California Form Ua 100

What is the California Form UA 100

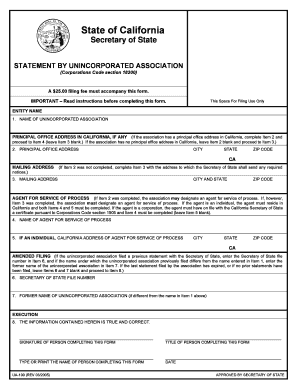

The California Form UA 100 is a document used for reporting information related to unincorporated associations in the state of California. This form is essential for organizations that operate without a formal corporate structure, allowing them to register and provide necessary details to the state. It serves as a means to ensure compliance with state regulations and maintain transparency in operations.

How to use the California Form UA 100

Using the California Form UA 100 involves filling out specific sections that require detailed information about the unincorporated association. Users must provide the name of the association, its principal office address, and the names and addresses of the members or officers. Once completed, the form must be submitted to the appropriate state agency to ensure that the association is officially recognized and compliant with California law.

Steps to complete the California Form UA 100

Completing the California Form UA 100 requires careful attention to detail. Here are the steps to follow:

- Gather necessary information about the association, including its name and address.

- List the names and addresses of all members or officers associated with the organization.

- Fill out the form accurately, ensuring all sections are completed.

- Review the form for any errors or omissions.

- Submit the completed form to the designated state office, either online or by mail.

Legal use of the California Form UA 100

The California Form UA 100 is legally binding once submitted to the state. It is crucial for unincorporated associations to use this form to comply with state laws, as failure to do so may result in penalties or legal complications. The form helps establish the legitimacy of the association and ensures that it operates within the legal framework set by California regulations.

Key elements of the California Form UA 100

Several key elements are essential when completing the California Form UA 100. These include:

- Association Name: The official name under which the association operates.

- Principal Office Address: The main location where the association conducts its activities.

- Member Information: Names and addresses of all members or officers involved in the association.

- Purpose of the Association: A brief description of the activities and goals of the organization.

Form Submission Methods

The California Form UA 100 can be submitted through various methods, ensuring flexibility for users. The options include:

- Online Submission: Many users prefer to fill out and submit the form electronically through the state's official website.

- Mail Submission: Users can also print the completed form and send it via postal service to the appropriate state office.

- In-Person Submission: For those who prefer direct interaction, submitting the form in person at designated state offices is an option.

Quick guide on how to complete california form ua 100

Complete California Form Ua 100 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed paperwork, allowing you to access the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage California Form Ua 100 on any device using airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign California Form Ua 100 with ease

- Obtain California Form Ua 100 and click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign California Form Ua 100 and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the california form ua 100

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is California Form Ua 100 and how does airSlate SignNow assist with it?

California Form Ua 100 is a critical document for businesses in the state, and airSlate SignNow provides a seamless way to prepare, sign, and manage this form electronically. With our platform, you can easily fill out the California Form Ua 100, ensuring compliance while saving time and resources.

-

What features does airSlate SignNow offer for managing California Form Ua 100?

airSlate SignNow offers features like customizable templates, document tracking, and secure cloud storage specifically for California Form Ua 100. These tools ensure that you can manage your forms efficiently and keep all essential documents accessible and organized.

-

Is airSlate SignNow a cost-effective solution for handling California Form Ua 100?

Yes, airSlate SignNow is a cost-effective solution for managing California Form Ua 100. Our pricing plans are designed to fit various business sizes, offering excellent value compared to traditional paper methods of managing forms.

-

Can I integrate airSlate SignNow with other applications for California Form Ua 100?

Absolutely! airSlate SignNow integrates seamlessly with popular applications like Google Drive, Salesforce, and Dropbox, making it easier to manage your California Form Ua 100 without disrupting your existing workflows.

-

What are the benefits of using airSlate SignNow for California Form Ua 100?

Using airSlate SignNow for your California Form Ua 100 offers numerous benefits such as increased efficiency, reduced processing time, and improved accuracy. Our platform allows for real-time collaboration, ensuring all stakeholders can easily access and sign the document.

-

How secure is airSlate SignNow when handling California Form Ua 100?

airSlate SignNow prioritizes security, especially when it comes to sensitive documents like California Form Ua 100. We use advanced encryption and secure servers to protect your data, ensuring that your documents are safe from unauthorized access.

-

Is there customer support available for issues related to California Form Ua 100?

Yes, airSlate SignNow offers robust customer support to assist users with any issues regarding California Form Ua 100. Our support team is available through various channels to ensure that you receive help promptly whenever you need it.

Get more for California Form Ua 100

- Intersession course scheduling form graduate theological union gtu

- Grambling state university registrar office form

- Grand canyon university application form

- Form for reimbursement

- Office of field experience masters counseling grand canyon form

- Gwynedd mercy transcript form

- Sample fy10 endowment report university advancement illinois form

- Immaculata university psyd form

Find out other California Form Ua 100

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online