Irs Form 1040

What is the IRS Form 1040?

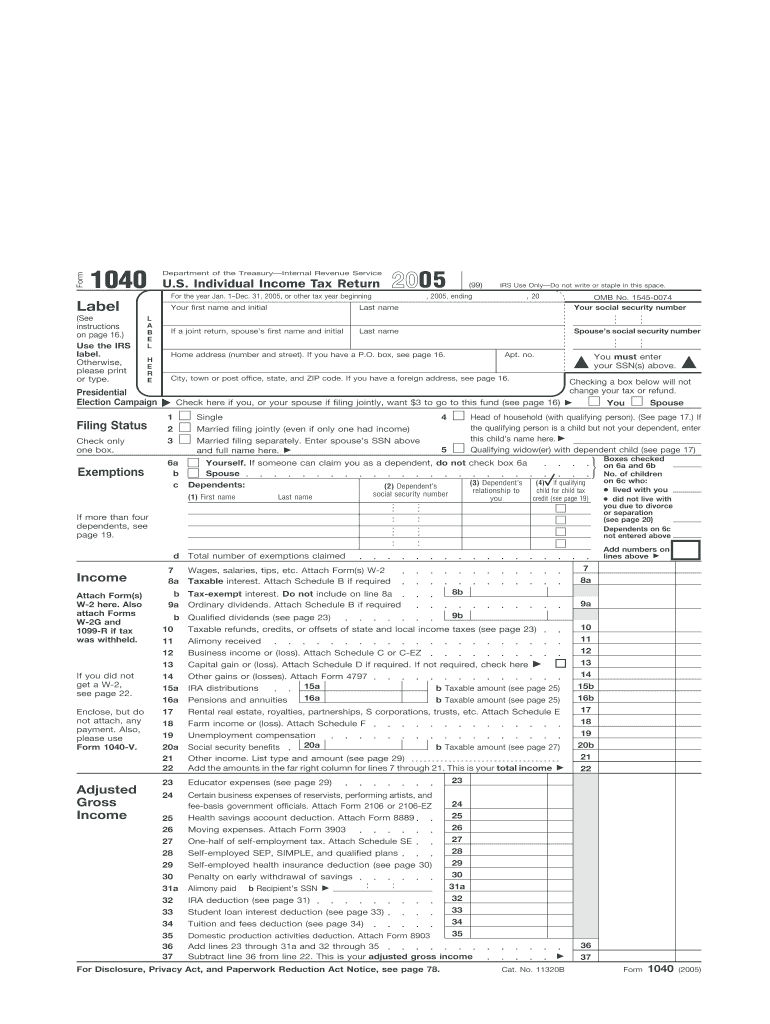

The IRS Form 1040 is a standard individual income tax return form used by U.S. taxpayers to report their annual income. This form allows taxpayers to calculate their tax liability, claim deductions and credits, and determine whether they owe additional taxes or are entitled to a refund. The 2005 version of the form includes specific instructions and requirements that reflect the tax laws and regulations applicable for that year. Understanding the purpose and structure of the Form 1040 is essential for accurate tax filing.

How to Obtain the IRS Form 1040

Taxpayers can obtain the IRS Form 1040 in several ways. The form is available for download from the official IRS website, where users can access the 2005 version in PDF format. Additionally, physical copies can often be found at local libraries, post offices, and IRS offices. Some tax preparation services may also provide the form as part of their offerings. Ensuring that you have the correct version for the tax year is crucial for compliance.

Steps to Complete the IRS Form 1040

Completing the IRS Form 1040 involves several key steps:

- Gather all necessary documentation, including W-2s, 1099s, and other income statements.

- Fill out personal information, such as name, address, and Social Security number.

- Report income from various sources, including wages, dividends, and interest.

- Claim deductions and credits applicable to your situation, which may reduce your taxable income.

- Calculate your total tax liability and determine if you owe taxes or are due a refund.

- Sign and date the form before submission.

Legal Use of the IRS Form 1040

The IRS Form 1040 is legally binding when completed accurately and submitted according to IRS guidelines. To ensure legal compliance, taxpayers must provide truthful information and maintain records of all income and deductions claimed. Filing the form electronically or via mail is acceptable, but it is essential to follow the specific regulations regarding signatures and submission methods to avoid penalties.

Filing Deadlines / Important Dates

For the 2005 tax year, the deadline for filing the IRS Form 1040 was typically April 15 of the following year. Taxpayers who missed this deadline may have faced penalties or interest on unpaid taxes. It is important to be aware of any extensions or changes to deadlines that may apply in specific circumstances. Staying informed about these dates helps ensure timely and compliant tax filing.

Required Documents

To complete the IRS Form 1040, taxpayers need to gather various documents, including:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Documentation for other income sources, such as rental income

- Records of deductible expenses, including mortgage interest and charitable contributions

Having these documents organized and ready will facilitate a smoother filing process.

Quick guide on how to complete irs form 1040

Complete Irs Form 1040 effortlessly on any gadget

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary form and securely preserve it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents quickly and efficiently. Manage Irs Form 1040 on any gadget using the airSlate SignNow Android or iOS applications, and streamline your document tasks today.

The easiest method to edit and electronically sign Irs Form 1040 with ease

- Locate Irs Form 1040 and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark important sections of your documents or redact sensitive details using tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, monotonous form searching, or errors that require printing new copies. airSlate SignNow manages all your document handling needs in just a few clicks from any device you prefer. Edit and electronically sign Irs Form 1040 while ensuring excellent communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

When and how should you start filing taxes?

When? I usually do a rough draft in late February or early March. I delay filing until April 12th (not the 15th, in case of online delays) if I owe money. If I am due a refund, then I proofread and file without waiting.How? As a CPA, I do my own taxes and my daughter’s. She qualifies for free filing through online providers - see links on the IRS website. Very easy, once she gives me all her information.My situation is more complicated, and I don’t qualify for free filing. (Schedules A, B, D and E, under the old nomenclature.) I go to the IRS website, where they have “fillable” versions of all the forms, and all the instructions. This is not something I recommend to anyone who isn’t already familiar with the tax code. Even I usually go through at least three iterations before I’m sure I’ve gotten everything right.We are fortunate that our state department of revenue has a good online filing program. I can knock out both state returns in under an hour, once the federal returns are done.There’s no shame in having a CPA or Enrolled Agent do your taxes. Just check their credentials; some places hire preparers who aren’t very well trained.

-

How could I pay tax to the government after I earn money by my individual design work?

I'm not familiar with how you would be taxed under an OPT visa, but you may be able to use the 2015 IRS Tax Withholding Calculator. This calculator is for permanent residents/citizens and it may help you determine how much money you'll owe for the whole year once you put in all applicable information.You can submit tax payments every quarter by filling out these forms and including checks to the IRS and Massachusetts Department of Revenue:IRS Form 1040-ES - Estimated Tax for IndividualsMA Form 1-ES - Estimated Tax Payment

-

I have an idea for self-employment, but I still live at home with my parents. How will I handle taxes?

Just fill out the tax forms as a regular taxpayer. Put your home address. The IRS doesn't care if the address is home or anywhere else. Fill out this form:and this one:Attach them to form 1040, and attach any money owed.Done.Or, you can use this very simple form:Hope that helps.

-

How much tax I need to pay for intern stipend in US?

All income earned in the United States is subject to Income Tax. This can vary based on factors like dependents, living status, etc but generally speaking your tax liability for the year assuming no other income is earned in the United States and that you pay taxes in another country on your income in that country is about $1,134. You might also owe Social Security and Medicare taxes, depending on your legal status. I have linked some IRS (the US Federal taxing authority) information below that covers how this works. If you do owe social insurance taxes, this will add another $1,607 to your tax bill. Alien Liability for Social Security and Medicare Taxes of Foreign Teachers, Foreign Researchers, and Other Foreign Professionals

-

What is a W-2 form and how important is it?

IRS form W-2 is an end-of-year summary that and employer gives to the employees and also sends to the IRS stating the amount of wages paid, as well as the amount of taxes withheld. Essentially the same information that also appears in the year-to-date column on your last paycheck of the year.You need this information to fill out your form 1040 (individual income tax return) and if you file the 1040 by paper mail, a copy of the W-2 form(s) must be attached.When the IRS receives your 1040, they will compare the W-2 that they got from you with the one they got from your employer.Your employer is required to give or mail it to you by the end of January.

-

How can I file my taxes as an expat?

As a U.S. citizen, you do generally have the obligation to file a U.S. tax return even though you live in Egypt. Note, however, that in some cases, if your income is below a certain threshold amount, you may not be required to file a federal income tax return. In Publication 501, the IRS includes a chart that lists the minimum thresholds based on filing status, age, and gross income. If you are above these thresholds, you generally need to file even if you do not owe U.S. tax. If you do not owe tax because of the Foreign Earned Income Exclusion, for instance, you still need to file a tax return in order to claim the exclusion.If e-filing is unavailable to you, then you must file your return by mail. If you have missed previous year filings, then you should consider entering into one of the IRS’s amnesty programs. For more information and to contact a tax firm dedicated to U.S.expat tax filings, please visit our website at expattaxprofessionals.com.

-

If you miss the April 15th deadline, is there no possible way to get a tax return?

Tax return forms for past years, including instructions, are available on line. You can print the ones you need, fill them in, and return them to the address provided with the instructions. This is also true of state tax return forms and instructions.If the government owes you money, they will send you a check. But they won't pay any interest on the time since you overpaid withholding. As a fellow taxpayer, I thank you for the extended, interest free loan you have made to the US Government. Every little bit helps.If you owe the government money, include a check for the money that the forms say you owe. The IRS will work out the additional money you owe in penalties and interest and send you a bill. Delaying this process will make the bill larger.I hope yours is the first case.

-

How do I fill out my FAFSA?

The FAFSA isn't as scary as it seems, but it's helpful to have the documents you'll need handy before you fill it out. It's available starting January 1 of the year you'll attend school, and it's best to complete it as early as possible so you get the most aid you'll qualify for. Be especially mindful of school and state deadlines that are earlier than the federal deadline of June 2017. Check out NerdWallet's 5 Hacks to Save Time on Your 2016 FAFSA. These are the basic steps: Gather the documents you'll need to complete the form by following this checklist.Log in to the FAFSA with your Federal Student Aid ID. You'll need an FSA ID to sign and submit the form electronically, and your parent will need one too if you're a dependent student. Create one here. Follow the prompts to fill out the FAFSA. This guide will help you fill it out according to your family situation. You'll be able to save time by importing income information from the IRS starting Feb. 7, 2016. Many families don't file their 2015 income taxes until closer to the deadline of April 18. But it's a good idea to fill out your FAFSA earlier than that. Use your parents' 2014 tax information to estimate their income, then go back in and update your FAFSA using the IRS Data Retrieval Tool once they've filed their taxes. More info here: Filling Out the FAFSA.

Create this form in 5 minutes!

How to create an eSignature for the irs form 1040

How to create an electronic signature for your Irs Form 1040 online

How to create an electronic signature for the Irs Form 1040 in Google Chrome

How to generate an eSignature for signing the Irs Form 1040 in Gmail

How to make an eSignature for the Irs Form 1040 right from your smartphone

How to generate an eSignature for the Irs Form 1040 on iOS devices

How to make an eSignature for the Irs Form 1040 on Android devices

People also ask

-

What is IRS Form 1040 and when do I need to file it?

IRS Form 1040 is the standard individual income tax return form used by the Internal Revenue Service (IRS) in the United States. You need to file it annually, typically by April 15, to report your income, deductions, and tax liability. Understanding how to properly complete IRS Form 1040 is essential for accurate tax reporting.

-

How can airSlate SignNow help with IRS Form 1040 submissions?

AirSlate SignNow streamlines the process of signing and submitting IRS Form 1040 by allowing users to electronically sign documents securely and efficiently. With our easy-to-use platform, you can send your completed IRS Form 1040 for signatures, ensuring that all necessary parties can sign it from anywhere, anytime.

-

Is airSlate SignNow compliant with IRS regulations for e-signatures?

Yes, airSlate SignNow complies with IRS regulations regarding electronic signatures. Our platform is designed to ensure that your e-signed IRS Form 1040 meets all legal requirements, giving you peace of mind that your documents are secure and valid.

-

What features does airSlate SignNow offer for managing IRS Form 1040?

AirSlate SignNow offers a range of features for managing IRS Form 1040, including document templates, automated reminders, and secure storage. These features simplify the process of preparing, signing, and submitting your tax returns, making it easier to stay organized during tax season.

-

Can I integrate airSlate SignNow with my accounting software for IRS Form 1040?

Absolutely! AirSlate SignNow integrates seamlessly with various accounting software, allowing you to import and export data for IRS Form 1040 easily. This integration helps streamline your tax preparation process by ensuring that all information is accurately reflected in your documents.

-

How much does airSlate SignNow cost for businesses needing to file IRS Form 1040?

AirSlate SignNow offers competitive pricing plans tailored for businesses, including options for those who frequently file IRS Form 1040. We provide flexible subscription plans that fit different budgets and needs, ensuring you have access to essential e-signature features without overspending.

-

What benefits does using airSlate SignNow provide for IRS Form 1040 preparation?

Using airSlate SignNow for your IRS Form 1040 preparation offers numerous benefits, including time savings, enhanced security, and improved collaboration. Our platform allows you to quickly gather e-signatures and manage your documents in one place, making tax filing less stressful and more efficient.

Get more for Irs Form 1040

Find out other Irs Form 1040

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe