Payroll Deduction Form Template

What is the Payroll Deduction Form Template

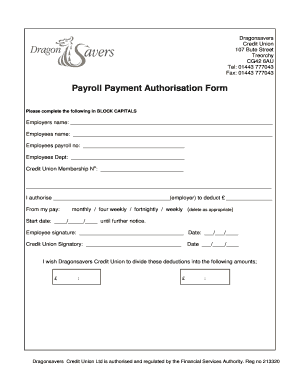

The payroll deduction form template is a standardized document used by employers to obtain employee consent for various deductions from their paychecks. These deductions can include contributions to retirement plans, health insurance premiums, and other benefits. By using this form, employers ensure compliance with legal requirements while providing employees with a clear understanding of how their pay will be affected. This form is essential for maintaining transparency and trust in the employer-employee relationship.

How to Use the Payroll Deduction Form Template

Utilizing the payroll deduction form template involves several straightforward steps. First, the employer should customize the template to reflect the specific deductions applicable to their organization. Next, employees must review the form carefully, ensuring they understand the deductions and their implications. Once completed, employees should sign the form electronically or physically, depending on the method of submission. Finally, employers should securely store the signed forms for record-keeping and compliance purposes.

Key Elements of the Payroll Deduction Form Template

A comprehensive payroll deduction form template typically includes several key elements. These may consist of:

- Employee Information: Name, address, and employee identification number.

- Deduction Details: Types of deductions, amounts, and frequency.

- Authorization Section: Employee signature and date to confirm consent.

- Employer Information: Company name and contact details for inquiries.

Incorporating these elements ensures clarity and facilitates the processing of deductions.

Steps to Complete the Payroll Deduction Form Template

Completing the payroll deduction form template involves a series of organized steps:

- Download the payroll deduction form template from a trusted source.

- Fill in the employee's personal information accurately.

- Specify the deductions being authorized, including amounts and frequency.

- Review the form for completeness and accuracy.

- Sign the form electronically or in writing, as required.

- Submit the completed form to the designated HR or payroll department.

Following these steps helps ensure that the payroll deductions are processed smoothly and efficiently.

Legal Use of the Payroll Deduction Form Template

The legal use of the payroll deduction form template is crucial for both employers and employees. To be considered valid, the form must comply with federal and state laws governing payroll deductions. This includes obtaining explicit consent from employees for each deduction listed. Additionally, the employer must retain signed forms for a specified period to demonstrate compliance during audits or legal inquiries. Utilizing a secure electronic signature solution can enhance the legal standing of the completed form.

Examples of Using the Payroll Deduction Form Template

There are various scenarios in which the payroll deduction form template can be applied. Common examples include:

- Setting up automatic contributions to a 401(k) retirement plan.

- Authorizing deductions for health insurance premiums.

- Enrolling in flexible spending accounts (FSAs) for medical expenses.

- Facilitating charitable contributions directly from paychecks.

These examples illustrate the versatility of the payroll deduction form template in managing employee benefits and financial planning.

Quick guide on how to complete payroll deduction form template word

Prepare payroll deduction form template word seamlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the right form and securely store it online. airSlate SignNow equips you with all the resources you need to create, alter, and eSign your documents swiftly without hassle. Manage payroll deduction form template on any device with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign payroll deduction form effortlessly

- Find employee deduction form and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant parts of the documents or redact sensitive data using tools that airSlate SignNow provides specifically for that purpose.

- Craft your eSignature with the Sign feature, which takes seconds and bears the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your requirements in document management in just a few clicks from any device you prefer. Modify and eSign payroll deduction template and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to payroll deduction authorization form template

Create this form in 5 minutes!

How to create an eSignature for the sample payroll deduction form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask paycheck deduction authorization form

-

What is a payroll deduction form template?

A payroll deduction form template is a standardized document used by businesses to obtain employee authorization for deductions from their paychecks. This template streamlines the process, making it easy for HR departments to manage payroll deductions efficiently. Using an electronic payroll deduction form template can also enhance compliance and reduce paperwork.

-

How can I create a payroll deduction form template using airSlate SignNow?

Creating a payroll deduction form template with airSlate SignNow is simple. You can start by choosing a pre-designed template or create one from scratch using our user-friendly editor. Once your form is designed, you can easily customize it according to your company's requirements and share it with employees for signing.

-

What are the benefits of using a payroll deduction form template?

Using a payroll deduction form template streamlines the payroll process, ensuring accuracy and compliance. It reduces the chances of errors and minimizes paperwork, saving time for HR teams. Additionally, it improves employee satisfaction by providing a clear and documented agreement regarding their deductions.

-

Is the payroll deduction form template customizable?

Yes, the payroll deduction form template offered by airSlate SignNow is fully customizable. You can add your company logo, adjust the text fields, and include specific instructions tailored to your needs. This flexibility ensures that the template aligns with your company's branding and operational requirements.

-

Can I integrate the payroll deduction form template with other software?

Absolutely! airSlate SignNow allows for seamless integration with various HR and payroll software, enhancing your workflow. By integrating the payroll deduction form template with your existing systems, you can ensure data consistency and improve efficiency in processing deductions.

-

What pricing options are available for using the payroll deduction form template?

airSlate SignNow offers competitive pricing plans to suit different business sizes and needs. You can choose a monthly or annual subscription, depending on your preference. Each plan includes access to the payroll deduction form template, allowing your organization to manage documents effectively without breaking the budget.

-

How does eSigning a payroll deduction form template work?

eSigning a payroll deduction form template with airSlate SignNow is straightforward and secure. Employees can electronically sign the template using any device, making the process quick and efficient. All signatures are legally binding, ensuring that your payroll changes are documented and protected.

Get more for payroll deductions form

- Affidavit of unemployment form

- Hipaa compliant authorization for release of patient information

- Publication 3676 b en sp rev 10 2015 irs certified volunteers providing free tax preparation irs form

- Unemployment insurance application ex servicemember and federal employee de 1101iabd edd ca form

- F 05080 form

- Cs 95 affidavit for termination of child support courts mo form

- Statement of existing lease agreement form

- Right to work checklist form

Find out other payroll deduction sheet

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe