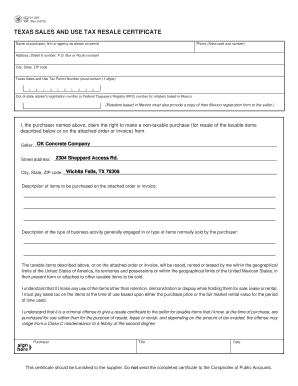

TEXAS SALES and USE TAX RESALE CERTIFICATE OK Concrete Form

What is the Texas Sales and Use Tax Resale Certificate OK Concrete

The Texas Sales and Use Tax Resale Certificate OK Concrete is a legal document that allows businesses to purchase tangible personal property without paying sales tax. This certificate is essential for retailers and wholesalers who intend to resell the items they acquire. By presenting this certificate to suppliers, businesses can ensure that they are not charged sales tax on purchases meant for resale, streamlining their operations and improving cash flow.

How to Use the Texas Sales and Use Tax Resale Certificate OK Concrete

To effectively use the Texas Sales and Use Tax Resale Certificate OK Concrete, a buyer must provide the completed certificate to the seller at the time of purchase. This document must include specific information, such as the buyer's name, address, and the nature of the business. It is crucial that the certificate is filled out accurately to avoid any potential legal issues. Sellers should retain a copy of the certificate for their records, as it serves as proof that the sale is exempt from sales tax.

Steps to Complete the Texas Sales and Use Tax Resale Certificate OK Concrete

Completing the Texas Sales and Use Tax Resale Certificate OK Concrete involves several straightforward steps:

- Obtain the form from a reliable source, ensuring it is the most current version.

- Fill in the buyer's name and address accurately.

- Provide the seller's name and address.

- Describe the type of property being purchased for resale.

- Sign and date the certificate to validate it.

Once completed, present the certificate to the seller to ensure the purchase is exempt from sales tax.

Legal Use of the Texas Sales and Use Tax Resale Certificate OK Concrete

The legal use of the Texas Sales and Use Tax Resale Certificate OK Concrete is governed by state tax laws. It is essential that the certificate is used solely for purchases intended for resale. Misuse of the certificate, such as using it for personal purchases or non-resale items, can result in penalties, including fines and back taxes. Businesses should maintain accurate records of all transactions involving the certificate to ensure compliance with state regulations.

Eligibility Criteria for the Texas Sales and Use Tax Resale Certificate OK Concrete

To be eligible for the Texas Sales and Use Tax Resale Certificate OK Concrete, a business must be registered with the Texas Comptroller of Public Accounts and possess a valid Texas sales tax permit. This certificate is typically available to retailers, wholesalers, and other entities engaged in the sale of tangible personal property. It is important for businesses to ensure they meet all eligibility requirements before utilizing the certificate to avoid complications during audits.

Examples of Using the Texas Sales and Use Tax Resale Certificate OK Concrete

Examples of using the Texas Sales and Use Tax Resale Certificate OK Concrete include:

- A retail store purchasing inventory from a supplier to sell in their physical or online store.

- A contractor buying materials for a construction project that will be billed to a client.

- A wholesaler acquiring goods to distribute to other retailers without incurring sales tax.

These scenarios illustrate how the certificate facilitates tax-exempt purchases for businesses engaged in resale activities.

Quick guide on how to complete texas sales and use tax resale certificate ok concrete

Effortlessly Prepare TEXAS SALES AND USE TAX RESALE CERTIFICATE OK Concrete on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage TEXAS SALES AND USE TAX RESALE CERTIFICATE OK Concrete on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Edit and Electronically Sign TEXAS SALES AND USE TAX RESALE CERTIFICATE OK Concrete with Ease

- Locate TEXAS SALES AND USE TAX RESALE CERTIFICATE OK Concrete and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight signNow sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, cumbersome form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you select. Modify and electronically sign TEXAS SALES AND USE TAX RESALE CERTIFICATE OK Concrete and ensure effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the texas sales and use tax resale certificate ok concrete

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a TEXAS SALES AND USE TAX RESALE CERTIFICATE OK Concrete?

A TEXAS SALES AND USE TAX RESALE CERTIFICATE OK Concrete allows businesses to purchase tangible personal property without paying state sales tax, provided the items are for resale. This certificate is important for wholesalers and retailers within the concrete industry to streamline their purchasing process while remaining compliant with tax regulations.

-

How can I obtain a TEXAS SALES AND USE TAX RESALE CERTIFICATE OK Concrete?

To obtain a TEXAS SALES AND USE TAX RESALE CERTIFICATE OK Concrete, businesses must complete the Texas resale certificate form and provide necessary information about their business operations. It's crucial to ensure that all details are accurate to avoid future tax complications when using the certificate for purchase.

-

Are there any costs associated with acquiring a TEXAS SALES AND USE TAX RESALE CERTIFICATE OK Concrete?

Acquiring a TEXAS SALES AND USE TAX RESALE CERTIFICATE OK Concrete usually does not incur any direct fees from the state. However, businesses might want to consult with a tax professional to understand any associated costs or potential implications when filing taxes.

-

Can airSlate SignNow help with the management of TEXAS SALES AND USE TAX RESALE CERTIFICATE OK Concrete?

Yes, airSlate SignNow offers features that simplify the documentation and eSigning process for TEXAS SALES AND USE TAX RESALE CERTIFICATE OK Concrete. With our user-friendly interface, managing and sharing your resale certificates securely and efficiently is easier than ever.

-

What are the benefits of using a TEXAS SALES AND USE TAX RESALE CERTIFICATE OK Concrete?

Using a TEXAS SALES AND USE TAX RESALE CERTIFICATE OK Concrete provides signNow financial benefits, such as avoiding sales tax on purchases for resale. This permits businesses to reinvest those savings into growth opportunities while maintaining compliance with Texas tax laws.

-

How often do I need to renew my TEXAS SALES AND USE TAX RESALE CERTIFICATE OK Concrete?

Typically, a TEXAS SALES AND USE TAX RESALE CERTIFICATE OK Concrete does not expire, but it is recommended to review and update your information regularly. Businesses should keep their records current to ensure they are compliant with state regulations and avoid any issues with auditors.

-

What integrations does airSlate SignNow offer for managing TEXAS SALES AND USE TAX RESALE CERTIFICATE OK Concrete?

airSlate SignNow integrates seamlessly with various business tools, enhancing document management for TEXAS SALES AND USE TAX RESALE CERTIFICATE OK Concrete. These integrations facilitate improved workflow efficiency, making it simpler to collaborate on essential paperwork across different platforms.

Get more for TEXAS SALES AND USE TAX RESALE CERTIFICATE OK Concrete

Find out other TEXAS SALES AND USE TAX RESALE CERTIFICATE OK Concrete

- Sign Indiana Legal Cease And Desist Letter Easy

- Can I Sign Kansas Legal LLC Operating Agreement

- Sign Kansas Legal Cease And Desist Letter Now

- Sign Pennsylvania Insurance Business Plan Template Safe

- Sign Pennsylvania Insurance Contract Safe

- How Do I Sign Louisiana Legal Cease And Desist Letter

- How Can I Sign Kentucky Legal Quitclaim Deed

- Sign Kentucky Legal Cease And Desist Letter Fast

- Sign Maryland Legal Quitclaim Deed Now

- Can I Sign Maine Legal NDA

- How To Sign Maine Legal Warranty Deed

- Sign Maine Legal Last Will And Testament Fast

- How To Sign Maine Legal Quitclaim Deed

- Sign Mississippi Legal Business Plan Template Easy

- How Do I Sign Minnesota Legal Residential Lease Agreement

- Sign South Carolina Insurance Lease Agreement Template Computer

- Sign Missouri Legal Last Will And Testament Online

- Sign Montana Legal Resignation Letter Easy

- How Do I Sign Montana Legal IOU

- How Do I Sign Montana Legal Quitclaim Deed