Employment Earnings Verification Form 2008-2026

What is the Employment Earnings Verification Form

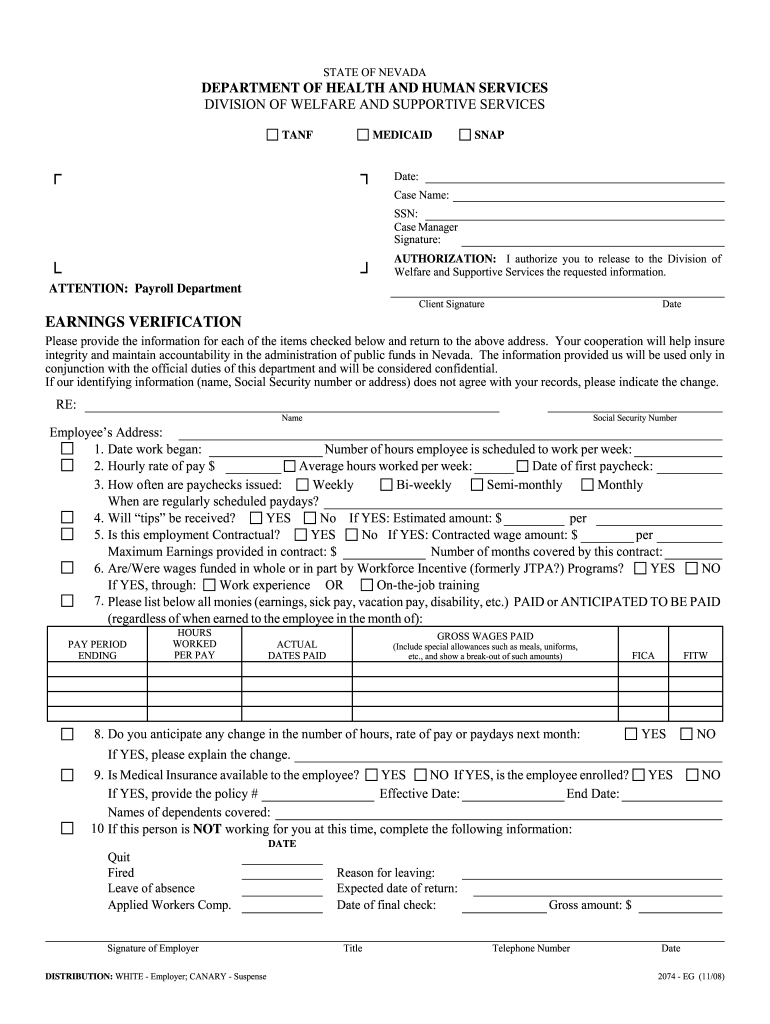

The Employment Earnings Verification Form is a crucial document used to confirm an individual's income and employment status. This form is often required for various assistance programs, including food stamps, to ensure that applicants meet eligibility criteria based on their earnings. It typically includes details such as the employee's name, employer information, job title, and income amount. Understanding the purpose of this form is essential for anyone applying for food assistance, as it helps to establish financial need.

How to use the Employment Earnings Verification Form

Using the Employment Earnings Verification Form involves several straightforward steps. First, obtain the form from your local food assistance office or download it from an official state website. Next, fill out the required sections accurately, ensuring that all information is current and reflects your employment status. After completing the form, submit it as directed—this may include online submission, mailing, or delivering it in person to the appropriate agency. It is important to keep a copy for your records.

Steps to complete the Employment Earnings Verification Form

Completing the Employment Earnings Verification Form can be done in a few methodical steps:

- Gather necessary documents, such as pay stubs or tax returns, to provide accurate income information.

- Fill in your personal details, including your name, address, and Social Security number.

- Provide your employer's information, including the company's name, address, and contact details.

- Detail your job title and the nature of your employment, including hours worked and pay rate.

- Review the form for accuracy before submission to avoid delays in processing.

Key elements of the Employment Earnings Verification Form

Several key elements are essential to the Employment Earnings Verification Form. These include:

- Personal Information: This section captures the applicant's name, address, and Social Security number.

- Employer Details: Information about the employer, including name and contact information, is necessary for verification.

- Income Information: This includes gross income, frequency of pay, and any other relevant earnings.

- Signature: The applicant must sign the form to certify that the information provided is true and accurate.

Legal use of the Employment Earnings Verification Form

The Employment Earnings Verification Form is legally binding, meaning that the information provided must be truthful and accurate. Misrepresentation can lead to penalties, including disqualification from assistance programs. It is important to understand that this form may be subject to audits, and therefore, maintaining accurate records and documentation is essential for compliance with state and federal regulations.

Form Submission Methods

Submitting the Employment Earnings Verification Form can be done through various methods, depending on local regulations. Common submission methods include:

- Online Submission: Many states offer online portals for easy form submission.

- Mail: You can print the completed form and send it via postal service to the designated agency.

- In-Person: Some applicants may choose to deliver the form directly to their local food assistance office.

Quick guide on how to complete what is an earnings verification form

Utilize the simpler technique to oversee your Employment Earnings Verification Form

The traditional approaches to finalizing and endorsing documents require an excessive amount of time in comparison to modern document management systems. Previously, you had to search for appropriate paper forms, print them out, fill in all the details, and dispatch them via postal service. Now, you can acquire, complete, and endorse your Employment Earnings Verification Form all within a single browser tab using airSlate SignNow. Preparing your Employment Earnings Verification Form has never been easier.

Steps to finalize your Employment Earnings Verification Form with airSlate SignNow

- Access the category page you need and locate your state-specific Employment Earnings Verification Form. Alternatively, utilize the search bar.

- Verify that the version of the form is accurate by viewing it.

- Click Obtain form and enter editing mode.

- Fill out your document with the necessary information utilizing the editing tools.

- Review the added information and click the Sign feature to authorize your form.

- Select the most suitable option to create your signature: generate it, sketch your signature, or upload an image of it.

- Click FINISHED to retain changes.

- Download the document to your device or proceed to Sharing options to send it digitally.

Efficient online solutions like airSlate SignNow make it easier to complete and submit your forms. Give it a try to discover how long document management and approval processes are truly intended to take. You’ll conserve a signNow amount of time.

Create this form in 5 minutes or less

FAQs

-

I am a layman. What is Form 16, Income Tax return and the fuss about it?

The filing of Income Tax returns is a mandatory duty along with the payment of Income Tax to the Government of India . As the season closes by (last date of filing return - 5th August for 2014), many new tax-payers are in qualms as to how to go with the procedure as well as do away with the seemingly complicated mechanism behind it .Following are some of the pointers , which I acquired through self-learning (all are written considering the tax procedures for an Individual, and not Companies or other organizations). Here goes :1) Firstly , it is important to understand that Income Tax return is a document which is filed by you stating your Total Income in a Financial Year through various sources of income i.e Salary , business, house property, etc . (Financial Year is the year of your income , and Assessment Year is the year next to it in which the tax is due . Eg - Financial Year 2013-14, Assessment Year 2014-15)It also states the Taxable income on that salary and the Total tax payable with surcharges and Education Cess . The Taxable income has an exemption of upto 2 lakh rupees(For an individual, and not a senior citizen) for this assessment year , and 2.5 lakhs for the next (As per the new budget) . You also get tax exemptions on various other investments/allowances such as HRA , Fixed Deposits , Insurance Policies , Provident Funds , Children's Education , etc under various clauses of Section 80.People should know that return is filed to intimate the Government of your tax statements and it should not be confused with the Tax-refund one gets if there is a surplus tax paid by you to the Government . Return is not Refund .2) Government of India collects Income Tax through three modes :a) TDS - Tax Deduction at Source . TDS is the system in which any corporation/business as an Employer is supposed to deduct the Income tax of an Employee from his/her salary at source and submit it to the GOI before the end of Financial Year . The tax is deducted regularly from the employee's salary in certain percentage so as to overcome the liability of Total Tax to be paid by the employer for the Financial Year.The Employer issues a TDS Certificate in the form of Form 16 or Form 16A to the Employee which would be used to claim the TDS by the employee while filing his/her return . Form 16 is the certificate issued for the tax deducted under the head Salaries . Form 16A is issued for tax deducted for income through other sources such as interests on securities,dividends,winnings,etc.If the employee has some extra income through other sources , he/she should intimate the Employer about it before so as to include it for TDS . The total tax paid by you through TDS is also available online on the TRACES portal which is linked to your Bank Account and PAN No. for your convenience . You can also generate and validate your Form 16 / 16A from the website to file your return online .b) Advance Tax and Self Assessment Tax .Advance Tax may also be called 'Pay as you earn' Tax . In India one has to estimate his income during the financial year.If your projected tax liability of the current Financial year is more than Rs 10000, you are supposed to pay Advance tax !This has to be paid in three instalments. 30 % by 15th Sept,60% minus first instalment by 15th Dec and 100% minus 2nd instalment by 15th March.For individuals who are earning only through salaries , the Advance Tax is taken care of through TDS by the employers and there is hardly any Advance Tax to be paid . But for individuals who have other sources of income , they have to pay Advance Tax .If one forgets to pay he is liable to pay interest @ 1% p.m.Self-Assessment Tax - While filing your Return of Income, one does a computation of income and taxes to be filled in the Return. On computation, sometimes it is noted that the Taxes paid either as Advance Tax or by way of TDS fall short of the Actual Tax Payable . The shortfall so determined is called the Self Assessment Tax which is payable before filing the Return of Income. c) TCS - Tax Collection at Source .Tax Collected at Source (TCS) is income tax collected by a Seller from a Payer on sale of certain items. The seller has to collect tax at specified rates from the payer who has purchased these items : Alcoholic liquor for human consumption Tendu leaves Timber obtained under a forest lease Timber obtained by any mode other than under a forest lease Any other forest produce not being timber or tendu leaves Scrap Minerals being coal or lignite or iron ore Scrap BatteriesSalaried Individuals are not concerned with TCS .3) Online Procedure for Filing your Return , Payment of Tax , and viewing/generating your TDS certificate . a) Filing Income Tax Return :The procedure is as simple as it gets . You have to go to the E-filing homepage of the GOI , i.e https://incometaxindiaefiling.go... and login to your account . If you don't have an account yet , you can create it through the 'Register Yourself' link above it . All you need is a PAN No. (obviously) . After logging in , you have to go to the E-file tab and select the 'Prepare and Submit online ITR' option . Alternatively , you can select the 'Upload Return' option to upload your return through an XML file downloaded from the 'Downloads' tab and filled offline by you .You have to enter your PAN No, select ITR Form name 'ITR1' (Form ITR1 is for salaried individuals, income from house property and other income) , select Assessment year and submit .Now all you have to do is fill the form with the tabs Personal Information , Income Details , Tax Details , Tax Paid and Verification and 80G to complete your Return and submit it to the Income Tax Department .The 'Income Details' tab asks for your Total Income through various sources , and Tax exemptions claimed by you under various clauses of Section 80 . It also computes the Income tax liability of yours for that Financial Year . The 'Tax details' tab asks for the TAN (Tax Deduction Account Number) and Details of Form 16/16A issued by the employer/generated by you for TDS . It also asks for Advance Tax / Self Assessment Tax, if paid and the Challan no. of the payment receipt .The 'Tax Paid and Verification' Tab asks for your Bank Account Number and IFSC code . If there is a surplus tax paid by you in the form of TDS/Advance Tax , you will get its refund with interest in a 4 months period by the Income Tax Department . After submitting the Return , you get a link on your registered E-mail id . This link provides you the ITR-V document (an acknowledgement slip) which you have to download , print , put your signature , and send it to the Bangalore division of the Income Tax Department for completion of your Return Filing . The address is mentioned in the document . Alternatively , you can evade the ITR-V process and opt to digitally sign in the beginning of E-filing , but the process requires you to spend money and is to be renewed every year .b) Payment of Tax - You can pay the TDS (Not required for an individual, it is to be paid by the employer) , Advance Tax or Self Assessment Tax through the portal of Tax Information Network , i.e e-TAX Payment System After filling the required form (ITNS 280 for Income Tax) , you pay the tax through your Bank Account , and get a Challan receipt which will be used during filing your return .c) View/ Generate TDS Certificate online .You can do it by logging on to the TRACES portal of the Tax Deduction System , i.e , Page on tdscpc.gov.in You will have to register yourself before logging in through your PAN no.You can view the details of your TDS deducted by the Employer via From 26AS on the portal .Also , you can generate your TDS Certificate in the form of Form 16/16A by entering the TAN No. of your Employer .

-

Is it legal for companies to charge a previous employee a fee for filling out an employment verification form?

I’m not a lawyer, but I’d say you don’t have to pay. The law, as I know it, requires former employers to confirm your dates of employment and title. If your former employer demands you pay a fee for this, ask for the demand in writing (say you need it for financial records), then send a copy of that demand to the company you applied to, and your state’s Office of the Attorney General or Labor Department. The demand on email would also work, as would a voicemail you can attach to an email.

-

What is the best way to fill out an 83(b) form?

Read Understanding an 83(b) Election to learn how to complete an 83(b) election, but from the way you phrased the question, I am not sure you understand what exactly an 83(b) election accomplishes.If a third party invests in your business, that is not necessarily a taxable transaction to you, unless you are personally selling the shares yourself rather than issuing new shares. If you are selling shares, an 83(b) election would not apply.If you are receiving "founder's shares" in the business and those shares are subject to some type of restrictions on your ability to sell them, then 83(b) very well may be appropriate, but it does not mean you will avoid the taxes. In fact you will actually accelerate your recognition of ordinary income for the current value of the shares you receive and owe tax on that income. With an 83(b) election, you pay the tax now to avoid paying more tax in the future (assuming the value of the stock increases) when the stock vests or the restrictions expire. After making an 83(b) election you pay capital gains tax on future increases in value rather than ordinary income tax and you only pay the capital gains tax when you sell the shares that were subject to the election.There are pros and cons to an 83(b) election and I would strongly suggest that you seek advice from tax professional before you decide how to proceed.

-

What are the biggest scams and frauds today?

Yes Yes.. I have been waiting to answer this question for quite long..So, this happened recently when I applied for an SBI Card and now I regret doing so. So, while applying for it, I had checked an option that said that “Whether I should be notified for Card Protection Plan” and I ticked it as Yes.Fortunately, my card got approved and then the torture began. I get a call from this gentleman (even before I received my card), that he is calling me from such and such Card Protection Plan and he started explaining me the features on it. He did not even wait for me to give a reply and he kept on speaking. And then, he came down to payment, asking me whether I would like to get it charged as a whole or as an emi. At that particular time, I asked him to send me a mail on all the features as I needed time to think. He insisted on me getting my card charged to which I refused stating that I would require a mail before I would agree to their terms and conditions. The gentleman abruptly disconnected the call without any courtesy.I thought this was over but I was wrong. I received another call the next day and I gave a similar reply and again this gentleman disconnected the call abruptly. I had to go on an international trip the next day but the calls just did not seemed to stop. I used to get calls every morning at 6 AM in Greece which is around 9:30 AM in India for my entire 10 Days of Travel When I complained the same on their Facebook Page since I did not want to make an international call, this is the reply I received.A bunch of Automated Replies. Needless to say, the day I landed in India, I made sure to blast them on the way they behave with people.It was later that I discovered, that these people sell your personal details to other fraud companies and I have been receiving varied calls such as My Card is being upgraded or my card has been blocked. One gentleman even went ahead in responding when I asked him an email regarding to the issue, that I will receive my mail....Wait for it....Via Bluetooth

Create this form in 5 minutes!

How to create an eSignature for the what is an earnings verification form

How to make an eSignature for your What Is An Earnings Verification Form in the online mode

How to generate an electronic signature for the What Is An Earnings Verification Form in Google Chrome

How to generate an electronic signature for signing the What Is An Earnings Verification Form in Gmail

How to make an electronic signature for the What Is An Earnings Verification Form right from your smartphone

How to generate an electronic signature for the What Is An Earnings Verification Form on iOS devices

How to make an eSignature for the What Is An Earnings Verification Form on Android

People also ask

-

What is an Employment Earnings Verification Form and why do I need it?

An Employment Earnings Verification Form is a document used to verify an employee's income and employment status. This form is essential for lenders, landlords, and other entities that require proof of income. With airSlate SignNow, you can easily create and send this form for electronic signatures, streamlining the verification process.

-

How can I create an Employment Earnings Verification Form using airSlate SignNow?

Creating an Employment Earnings Verification Form with airSlate SignNow is simple. Just log in to your account, select 'Create Document,' and choose the appropriate template or start from scratch. You can customize the form to meet your specific needs and send it out for eSignature in minutes.

-

Is there a cost associated with using airSlate SignNow for Employment Earnings Verification Forms?

Yes, airSlate SignNow offers various pricing plans depending on your business needs. Our plans are designed to be cost-effective, allowing you to manage multiple Employment Earnings Verification Forms without breaking the bank. Visit our pricing page for detailed information on the available options.

-

What features does airSlate SignNow offer for Employment Earnings Verification Forms?

airSlate SignNow provides a range of features for handling Employment Earnings Verification Forms, including customizable templates, secure eSignature options, and document tracking. These features enhance efficiency and ensure that your forms are completed promptly and securely.

-

Can I integrate airSlate SignNow with other applications for Employment Earnings Verification Forms?

Absolutely! airSlate SignNow offers seamless integrations with various applications such as CRM systems and cloud storage services. This allows you to streamline the process of creating and managing Employment Earnings Verification Forms, enhancing your workflow.

-

How does airSlate SignNow ensure the security of my Employment Earnings Verification Forms?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure storage methods to protect your Employment Earnings Verification Forms from unauthorized access. Additionally, our platform complies with industry standards to ensure your data remains safe.

-

What are the benefits of using airSlate SignNow for Employment Earnings Verification Forms?

Using airSlate SignNow for Employment Earnings Verification Forms offers signNow benefits, including time savings, improved accuracy, and enhanced convenience. The ability to eSign documents remotely means you can obtain necessary verifications without delays, making your processes faster.

Get more for Employment Earnings Verification Form

Find out other Employment Earnings Verification Form

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF