Ct 200 V Form

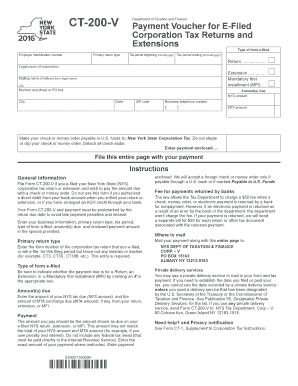

What is the CT 200 V?

The CT 200 V is a tax form used in New York State for reporting various tax-related information. Specifically, it is utilized by certain businesses to report their income and calculate their tax liabilities. This form is essential for compliance with state tax regulations, ensuring that businesses fulfill their obligations accurately and on time. Understanding the purpose and requirements of the CT 200 V is crucial for any business operating in New York.

How to Use the CT 200 V

Using the CT 200 V involves several steps to ensure accurate completion. First, gather all necessary financial information, including income statements and expense reports. Next, carefully fill out each section of the form, ensuring that all figures are accurate and reflect the business's financial activities. After completing the form, review it for any errors before submission. Utilizing electronic signature tools can streamline this process, making it easier to submit the form securely online.

Steps to Complete the CT 200 V

Completing the CT 200 V requires attention to detail. Follow these steps:

- Gather all relevant financial documents, such as income statements and expense records.

- Access the CT 200 V form, which can be obtained online or through state tax offices.

- Fill out the form, ensuring all calculations are accurate and complete.

- Review the form for any discrepancies or missing information.

- Sign the form electronically or manually, as required.

- Submit the completed form either online or by mail, following the specific submission guidelines provided by the state.

Legal Use of the CT 200 V

The legal use of the CT 200 V is governed by New York State tax laws. To be considered legally binding, the form must be completed accurately and submitted within the designated deadlines. Electronic signatures are recognized under U.S. law, provided they comply with regulations such as the ESIGN Act and UETA. Using a reliable eSignature platform can enhance the legitimacy of the submission, ensuring that all legal requirements are met.

Filing Deadlines / Important Dates

Filing deadlines for the CT 200 V are critical for compliance. Typically, businesses must submit this form by the due date specified by the New York State Department of Taxation and Finance. It is essential to stay informed about these deadlines to avoid penalties. Mark your calendar with important dates to ensure timely filing and maintain good standing with state tax authorities.

Form Submission Methods

The CT 200 V can be submitted through various methods, including online, by mail, or in person. Online submission is often the most efficient option, allowing for quick processing and confirmation. If submitting by mail, ensure that the form is sent to the correct address and consider using certified mail for tracking purposes. In-person submissions may be available at designated tax offices, providing an opportunity for immediate assistance if needed.

Quick guide on how to complete ct 200 v

Handle Ct 200 V effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed forms, allowing you to locate the correct document and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without interruptions. Manage Ct 200 V on any device using airSlate SignNow's Android or iOS applications and simplify your document-centric tasks today.

The easiest method to modify and eSign Ct 200 V with ease

- Find Ct 200 V and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact confidential information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your updates.

- Select your preferred method to share your form, via email, SMS, an invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your choice. Modify and eSign Ct 200 V, ensuring seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct 200 v

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ct 200 v and how does it enhance document signing?

The ct 200 v is a robust feature within airSlate SignNow that allows users to streamline the eSigning process. It enhances document signing by providing customizable templates and a user-friendly interface, ensuring that documents can be signed quickly and securely.

-

How much does airSlate SignNow cost in relation to the ct 200 v feature?

Pricing for airSlate SignNow depends on the specific plan you choose, but the ct 200 v feature is included in various tiers, making it a cost-effective option for businesses of all sizes. You can choose from plans that fit your budget and needs, ensuring you get the most value.

-

What benefits does the ct 200 v offer for businesses?

The ct 200 v provides numerous benefits, including reduced turnaround times for document approvals and improved compliance through secure eSigning. Businesses using the ct 200 v can enhance productivity by automating their signing processes and tracking document status in real-time.

-

How does the ct 200 v integrate with other business applications?

The ct 200 v seamlessly integrates with popular business applications such as Salesforce, Google Drive, and Dropbox. This integration allows users to manage their document workflows more efficiently, ensuring that eSigning is a part of their existing processes.

-

Is the ct 200 v suitable for small businesses?

Yes, the ct 200 v is designed to be user-friendly and flexible, making it ideal for small businesses looking to enhance their document signing capabilities. Its affordability and ease of use mean that even companies with limited resources can utilize its powerful features.

-

What types of documents can I sign using the ct 200 v?

With the ct 200 v, you can sign a wide range of documents including contracts, NDAs, and agreements. The versatility of this feature ensures that all your critical documents can be managed and signed electronically, speeding up business processes.

-

Can I track the status of a document signed with the ct 200 v?

Absolutely! One of the key features of the ct 200 v is its tracking capabilities. Users can easily monitor the status of their documents, seeing when they have been viewed, signed, or completed, thereby ensuring accountability throughout the signing process.

Get more for Ct 200 V

- Vr 018 6 04 mva marylandgov form

- Provider dispute resolution request healthcare partners form

- Ga rush spirit order form back

- Super bill treasure coast ultrasound form

- 2017 easp form

- Personal bank account statement form

- Sea waybill for combined transport or port to port wec lines form

- Virginia death certificatepdf al firdaus muslim funeral home form

Find out other Ct 200 V

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF