Form it 47 Request for Municipal Income Tax Account Columbus Incometax Columbus 2007

What is the Form IT 47 Request For Municipal Income Tax Account Columbus Incometax Columbus

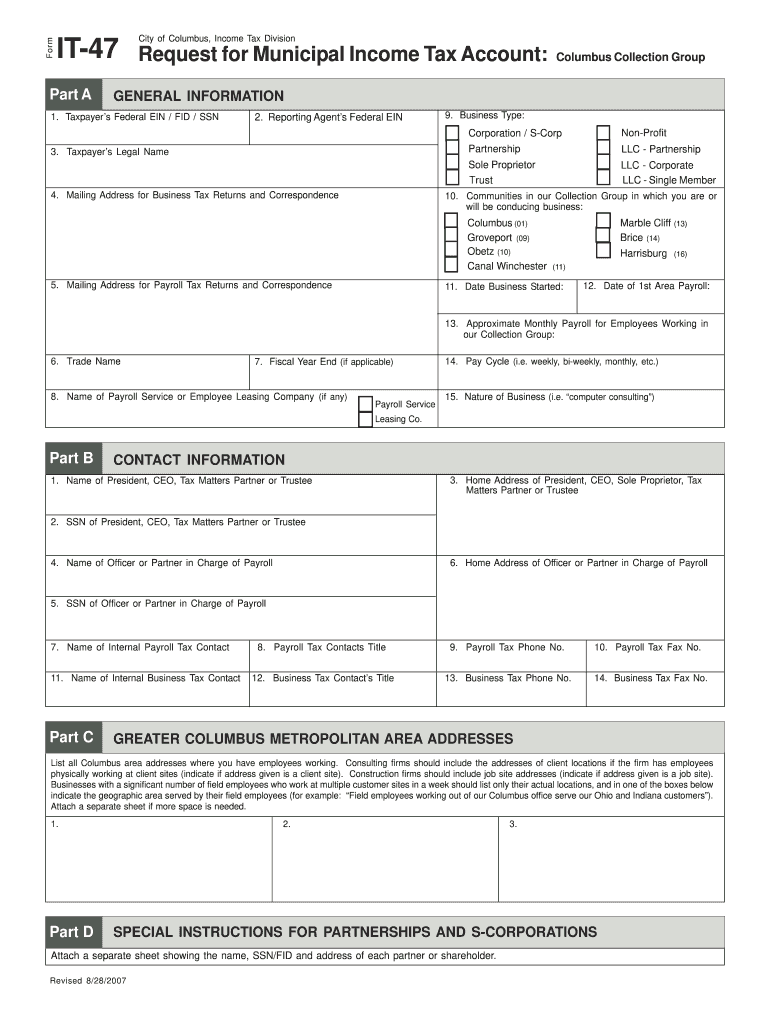

The Form IT 47 Request For Municipal Income Tax Account Columbus is a crucial document for individuals and businesses seeking to establish or update their municipal income tax accounts in Columbus, Ohio. This form is specifically designed for taxpayers who need to register for income tax purposes within the city. It captures essential information such as the taxpayer's name, address, and Social Security number or Employer Identification Number (EIN). The completion of this form is a vital step in ensuring compliance with local tax regulations.

Steps to Complete the Form IT 47 Request For Municipal Income Tax Account Columbus Incometax Columbus

Completing the Form IT 47 requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including your personal details and any relevant business information.

- Access the form through the official Columbus income tax website or authorized platforms.

- Fill in the required fields accurately, ensuring that all information is current and correct.

- Review the completed form for any errors or omissions.

- Sign and date the form as required.

- Submit the form according to the specified submission methods, either online, by mail, or in person.

How to Obtain the Form IT 47 Request For Municipal Income Tax Account Columbus Incometax Columbus

The Form IT 47 can be obtained through various channels. The most straightforward method is to visit the official Columbus income tax website, where the form is available for download. Alternatively, you can request a physical copy by contacting the Columbus income tax department directly. It is essential to ensure you are using the most current version of the form to avoid any compliance issues.

Legal Use of the Form IT 47 Request For Municipal Income Tax Account Columbus Incometax Columbus

The legal use of the Form IT 47 is governed by the municipal tax laws of Columbus, Ohio. This form must be completed accurately to establish a taxpayer's income tax account with the city. Failing to submit this form can result in penalties or issues with tax compliance. It is important to understand that the information provided on this form is subject to verification by the tax authorities, and any discrepancies can lead to legal consequences.

Key Elements of the Form IT 47 Request For Municipal Income Tax Account Columbus Incometax Columbus

Several key elements are essential for the completion of the Form IT 47:

- Taxpayer Identification: This includes your name, address, and Social Security number or EIN.

- Business Information: If applicable, provide details about your business, including its name and type.

- Signature: A valid signature is required to authenticate the form.

- Date: The date of submission must be clearly indicated.

Form Submission Methods (Online / Mail / In-Person)

The Form IT 47 can be submitted through various methods to accommodate different preferences:

- Online: Many taxpayers prefer to submit the form electronically through the Columbus income tax portal.

- Mail: You can print the completed form and send it via postal service to the designated tax office.

- In-Person: For those who prefer face-to-face interactions, submitting the form in person at the tax office is an option.

Quick guide on how to complete form it 47 request for municipal income tax account columbus incometax columbus

Your assistance manual on how to prepare your Form IT 47 Request For Municipal Income Tax Account Columbus Incometax Columbus

If you’re curious about how to finish and submit your Form IT 47 Request For Municipal Income Tax Account Columbus Incometax Columbus, here are some straightforward recommendations on how to simplify tax filing.

To start, you simply need to create your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an extremely user-friendly and robust document tool that enables you to modify, draft, and finalize your tax forms effortlessly. With its editor, you can alternate between text, check boxes, and eSignatures, returning to adjust responses where necessary. Streamline your tax handling with advanced PDF editing, eSigning, and easy sharing options.

Follow the instructions below to complete your Form IT 47 Request For Municipal Income Tax Account Columbus Incometax Columbus in just a few minutes:

- Create your account and start working on PDFs in no time.

- Utilize our directory to locate any IRS tax document; explore various versions and schedules.

- Click Get form to access your Form IT 47 Request For Municipal Income Tax Account Columbus Incometax Columbus in our editor.

- Populate the necessary fillable fields with your details (text, numbers, check marks).

- Use the Sign Tool to affix your legally-recognized eSignature (if required).

- Review your document and correct any inaccuracies.

- Preserve modifications, print your version, send it to your recipient, and download it to your device.

Utilize this manual to electronically submit your taxes with airSlate SignNow. Keep in mind that submitting on paper could lead to errors in returns and delay refunds. Before e-filing your taxes, ensure you check the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct form it 47 request for municipal income tax account columbus incometax columbus

FAQs

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How do I request for Income Tax refund if it's failed due to closure of account?

Login to Income Tax efiling website.Go to ‘My Account’. In the drop down click on ‘Service Request’ In the ‘Request Type’ click on ‘New Request’, And select ‘Request Category’ as ‘Refund Reissue’Fill in the ‘Bank Account Number’, ‘Account Type’. ‘IFSC Code’ and ‘Bank Name’ and click on ‘Submit’

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

-

How long does it take for Facebook to get back to you after you fill out your account form when you got locked out?

Up to 48 hrs.

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

Someone is impersonating my Instagram. How long will it take for the impersonation account to be deleted? Do I get a notification? I filled out the form and sent a photo of myself with my ID, but received no confirmation it was received.

This would be in keeping with the idea of individual freedom, in that, each person should be free to define his own thinking and his own life absent those real actions, not opinions, that are detrimental to another or to society.In keeping with the tradition of American freedom to think independently as noted here with a Thomas Jefferson quote from 1802 in a letter to the Baptist Bishops of Danbury CT. The Bishops were intent on making the Baptist Church the default religion of the new“Believing with you that religion is a matter which lies solely between Man & his God, that he owes account to none other for his faith or his worship, that the legitimate powers of government signNow actions only, & not opinions, I contemplate with sovereign reverence that act of the whole American people which declared that their legislature should "make no law respecting an establishment of religion, or prohibiting the free exercise thereof," thus building a wall of separation between Church & State.”Freedom of religion is a great deal more that deciding what god one may or may not believe in; it is the freedom to think independently, to hold with value those opinions that may differ from others or from government as opposed to a government sponsored and centered belief, which in itself may become intellectually stifling and oppressive to the imaginative mind.Freedom of Religion is also freedom from a religious mandate to believe or to hold one religious belief above all others. The definition of religion is simply the claim that my belief is of “supreme importance” which may also apply to that secular or political ideology and even to that atheistic belief or opinion that gods do not exist. Religious belief is not exclusive to the supernatural, but, rather, inclusive of all opinion.As an Atheist, my Atheism is my opinion of life and living, my religious belief, and I consider it of “supreme Importance” to me, and do I believe that others should think the same, yes, I do. Do I believe that I should make or force others to believe as I do, no.Hopefully there will come a day, in keeping with the thought, the wish and the dream of Martin Luther King, that we are judged not by the god one may or may not belief in, ”—- but by the content of their character.”“I have a dream that my four little children will one day live in a nation where they will not be judged by the color of their skin, but by the content of their character.” Martin Luther King, Jr.To respond directly to the question of what religion is best for America and in keeping with the definition of religion as something of supreme importance, I would say that the American Constitution is, by far, the best religion for American

Create this form in 5 minutes!

How to create an eSignature for the form it 47 request for municipal income tax account columbus incometax columbus

How to create an electronic signature for the Form It 47 Request For Municipal Income Tax Account Columbus Incometax Columbus online

How to generate an eSignature for your Form It 47 Request For Municipal Income Tax Account Columbus Incometax Columbus in Google Chrome

How to generate an electronic signature for signing the Form It 47 Request For Municipal Income Tax Account Columbus Incometax Columbus in Gmail

How to create an electronic signature for the Form It 47 Request For Municipal Income Tax Account Columbus Incometax Columbus straight from your smartphone

How to create an electronic signature for the Form It 47 Request For Municipal Income Tax Account Columbus Incometax Columbus on iOS devices

How to create an eSignature for the Form It 47 Request For Municipal Income Tax Account Columbus Incometax Columbus on Android

People also ask

-

What is the Form IT 47 Request For Municipal Income Tax Account Columbus?

The Form IT 47 Request For Municipal Income Tax Account Columbus is a necessary document for businesses in Columbus to open an account for municipal income tax purposes. By completing this form, businesses ensure compliance with local tax regulations, which is critical for smooth operations in Columbus. airSlate SignNow provides a seamless way to eSign and submit this form efficiently.

-

How can airSlate SignNow help with the Form IT 47 Request For Municipal Income Tax Account Columbus?

airSlate SignNow offers a user-friendly platform for electronically signing and submitting the Form IT 47 Request For Municipal Income Tax Account Columbus. By leveraging our eSignature capabilities, you can streamline the process, minimize delays, and ensure your submissions are properly handled. This makes managing your municipal income tax accounts much easier.

-

Is there a cost associated with using airSlate SignNow for the Form IT 47 Request For Municipal Income Tax Account Columbus?

Yes, there are various pricing plans for using airSlate SignNow, starting from a cost-effective individual plan to more comprehensive business solutions. Each plan provides different features that can support your needs, including assistance with electronic signatures for forms like the Form IT 47 Request For Municipal Income Tax Account Columbus. We recommend reviewing our pricing page for specific details.

-

What features does airSlate SignNow offer for managing the Form IT 47 Request For Municipal Income Tax Account Columbus?

airSlate SignNow includes features such as customizable templates, secure eSignatures, and easy document sharing tailored for the Form IT 47 Request For Municipal Income Tax Account Columbus. Additionally, users can track their documents and receive notifications, ensuring that the process is efficient and transparent. These features enhance your experience and compliance when managing municipal income tax forms.

-

Can I integrate airSlate SignNow with other software for the Form IT 47 Request For Municipal Income Tax Account Columbus?

Absolutely! airSlate SignNow offers integrations with various platforms such as CRMs and project management tools, enhancing your workflow with the Form IT 47 Request For Municipal Income Tax Account Columbus. This connectivity ensures that your eSigning process is seamlessly incorporated into your existing systems, optimizing efficiency and reducing administrative burdens.

-

What are the benefits of eSigning the Form IT 47 Request For Municipal Income Tax Account Columbus with airSlate SignNow?

Using airSlate SignNow to eSign the Form IT 47 Request For Municipal Income Tax Account Columbus comes with numerous benefits, including increased security, reduced paperwork, and faster turnaround times. eSigning eliminates the hassles of physical signatures, providing a more convenient way to manage your municipal income tax obligations. This efficiency allows businesses to focus on growth rather than administrative tasks.

-

Is airSlate SignNow compliant with tax regulations for the Form IT 47 Request For Municipal Income Tax Account Columbus?

Yes, airSlate SignNow is committed to compliance with the necessary regulations for handling documents like the Form IT 47 Request For Municipal Income Tax Account Columbus. Our platform adheres to industry-standard security measures and eSignature laws, ensuring that your submissions are legally binding and valid. This compliance is crucial for maintaining your business's integrity in the tax filing process.

Get more for Form IT 47 Request For Municipal Income Tax Account Columbus Incometax Columbus

Find out other Form IT 47 Request For Municipal Income Tax Account Columbus Incometax Columbus

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP