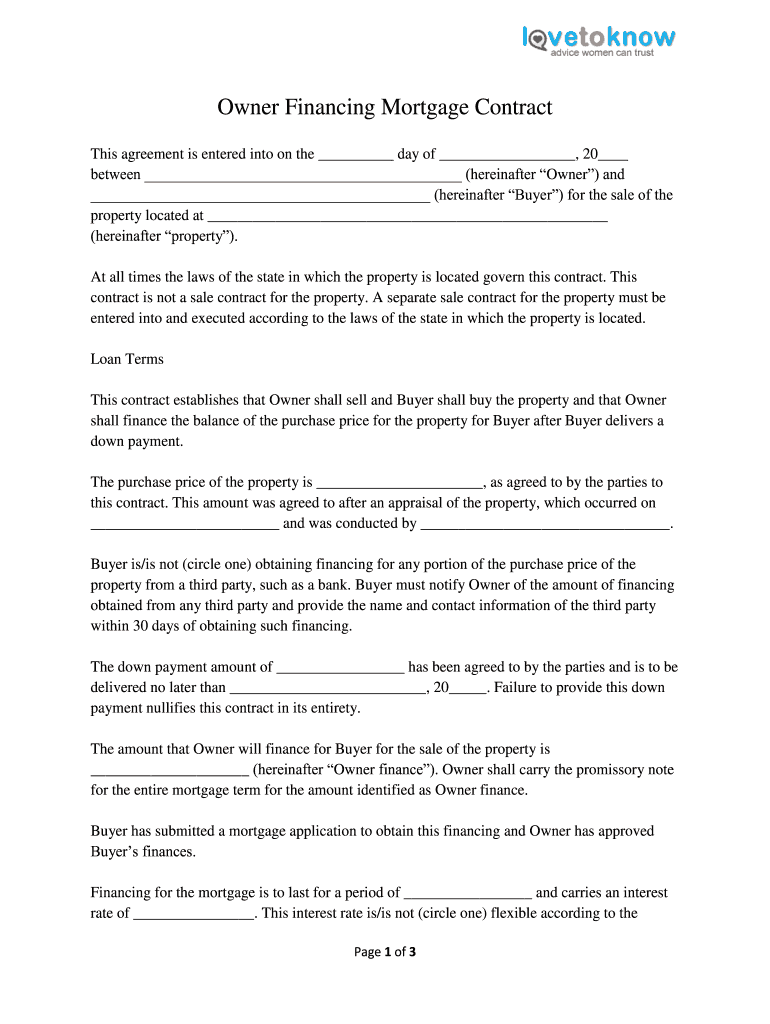

Owner Financing Contract Form

What is the Owner Financing Contract

An owner financing contract is a legal agreement between a seller and a buyer where the seller provides financing to the buyer for the purchase of a property. This arrangement allows the buyer to make payments directly to the seller instead of obtaining a traditional mortgage from a bank or financial institution. Owner financing can be beneficial for buyers who may not qualify for conventional loans, and it can provide sellers with a steady income stream. The contract typically outlines the terms of the financing, including the purchase price, interest rate, payment schedule, and any other conditions agreed upon by both parties.

Key Elements of the Owner Financing Contract

When drafting an owner financing contract, several key elements must be included to ensure clarity and legal compliance. These elements typically consist of:

- Purchase Price: The total amount the buyer agrees to pay for the property.

- Down Payment: The initial payment made by the buyer, which is usually a percentage of the purchase price.

- Interest Rate: The rate at which interest will accrue on the remaining balance.

- Payment Schedule: The frequency and amount of payments to be made by the buyer.

- Loan Term: The duration over which the buyer will repay the loan.

- Default Terms: Conditions under which the seller can take action if the buyer fails to make payments.

- Property Description: A detailed description of the property being sold.

Steps to Complete the Owner Financing Contract

Completing an owner financing contract involves several important steps to ensure that both parties are protected and that the agreement is legally binding. These steps include:

- Negotiate Terms: Both parties should discuss and agree on the terms of the financing, including purchase price and payment schedule.

- Draft the Contract: Use a template or legal assistance to draft the owner financing contract, incorporating all agreed-upon terms.

- Review the Contract: Both parties should review the contract carefully to ensure all details are correct and understood.

- Sign the Contract: Both the buyer and seller must sign the contract, making it legally binding.

- Record the Agreement: Depending on state laws, it may be necessary to record the contract with the local government to protect both parties' interests.

Legal Use of the Owner Financing Contract

For an owner financing contract to be legally enforceable, it must comply with applicable state and federal laws. This includes adhering to regulations concerning interest rates, disclosures, and consumer protection laws. It is crucial for both parties to understand their rights and obligations under the contract. Consulting with a legal professional familiar with real estate transactions can help ensure that the contract meets all legal requirements and protects the interests of both the buyer and the seller.

How to Obtain the Owner Financing Contract

Obtaining an owner financing contract can be done through several methods. Buyers and sellers can access templates online, which can be customized to fit their specific situation. Legal professionals can also provide tailored contracts that meet individual needs and ensure compliance with local laws. Additionally, real estate agents experienced in owner financing can offer guidance and resources to facilitate the process. It is important to ensure that any contract used is comprehensive and legally sound.

Examples of Using the Owner Financing Contract

Owner financing contracts can be utilized in various scenarios. Common examples include:

- Residential Sales: Homebuyers who may not qualify for traditional mortgages can benefit from owner financing when purchasing a home.

- Mobile Home Transactions: Buyers of mobile homes often use owner financing as a flexible purchasing option.

- Investment Properties: Investors may use owner financing to acquire rental properties, allowing for quicker transactions without bank involvement.

Quick guide on how to complete owner financing contract form

The optimal method to locate and sign Owner Financing Contract

Across your entire organization, ineffective workflows surrounding paper approval can drain a signNow amount of productive time. Signing documents like Owner Financing Contract is an inherent aspect of operations in any enterprise, which is why the effectiveness of each agreement’s lifecycle signNowly impacts the overall performance of the organization. With airSlate SignNow, signing your Owner Financing Contract is as straightforward and quick as possible. You will discover on this platform the latest version of nearly any form. Even better, you can sign it instantly without needing to install external software on your system or printing hard copies.

Instructions to obtain and sign your Owner Financing Contract

- Browse our library by category or utilize the search feature to find the form you require.

- View the form preview by clicking on Learn more to confirm it is the correct one.

- Press Get form to start editing immediately.

- Fill out your form and insert any necessary information using the toolbar.

- When finished, click the Sign tool to sign your Owner Financing Contract.

- Choose the signature method that suits you best: Draw, Generate initials, or upload a picture of your handwritten signature.

- Click Done to finalize editing and move on to document-sharing options as needed.

With airSlate SignNow, you have everything necessary to manage your paperwork efficiently. You can find, complete, edit, and even share your Owner Financing Contract in a single tab without any complications. Enhance your processes by using a unified, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

How do I fill out Form 30 for ownership transfer?

Form 30 for ownership transfer is a very simple self-explanatory document that can filled out easily. You can download this form from the official website of the Regional Transport Office of a concerned state. Once you have downloaded this, you can take a printout of this form and fill out the request details.Part I: This section can be used by the transferor to declare about the sale of his/her vehicle to another party. This section must have details about the transferor’s name, residential address, and the time and date of the ownership transfer. This section must be signed by the transferor.Part II: This section is for the transferee to acknowledge the receipt of the vehicle on the concerned date and time. A section for hypothecation is also provided alongside in case a financier is involved in this transaction.Official Endorsement: This section will be filled by the RTO acknowledging the transfer of vehicle ownership. The transfer of ownership will be registered at the RTO and copies will be provided to the seller as well as the buyer.Once the vehicle ownership transfer is complete, the seller will be free of any responsibilities with regard to the vehicle.

-

What forms do I need to fill out as a first-year LLC owner? It's a partnership LLC.

A Limited Liability Company (LLC) is business structure that provides the limited liability protection features of a corporation and the tax efficiencies and operational flexibility of a partnership.Unlike shareholders in a corporation, LLCs are not taxed as a separate business entity. Instead, all profits and losses are "passed through" the business to each member of the LLC. LLC members report profits and losses on their personal federal tax returns, just like the owners of a partnership would.The owners of an LLC have no personal liability for the obligations of the LLC. An LLC is the entity of choice for a businesses seeking to flow through losses to its investors because an LLC offers complete liability protection to all its members. The basic requirement for forming an Limited Liability Company are:Search your business name - before you form an LLC, you should check that your proposed business name is not too similar to another LLC registered with your state's Secretary of StateFile Articles of Organization - the first formal paper you will need file with your state's Secretary of State to form an LLC. This is a necessary document for setting up an LLC in many states. Create an Operating Agreement - an agreement among LLC members governing the LLC's business, and member's financial and managerial rights and duties. Think of this as a contract that governs the rules for the people who own the LLC. Get an Employer Identification Number (EIN) - a number assigned by the IRS and used to identify taxpayers that are required to file various business tax returns. You can easily file for an EIN online if you have a social security number. If you do not have a social security number or if you live outsides of United States, ask a business lawyer to help you get one.File Statement of Information - includes fairly basic information about the LLC that you need to file with your state’s Secretary of State every 2 years. Think of it as a company census you must complete every 2 years.Search and Apply for Business Licenses and Permits - once your business is registered, you should look and apply for necessary licenses and permits you will need from the county and city where you will do business. Every business has their own business licenses and permits so either do a Google search of your business along with the words "permits and licenses" or talk to a business lawyer to guide you with this.If you have any other questions, talk to a business lawyer who will clarify and help you with all 6 above steps or answer any other question you may have about starting your business.I am answering from the perspective of a business lawyer who represents businesspersons and entrepreneurs with their new and existing businesses. Feel free to contact me sam@mollaeilaw.com if you need to form your LLC.In my course, How To Incorporate Your Business on Your Own: Quick & Easy, you will learn how to form your own Limited Liability Company (LLC) or Corporation without a lawyer, choose a business name, file a fictitious business name, file Articles of Organization or Articles of Incorporation, create Operating Agreement or Bylaws, apply for an EIN, file Statement of Information, and how to get business licenses and permits.

-

Do un-contracted workers have to fill out IRS W4 form?

I have no idea what an “un-contracted worker” is. I am not familiar with that term.Employees working in the U.S. complete a Form W-4.Independent contractors in the U.S. do not. Instead, they usually complete a Form W-9.If unclear on the difference between an employee or an independent contractor, see Independent Contractor Self Employed or Employee

-

How a Non-US residence company owner (has EIN) should fill the W-7 ITIN form out? Which option is needed to be chosen in the first part?

Depends on the nature of your business and how it is structured.If you own an LLC taxed as a passthrough entity, then you probably will check option b and submit the W7 along with your US non-resident tax return. If your LLC’s income is not subject to US tax, then you will check option a.If the business is a C Corp, then you probably don’t need an ITIN, unless you are receiving taxable compensation from the corporation and then we are back to option b.

-

How should I fill this contract form "Signed this... day of..., 2016"?

I agree that you need to have the document translated to your native language or read to you by an interpreter.

-

How do you fill out a W2 tax form if I'm an independent contractor?

Thanks for asking.If you are asking how to report your income as an independent contractor, then you do not fill out a W-2. You will report your income on your federal tax return on Schedule C which will have on which you list all of your non-employee income and associated expenses. The resulting net income, transferred to Schedule A is what you will pay self-employment and federal income tax on. If this too confusing, either get some good tax reporting software or get a tax professional to help you with it.If you are asking how to fill out a W-2 for someone that worked for you, either get some good tax reporting software or get a tax professional to help you with it.This is not tax advice, it is only my opinion on how to answer this question.

-

Do military members have to pay any fee for leave or fiancee forms?

