Utah Owner Worker Registration What is it Form

What is the worker registration form?

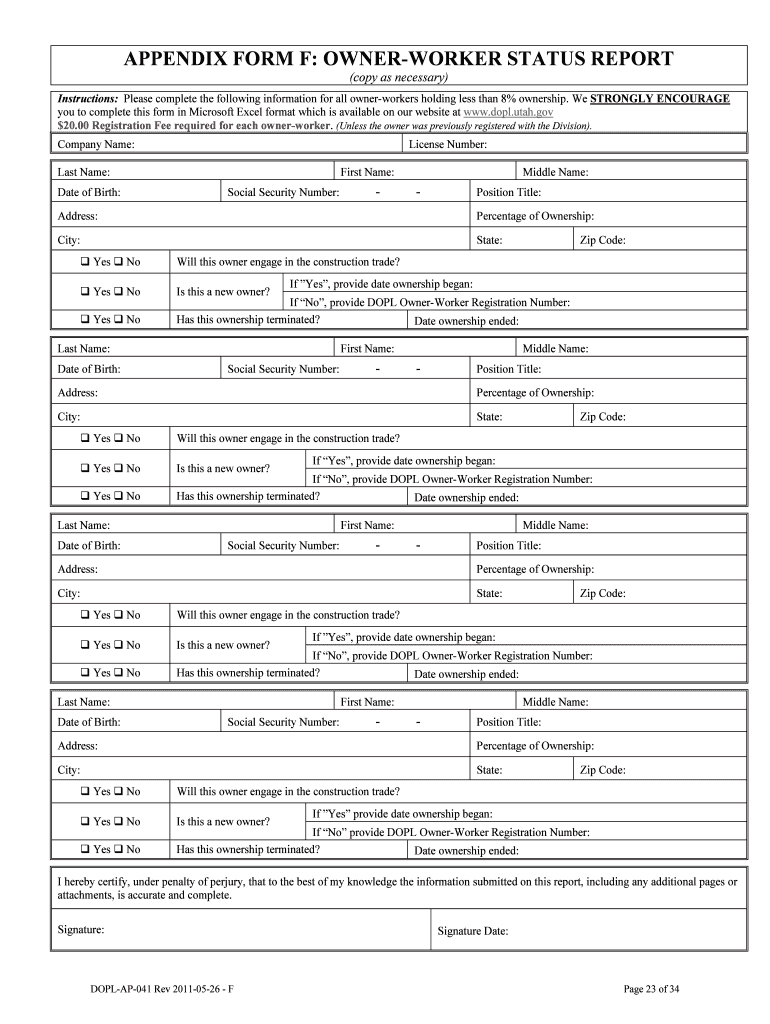

The worker registration form is a crucial document for individuals seeking to register as workers in various capacities, particularly in states like Utah. This form serves to officially record the details of a worker, ensuring compliance with state regulations and labor laws. It typically includes essential information such as the worker's name, address, contact information, and employment history. Understanding the purpose and requirements of this form is vital for both workers and employers to maintain legal compliance and facilitate smooth employment processes.

Steps to complete the worker registration form

Completing the worker registration form involves several straightforward steps. First, gather all necessary personal information, including your full name, address, and social security number. Next, accurately fill out the form, ensuring that all details are correct and up-to-date. Pay particular attention to any sections that require additional documentation or verification. Once completed, review the form for any errors before submitting it. Depending on your location, you may be able to submit the form electronically or via traditional mail.

Legal use of the worker registration form

The worker registration form is legally binding when filled out correctly and submitted according to state regulations. It is essential to understand that this form must adhere to specific legal standards to ensure its validity. Compliance with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA) is necessary when submitting the form electronically. This ensures that the digital signatures and submissions are recognized as legally valid, providing protection for both the worker and the employer.

Required documents for the worker registration form

When completing the worker registration form, several supporting documents may be required to verify the information provided. Commonly required documents include a government-issued photo ID, proof of residency, and any relevant employment history records. Additionally, if applicable, you may need to submit tax identification numbers or other identification numbers specific to your employment status. Having these documents ready can streamline the registration process and help avoid delays.

Form submission methods

There are various methods to submit the worker registration form, depending on your location and the specific requirements of the state. Common submission methods include online submission through a designated state portal, mailing the completed form to the appropriate state agency, or delivering it in person to a local office. Each method has its own set of guidelines and processing times, so it is advisable to check the specific requirements for your state to ensure timely processing.

Eligibility criteria for the worker registration form

Eligibility to complete the worker registration form typically requires individuals to meet certain criteria. Generally, applicants must be of legal working age, which is usually at least sixteen years old, and must provide valid identification. Additionally, individuals may need to demonstrate their eligibility to work in the United States, which often involves providing a social security number or other relevant documentation. Understanding these criteria is essential for a successful registration process.

Quick guide on how to complete utah owner worker registration what is it form

Effortlessly Prepare Utah Owner Worker Registration What Is It Form on Any Device

The management of documents online has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, edit, and eSign your documents quickly without hindrances. Handle Utah Owner Worker Registration What Is It Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

Effortlessly Modify and eSign Utah Owner Worker Registration What Is It Form

- Locate Utah Owner Worker Registration What Is It Form and then click Get Form to begin.

- Make use of the tools at your disposal to complete your form.

- Highlight important sections of the documents or redact sensitive details with tools provided by airSlate SignNow specifically for that function.

- Craft your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and then click on the Done button to finalize your changes.

- Choose how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes requiring new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you prefer. Modify and eSign Utah Owner Worker Registration What Is It Form to ensure effective communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

What forms do I need to fill out as a first-year LLC owner? It's a partnership LLC.

A Limited Liability Company (LLC) is business structure that provides the limited liability protection features of a corporation and the tax efficiencies and operational flexibility of a partnership.Unlike shareholders in a corporation, LLCs are not taxed as a separate business entity. Instead, all profits and losses are "passed through" the business to each member of the LLC. LLC members report profits and losses on their personal federal tax returns, just like the owners of a partnership would.The owners of an LLC have no personal liability for the obligations of the LLC. An LLC is the entity of choice for a businesses seeking to flow through losses to its investors because an LLC offers complete liability protection to all its members. The basic requirement for forming an Limited Liability Company are:Search your business name - before you form an LLC, you should check that your proposed business name is not too similar to another LLC registered with your state's Secretary of StateFile Articles of Organization - the first formal paper you will need file with your state's Secretary of State to form an LLC. This is a necessary document for setting up an LLC in many states. Create an Operating Agreement - an agreement among LLC members governing the LLC's business, and member's financial and managerial rights and duties. Think of this as a contract that governs the rules for the people who own the LLC. Get an Employer Identification Number (EIN) - a number assigned by the IRS and used to identify taxpayers that are required to file various business tax returns. You can easily file for an EIN online if you have a social security number. If you do not have a social security number or if you live outsides of United States, ask a business lawyer to help you get one.File Statement of Information - includes fairly basic information about the LLC that you need to file with your state’s Secretary of State every 2 years. Think of it as a company census you must complete every 2 years.Search and Apply for Business Licenses and Permits - once your business is registered, you should look and apply for necessary licenses and permits you will need from the county and city where you will do business. Every business has their own business licenses and permits so either do a Google search of your business along with the words "permits and licenses" or talk to a business lawyer to guide you with this.If you have any other questions, talk to a business lawyer who will clarify and help you with all 6 above steps or answer any other question you may have about starting your business.I am answering from the perspective of a business lawyer who represents businesspersons and entrepreneurs with their new and existing businesses. Feel free to contact me sam@mollaeilaw.com if you need to form your LLC.In my course, How To Incorporate Your Business on Your Own: Quick & Easy, you will learn how to form your own Limited Liability Company (LLC) or Corporation without a lawyer, choose a business name, file a fictitious business name, file Articles of Organization or Articles of Incorporation, create Operating Agreement or Bylaws, apply for an EIN, file Statement of Information, and how to get business licenses and permits.

-

What is the proper way to fill out the GST registration form?

Hi,I have already wrote an article on GST registration process. Here is the article:GST Registration | SlickAccount BlogIts a guide to step-by-step GST registration.I hope it would solve your issues and help to register under GST easily.Thanks

-

Is it true that only a fiance or wife can ask for a leave request for a US soldier?

I’ll echo a number of other answers here . . .Only the service member can request leave. Period.In addition . . .There is NO fee for applying for leave.Emergency Leave:Must still be requested by the service member using a DA Form 31 (Leave Request). A family can notify the service member of an emergency or other major event via the Red Cross. It’s one of the missions in their Congressional Charter. The Red Cross will verify the nature of the need and can track down a service member quickly. One does need sufficient identifying information to ensure they find the correct service member. Name alone is very rarely sufficient. I was notified in this manner when my father was by ambulance to a hospital in a condition very near death. One of my relatives knew exactly what to do and called the Red Cross. It was amazing how quickly I was found and notified.Occasionally service members or one of their family members will have what they think is a bright idea to invent a dire emergency to trigger an emergency leave. Don’t do it. The military invariably finds out it was fraudulent, nearly always immediately as we know it sometimes happens and will follow up to verify the signNow facts are substantively true (not unusual for some details to be inaccurate). There’s Hell to pay if an “emergency” is discovered to be a fraud. “Death in family” must be in the immediate, nuclear, family: mother, father, sister or brother, spouse, or children. “Dire emergencies” with extended family members (grandma, aunt, uncle, cousin, niece or nephew) don’t qualify for emergency leave - although a regular leave might be arranged. The sole exception to the latter would be if the grandparent, aunt or uncle were in loco parentis, i.e. were the guardian acting as a parent with legal custody while the service member was a minor child. This is a broad brush-stroke about it. The Red Cross and military commands know all the finer points of this . . . what kinds of emergencies and family relationships qualify and which do not. Bottom line: don’t lie about something trying to get a service member on emergency leave. It’s criminal fraud in the form of false official statements and will be dealt with as criminal fraud.

-

I have created a registration form in HTML. When someone fills it out, how do I get the filled out form sent to my email?

Are you assuming that the browser will send the email? That is not the way it is typically done. You include in your registration form a and use PHP or whatever on the server to send the email. In PHP it is PHP: mail - Manual But if you are already on the server it seems illogical to send an email. Just register the user immediately.

-

How a Non-US residence company owner (has EIN) should fill the W-7 ITIN form out? Which option is needed to be chosen in the first part?

Depends on the nature of your business and how it is structured.If you own an LLC taxed as a passthrough entity, then you probably will check option b and submit the W7 along with your US non-resident tax return. If your LLC’s income is not subject to US tax, then you will check option a.If the business is a C Corp, then you probably don’t need an ITIN, unless you are receiving taxable compensation from the corporation and then we are back to option b.

Create this form in 5 minutes!

How to create an eSignature for the utah owner worker registration what is it form

How to generate an electronic signature for the Utah Owner Worker Registration What Is It Form in the online mode

How to make an eSignature for the Utah Owner Worker Registration What Is It Form in Google Chrome

How to make an electronic signature for putting it on the Utah Owner Worker Registration What Is It Form in Gmail

How to generate an eSignature for the Utah Owner Worker Registration What Is It Form straight from your smartphone

How to generate an eSignature for the Utah Owner Worker Registration What Is It Form on iOS devices

How to generate an electronic signature for the Utah Owner Worker Registration What Is It Form on Android devices

People also ask

-

What is a worker registration form and how can airSlate SignNow help?

A worker registration form is a document used to collect essential information from employees or contractors. airSlate SignNow simplifies this process by allowing users to create, send, and eSign worker registration forms efficiently, ensuring a streamlined onboarding experience.

-

How does airSlate SignNow ensure the security of my worker registration form?

airSlate SignNow prioritizes security by employing industry-standard encryption for all documents, including worker registration forms. Additionally, our platform complies with regulations like GDPR and HIPAA, ensuring the safety of sensitive information during transmission and storage.

-

Can I customize my worker registration form with airSlate SignNow?

Yes, airSlate SignNow offers customizable templates for worker registration forms. You can easily add fields, logos, and company branding to create an engaging and professional document tailored to your business needs.

-

What pricing options are available for using airSlate SignNow for worker registration forms?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. You can start with a free trial and choose a subscription plan that best fits your organization’s needs for processing worker registration forms and other documents.

-

Can I integrate airSlate SignNow with other applications for handling worker registration forms?

Absolutely! airSlate SignNow seamlessly integrates with numerous applications, such as CRM systems and document management tools. This allows you to automate workflows around your worker registration forms, enhancing efficiency and productivity.

-

What are the benefits of using airSlate SignNow for worker registration forms?

Utilizing airSlate SignNow for worker registration forms streamlines the documentation process, saves time, and reduces paperwork. The ability to eSign documents ensures faster processing, while our user-friendly interface makes it accessible for everyone in your organization.

-

Is there support available for using airSlate SignNow with worker registration forms?

Yes, airSlate SignNow provides comprehensive support, including tutorials, user guides, and customer service. If you have any questions regarding worker registration forms or require assistance, our support team is readily available to help.

Get more for Utah Owner Worker Registration What Is It Form

Find out other Utah Owner Worker Registration What Is It Form

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent