State Form 11274r30 11 12

What is the State Form 11274r30 11 12

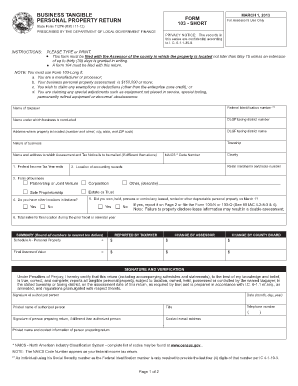

The State Form 11274r30 11 12 is a specific document used within the United States for various administrative purposes. This form may be required for compliance with state regulations, facilitating processes such as applications, notifications, or other official communications. Understanding its purpose is essential for individuals and businesses to ensure proper completion and submission.

How to use the State Form 11274r30 11 12

Using the State Form 11274r30 11 12 involves several key steps. Begin by obtaining the form from the appropriate state agency or online resource. Carefully read the instructions provided with the form to ensure you understand the requirements. Fill out the form completely, ensuring that all necessary information is accurate and up to date. Once completed, you can submit the form according to the specified submission methods, which may include online submission, mailing, or in-person delivery.

Steps to complete the State Form 11274r30 11 12

Completing the State Form 11274r30 11 12 requires attention to detail. Follow these steps for successful completion:

- Obtain the latest version of the form from a reliable source.

- Review the instructions carefully to understand what information is required.

- Fill in personal or business details as requested, ensuring accuracy.

- Double-check all entries for completeness and correctness.

- Sign and date the form where indicated.

- Submit the form according to the preferred method outlined in the instructions.

Legal use of the State Form 11274r30 11 12

The legal use of the State Form 11274r30 11 12 is contingent upon its proper completion and submission according to state laws. When filled out correctly, this form can serve as a legally binding document, provided it meets specific criteria established by relevant legal frameworks. It is crucial to ensure compliance with all applicable regulations to avoid potential legal issues.

Key elements of the State Form 11274r30 11 12

Several key elements are essential for the proper completion of the State Form 11274r30 11 12. These include:

- Identification information, such as name, address, and contact details.

- Specific details related to the purpose of the form.

- Signature of the individual or authorized representative.

- Date of submission.

Form Submission Methods (Online / Mail / In-Person)

The State Form 11274r30 11 12 can typically be submitted through various methods, depending on the requirements set by the issuing authority. Common submission methods include:

- Online submission via the state agency's website.

- Mailing the completed form to the designated address.

- Delivering the form in person to the appropriate office.

Quick guide on how to complete state form 11274r30 11 12

Effortlessly prepare State Form 11274r30 11 12 on any device

Managing documents online has become increasingly popular among businesses and individuals. It presents an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily find the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Work with State Form 11274r30 11 12 on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to modify and eSign State Form 11274r30 11 12 with ease

- Find State Form 11274r30 11 12 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or hide sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Decide how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and eSign State Form 11274r30 11 12 and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the state form 11274r30 11 12

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is State Form 11274r30 11 12 and how can it be used?

State Form 11274r30 11 12 is a specific document used for various administrative purposes. With airSlate SignNow, you can easily send, eSign, and manage this form digitally, saving time and ensuring compliance while minimizing paperwork.

-

How does airSlate SignNow enhance the process of filling out State Form 11274r30 11 12?

airSlate SignNow streamlines the process of filling out State Form 11274r30 11 12 by offering a user-friendly interface and customizable templates. Users can quickly input data, add signatures, and share the form securely with all necessary parties.

-

What pricing plans does airSlate SignNow offer for using State Form 11274r30 11 12?

airSlate SignNow offers flexible pricing plans that cater to various business needs, allowing users to effectively manage documents like State Form 11274r30 11 12. Whether you’re an individual or part of a large team, there's a plan that suits your requirements.

-

Can I integrate airSlate SignNow with other applications for State Form 11274r30 11 12?

Yes, airSlate SignNow supports various integrations with popular applications, enabling users to streamline workflows involving State Form 11274r30 11 12. This allows for seamless data transfer and enhances overall efficiency across platforms.

-

What are the key benefits of using airSlate SignNow for State Form 11274r30 11 12?

Using airSlate SignNow for State Form 11274r30 11 12 provides numerous benefits, including time savings, improved accuracy, and enhanced security. The platform ensures that your documents are handled efficiently and compliantly, vital for organizational success.

-

Is airSlate SignNow user-friendly for first-time users of State Form 11274r30 11 12?

Absolutely! airSlate SignNow is designed to be intuitive, making it easy for first-time users to navigate and complete State Form 11274r30 11 12 without a steep learning curve. Our tutorials and support resources further assist new users.

-

What security measures does airSlate SignNow implement for State Form 11274r30 11 12?

airSlate SignNow prioritizes the security of all documents, including State Form 11274r30 11 12, by employing advanced encryption and secure access protocols. You can trust that your sensitive information is protected throughout the signing process.

Get more for State Form 11274r30 11 12

Find out other State Form 11274r30 11 12

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free