Form C 3 Uge

What is the Form C 3 Uge

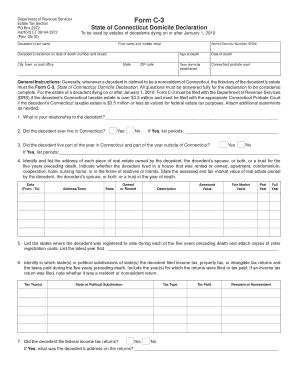

The Form C 3 Uge is a specific document used in various administrative and legal contexts within the United States. It serves as a formal declaration or request related to certain regulatory or compliance obligations. Understanding its purpose is crucial for individuals and businesses alike, as it ensures adherence to legal requirements and facilitates smooth interactions with governmental or regulatory bodies.

How to use the Form C 3 Uge

Using the Form C 3 Uge involves several key steps to ensure proper completion and submission. First, gather all necessary information and documentation required to fill out the form accurately. Next, complete the form by following the provided instructions, ensuring that all sections are filled out completely. Finally, submit the form through the appropriate channels, which may include online submission, mailing, or in-person delivery, depending on the requirements set forth by the issuing authority.

Steps to complete the Form C 3 Uge

Completing the Form C 3 Uge can be straightforward if you follow these steps:

- Review the form instructions thoroughly to understand the requirements.

- Gather all necessary supporting documents, such as identification or financial records.

- Fill out the form accurately, ensuring that all fields are completed as required.

- Double-check the information for accuracy and completeness before submission.

- Submit the form according to the guidelines provided, ensuring that you retain a copy for your records.

Legal use of the Form C 3 Uge

The legal use of the Form C 3 Uge is governed by specific regulations that define its validity and enforceability. To ensure that the form is legally recognized, it must be completed accurately and submitted in accordance with the relevant laws. This includes adhering to any deadlines and ensuring that all required signatures are obtained. Utilizing a reliable eSignature solution can further enhance the legal standing of the form by providing a secure and verifiable signing process.

Key elements of the Form C 3 Uge

Key elements of the Form C 3 Uge include:

- Identification Information: Personal or business details that identify the filer.

- Purpose of the Form: A clear statement of the intent behind submitting the form.

- Signature Section: A designated area for the required signatures, which may include electronic signatures.

- Date of Submission: The date on which the form is completed and submitted.

Form Submission Methods

The Form C 3 Uge can be submitted through various methods, depending on the requirements of the issuing authority. Common submission methods include:

- Online Submission: Many agencies allow for electronic submission through their websites.

- Mail: Forms can often be printed and mailed to the appropriate address.

- In-Person: Some forms may need to be submitted in person at designated offices.

Quick guide on how to complete form c 3 uge

Effortlessly Prepare Form C 3 Uge on Any Device

Digital document management has gained popularity among both businesses and individuals. It offers a perfect environmentally-friendly alternative to conventional printed and signed documents, as you can obtain the right format and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without any delays. Manage Form C 3 Uge on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to edit and eSign Form C 3 Uge with ease

- Find Form C 3 Uge and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark signNow sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign feature, which takes mere seconds and has the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to share your form: via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form C 3 Uge and ensure excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form c 3 uge

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form C 3 UGE and how does it relate to airSlate SignNow?

Form C 3 UGE is a specific form often used in various business processes. airSlate SignNow allows users to easily create, send, and eSign Form C 3 UGE digitally, streamlining your document workflow and improving efficiency.

-

How much does it cost to use airSlate SignNow for form C 3 UGE?

airSlate SignNow offers flexible pricing plans tailored to fit different business needs. Users can access features for managing Form C 3 UGE at competitive rates, ensuring that you receive high value for an affordable price.

-

What features does airSlate SignNow provide for managing form C 3 UGE?

airSlate SignNow offers a wide range of features for handling Form C 3 UGE, including easy document creation, customizable templates, automated workflows, and secure eSigning. These tools help businesses efficiently manage their document processes.

-

Is it safe to sign form C 3 UGE using airSlate SignNow?

Yes, signing Form C 3 UGE with airSlate SignNow is secure. The platform employs advanced encryption and security measures, ensuring that your sensitive data remains protected while you manage your documents.

-

Can I integrate airSlate SignNow with other applications for form C 3 UGE?

Absolutely! airSlate SignNow supports various integrations with popular tools such as CRM systems, cloud storage, and project management applications, allowing you to seamlessly incorporate Form C 3 UGE into your existing workflows.

-

What are the benefits of using airSlate SignNow for form C 3 UGE?

Using airSlate SignNow for Form C 3 UGE offers numerous benefits including time savings, reduced paperwork, and enhanced collaboration. Moreover, its user-friendly interface makes managing electronic signatures and document workflows simple and efficient.

-

How can I get started with airSlate SignNow for form C 3 UGE?

Getting started with airSlate SignNow for Form C 3 UGE is easy. Simply sign up for an account, explore the features, and begin creating and sending your Form C 3 UGE documents for eSignature in minutes.

Get more for Form C 3 Uge

Find out other Form C 3 Uge

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document