcu

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word