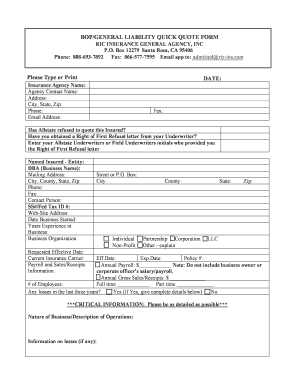

General Liability Quote Form

What is the general liability quote?

A general liability quote is a document that provides an estimate of the cost of general liability insurance for a business. This type of insurance protects businesses from financial loss due to claims of injury, property damage, and negligence. The quote outlines the coverage options available, premium amounts, and any deductibles that may apply. Understanding the specifics of a general liability quote is essential for business owners to ensure they have adequate protection against potential risks.

How to obtain the general liability quote

To obtain a general liability quote, businesses typically need to follow a straightforward process. First, gather relevant information about the business, including its size, industry, and any previous claims history. Next, contact insurance providers or use online platforms that specialize in insurance quotes. Many providers offer online forms where you can input your information and receive a quote quickly. It's advisable to compare multiple quotes to find the best coverage and price for your specific needs.

Steps to complete the general liability quote

Completing a general liability quote involves several key steps:

- Gather Information: Collect details about your business, including the nature of operations, number of employees, and annual revenue.

- Provide Accurate Data: Ensure that all information submitted is accurate and up to date to receive a precise quote.

- Review Coverage Options: Evaluate different coverage options and limits offered in the quote to determine what best suits your business needs.

- Ask Questions: If any part of the quote is unclear, reach out to the insurance provider for clarification.

- Finalize the Quote: Once satisfied with the terms, you can proceed to purchase the policy or request further adjustments.

Legal use of the general liability quote

The legal use of a general liability quote is significant for ensuring that businesses are adequately protected against potential lawsuits and claims. When a business accepts a quote and purchases the insurance policy, it enters a legal agreement with the insurer. This agreement outlines the terms of coverage, including exclusions and limitations. Understanding these legal aspects is crucial for business owners to avoid gaps in coverage that could lead to financial losses.

Key elements of the general liability quote

A general liability quote typically includes several key elements that are essential for understanding the coverage offered:

- Premium Amount: The cost of the insurance coverage, which may vary based on the business's risk profile.

- Coverage Limits: The maximum amount the insurer will pay for claims under the policy.

- Deductibles: The amount the business must pay out of pocket before the insurance coverage kicks in.

- Exclusions: Specific situations or conditions that are not covered by the policy.

- Policy Terms: The duration of the coverage and any renewal conditions.

Examples of using the general liability quote

Businesses can utilize general liability quotes in various scenarios. For instance, a small construction company may seek a general liability quote to protect itself against claims of property damage while on a job site. Similarly, a retail store may request a quote to cover potential customer injuries occurring within its premises. By obtaining and reviewing these quotes, businesses can make informed decisions about the level of coverage they require to mitigate risks effectively.

Quick guide on how to complete general liability quote

Complete General Liability Quote effortlessly on any gadget

Managing documents online has become a trend for companies and individuals alike. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, as you can access the correct form and securely store it digitally. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without holdups. Handle General Liability Quote on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign General Liability Quote effortlessly

- Obtain General Liability Quote and click on Get Form to begin.

- Make use of the provided tools to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides explicitly for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal significance as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Modify and eSign General Liability Quote and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the general liability quote

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are general liability quotes and why do I need them?

General liability quotes provide estimates of the cost of insurance that protects businesses against claims of bodily injury, property damage, and personal injury. Obtaining general liability quotes is essential as it helps you understand your coverage options and budget for potential risks associated with your business operations.

-

How can I obtain general liability quotes for my business?

You can obtain general liability quotes by signNowing out to insurance providers or using online comparison tools. Many platforms, including airSlate SignNow, streamline this process, allowing you to get quick and accurate general liability quotes tailored to your specific needs and business type.

-

What factors affect the pricing of general liability quotes?

The pricing of general liability quotes is influenced by various factors, including the size of your business, industry risk, location, and claims history. Understanding these variables can help you anticipate potential costs and choose the best policy for your specific requirements.

-

What features should I look for in general liability quotes?

When reviewing general liability quotes, it’s important to consider coverage limits, exclusions, and any additional endorsements that may be included. Look for flexible options that align with your business needs, ensuring that the chosen policy provides comprehensive protection against potential liabilities.

-

Are general liability quotes the same for all types of businesses?

No, general liability quotes can vary signNowly between different types of businesses due to diverse risk factors. For instance, contractors may face different liabilities compared to retail businesses, affecting the general liability quotes they receive.

-

How do I compare different general liability quotes effectively?

To compare general liability quotes effectively, take note of the coverage limits, deductibles, and overall premiums. Additionally, assess the insurer's reputation, customer service, and claims handling process to ensure you choose the best policy for your business.

-

Can I integrate my general liability quotes into airSlate SignNow?

Yes, airSlate SignNow offers seamless integration capabilities that allow you to manage your general liability quotes along with other essential documents. This integration helps streamline the workflow for obtaining and signing insurance documents, enhancing your overall operational efficiency.

Get more for General Liability Quote

Find out other General Liability Quote

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online