NOOOOOOO. You are talking to a military romance scammer. I received an email from the US Army that directly answers your question that is pasted below please keep reading.I believe you are the victim of a military Romance Scam whereas the person you are talking to is a foreign national posing as an American Soldier claiming to be stationed overseas on a peacekeeping mission. That's the key to the scam they always claim to be on a peacekeeping mission.Part of their scam is saying that they have no access to their money that their mission is highly dangerous.If your boyfriend girlfriend/future husband/wife is asking you to do the following or has exhibited this behavior, it is a most likely a scam:Moves to private messaging site immediately after meeting you on Facebook or SnapChat or Instagram or some dating or social media site. Often times they delete the site you met them on right after they asked you to move to a more private messaging siteProfesses love to you very quickly & seems to quote poems and song lyrics along with using their own sort of broken language, as they profess their love and devotion quickly. They also showed concern for your health and love for your family.Promises marriage as soon as he/she gets to state for leave that they asked you to pay for.They Requests money (wire transfers) and Amazon, iTune ,Verizon, etc gift cards, for medicine, religious practices, and leaves to come home, internet access, complete job assignments, help sick friend, get him out of trouble, or anything that sounds fishy.The military does provide all the soldier needs including food medical Care and transportation for leave. Trust me, I lived it, you are probably being scammed. I am just trying to show you examples that you are most likely being connned.Below is an email response I received after I sent an inquiry to the US government when I discovered I was scammed. I received this wonderful response back with lots of useful links on how to find and report your scammer. And how to learn more about Romance Scams.Right now you can also copy the picture he gave you and do a google image search and you will hopefully see the pictures of the real person he is impersonating. this doesn't always work and take some digging. if you find the real person you can direct message them and alert them that their image is being used for scamming.Good Luck to you and I'm sorry this may be happening to you. please continue reading the government response I received below it's very informative. You have contacted an email that is monitored by the U.S. Army Criminal Investigation Command. Unfortunately, this is a common concern. We assure you there is never any reason to send money to anyone claiming to be a Soldier online. If you have only spoken with this person online, it is likely they are not a U.S. Soldier at all. If this is a suspected imposter social media profile, we urge you to report it to that platform as soon as possible. Please continue reading for more resources and answers to other frequently asked questions: How to report an imposter Facebook profile: Caution-https://www.facebook.com/help/16... < Caution-https://www.facebook.com/help/16... > Answers to frequently asked questions: - Soldiers and their loved ones are not charged money so that the Soldier can go on leave. - Soldiers are not charged money for secure communications or leave. - Soldiers do not need permission to get married. - Soldiers emails are in this format: john.doe.mil@mail.mil < Caution-mailto: john.doe.mil@mail.mil > anything ending in .us or .com is not an official email account. - Soldiers have medical insurance, which pays for their medical costs when treated at civilian health care facilities worldwide – family and friends do not need to pay their medical expenses. - Military aircraft are not used to transport Privately Owned Vehicles. - Army financial offices are not used to help Soldiers buy or sell items of any kind. - Soldiers deployed to Combat Zones do not need to solicit money from the public to feed or house themselves or their troops. - Deployed Soldiers do not find large unclaimed sums of money and need your help to get that money out of the country. Anyone who tells you one of the above-listed conditions/circumstances is true is likely posing as a Soldier and trying to steal money from you. We would urge you to immediately cease all contact with this individual. For more information on avoiding online scams and to report this crime, please see the following sites and articles: This article may help clarify some of the tricks social media scammers try to use to take advantage of people: Caution-https://www.army.mil/article/61432/< Caution-https://www.army.mil/article/61432/> CID advises vigilance against 'romance scams,' scammers impersonating Soldiers Caution-https://www.army.mil/article/180749 < Caution-https://www.army.mil/article/180749 > FBI Internet Crime Complaint Center: Caution-http://www.ic3.gov/default.aspx< Caution-http://www.ic3.gov/default.aspx> U.S. Army investigators warn public against romance scams: Caution-https://www.army.mil/article/130...< Caution-https://www.army.mil/article/130...> DOD warns troops, families to be cybercrime smart -Caution-http://www.army.mil/article/1450...< Caution-http://www.army.mil/article/1450...> Use caution with social networking Caution-https://www.army.mil/article/146...< Caution-https://www.army.mil/article/146...> Please see our frequently asked questions section under scams and legal issues. Caution-http://www.army.mil/faq/ < Caution-http://www.army.mil/faq/ > or visit Caution-http://www.cid.army.mil/ < Caution-http://www.cid.army.mil/ >. The challenge with most scams is determining if an individual is a legitimate member of the US Army. Based on the Privacy Act of 1974, we cannot provide this information. If concerned about a scam you may contact the Better Business Bureau (if it involves a solicitation for money), or local law enforcement. If you're involved in a Facebook or dating site scam, you are free to contact us direct; (571) 305-4056. If you have a social security number, you can find information about Soldiers online at Caution-https://www.dmdc.osd.mil/appj/sc... < Caution-https://www.dmdc.osd.mil/appj/sc... > . While this is a free search, it does not help you locate a retiree, but it can tell you if the Soldier is active duty or not. If more information is needed such as current duty station or location, you can contact the Commander Soldier's Records Data Center (SRDC) by phone or mail and they will help you locate individuals on active duty only, not retirees. There is a fee of $3.50 for businesses to use this service. The check or money order must be made out to the U.S. Treasury. It is not refundable. The address is: Commander Soldier's Records Data Center (SRDC) 8899 East 56th Street Indianapolis, IN 46249-5301 Phone: 1-866-771-6357 In addition, it is not possible to remove social networking site profiles without legitimate proof of identity theft or a scam. If you suspect fraud on this site, take a screenshot of any advances for money or impersonations and report the account on the social networking platform immediately. Please submit all information you have on this incident to Caution-www.ic3.gov < Caution-http://www.ic3.gov > (FBI website, Internet Criminal Complaint Center), immediately stop contact with the scammer (you are potentially providing them more information which can be used to scam you), and learn how to protect yourself against these scams at Caution-http://www.ftc.gov < Caution-http://www.ftc.gov > (Federal Trade Commission's website)

Create this form in 5 minutes!

How to create an eSignature for the owner financing contract form

How to create an electronic signature for the Owner Financing Contract Form in the online mode

How to create an electronic signature for your Owner Financing Contract Form in Google Chrome

How to create an eSignature for signing the Owner Financing Contract Form in Gmail

How to create an eSignature for the Owner Financing Contract Form from your mobile device

How to generate an eSignature for the Owner Financing Contract Form on iOS devices

How to create an eSignature for the Owner Financing Contract Form on Android OS

People also ask

-

What is an Owner Financing Contract and how does it work?

An Owner Financing Contract is a legal agreement where the seller offers financing to the buyer, allowing them to purchase property without traditional mortgage processes. This contract outlines the terms of the financing, including payment schedules and interest rates, making it easier for buyers to acquire property. With airSlate SignNow, you can easily create, send, and eSign Owner Financing Contracts digitally, streamlining the entire process.

-

What features does airSlate SignNow offer for Owner Financing Contracts?

airSlate SignNow provides a variety of features tailored for Owner Financing Contracts, including customizable templates, electronic signatures, and document tracking. These features ensure that your contracts are not only professional but also legally binding. Additionally, our user-friendly interface makes it simple to manage multiple contracts in one secure platform.

-

Is airSlate SignNow cost-effective for creating Owner Financing Contracts?

Yes, airSlate SignNow is designed to be a cost-effective solution for creating Owner Financing Contracts. Our pricing plans are competitive, offering robust features that simplify document management without breaking the bank. You can choose a plan that fits your business needs, ensuring you get great value for your investment.

-

Can I integrate airSlate SignNow with other tools for managing Owner Financing Contracts?

Absolutely! airSlate SignNow seamlessly integrates with a variety of third-party applications, allowing you to manage your Owner Financing Contracts alongside your existing tools. Whether you use CRM systems, cloud storage, or project management software, our integrations help streamline your workflow and improve efficiency.

-

How secure is the data in my Owner Financing Contracts with airSlate SignNow?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure cloud storage to protect all data related to your Owner Financing Contracts. Our compliance with industry standards ensures that your documents are safe from unauthorized access while you manage your transactions.

-

Can I customize my Owner Financing Contract templates in airSlate SignNow?

Yes, airSlate SignNow allows you to fully customize your Owner Financing Contract templates to meet your specific needs. You can add clauses, adjust formatting, and include branding elements to ensure your contracts reflect your business identity. This flexibility helps you create professional and tailored documents quickly.

-

What support does airSlate SignNow offer for users creating Owner Financing Contracts?

airSlate SignNow provides comprehensive support for users creating Owner Financing Contracts. Our dedicated customer service team is available via chat, email, and phone to assist you with any questions or issues. We also offer a variety of resources, including tutorials and FAQs, to help you maximize your use of the platform.

Get more for Owner Financing Contract

Find out other Owner Financing Contract

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form