In 111 Form

What is the In 111 Form

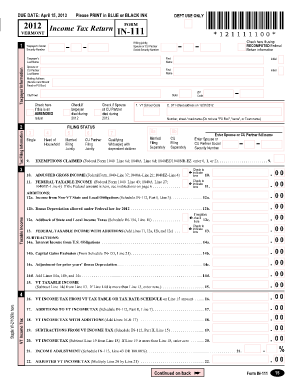

The In 111 Form is a specific document used primarily for tax purposes in the United States. It is typically associated with the reporting of income and deductions for individuals or businesses. This form plays a crucial role in ensuring that taxpayers comply with federal tax regulations and accurately report their financial activities. Understanding the purpose and requirements of the In 111 Form is essential for anyone looking to file their taxes correctly.

How to use the In 111 Form

Using the In 111 Form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, such as income statements and receipts for deductions. Next, carefully fill out the form, ensuring that all information is accurate and complete. Once the form is filled out, review it for any errors before submitting it to the appropriate tax authority. It is important to keep a copy of the completed form for your records.

Steps to complete the In 111 Form

Completing the In 111 Form requires attention to detail. Follow these steps for a smooth process:

- Collect all relevant financial documents, including W-2s and 1099s.

- Begin filling out the form by entering your personal information, such as name, address, and Social Security number.

- Report your income by entering amounts from your financial documents in the appropriate sections.

- List any deductions you are eligible for, ensuring you have supporting documents for each deduction.

- Review the completed form for accuracy and completeness.

- Sign and date the form before submission.

Key elements of the In 111 Form

The In 111 Form includes several key elements that are vital for accurate tax reporting. These elements typically consist of:

- Personal identification information, including name and Social Security number.

- Income reporting sections for various sources of income.

- Deductions and credits that can reduce taxable income.

- Signature line to validate the information provided.

Each element must be completed accurately to ensure compliance with tax regulations.

Legal use of the In 111 Form

The In 111 Form is legally binding when filled out and submitted according to IRS guidelines. It is essential to ensure that all information is truthful and accurate, as any discrepancies can lead to penalties or legal issues. The form must be submitted by the designated filing deadlines to avoid late fees. Understanding the legal implications of using this form is crucial for all taxpayers.

Filing Deadlines / Important Dates

Filing deadlines for the In 111 Form are critical for compliance. Typically, the form must be submitted by April 15 of each year for individual taxpayers. However, extensions may be available under certain circumstances. It is important to stay informed about any changes to deadlines or requirements to avoid penalties.

Quick guide on how to complete in 111 form

Effortlessly Prepare In 111 Form on Any Device

Managing documents online has become increasingly favored by both companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed records, as you can easily find the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without delays. Handle In 111 Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Edit and Electronically Sign In 111 Form with Ease

- Find In 111 Form and click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize signNow sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose your delivery method for the form: via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs with a few clicks from your preferred device. Modify and eSign In 111 Form and ensure excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the in 111 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the In 111 Form in airSlate SignNow?

The In 111 Form is a specific document format created to streamline electronic signatures in compliance with relevant regulations. Utilizing airSlate SignNow, businesses can efficiently manage, send, and eSign In 111 Forms, ensuring a seamless workflow. This feature enhances productivity while maintaining legal requirements.

-

How much does it cost to use airSlate SignNow for In 111 Form?

airSlate SignNow offers competitive pricing plans suitable for various business needs, including handling In 111 Forms. Pricing typically varies based on the features and number of users required. For detailed pricing information, it's best to visit our pricing page or contact our sales team directly.

-

What features does airSlate SignNow offer for In 111 Form management?

With airSlate SignNow, users can easily create, send, manage, and eSign In 111 Forms using our intuitive platform. Key features include document templates, real-time tracking, and secure storage options. These tools simplify the entire signing process and enhance collaboration among teams.

-

Can I integrate airSlate SignNow with other applications for In 111 Form processing?

Yes, airSlate SignNow supports numerous integrations with popular applications and platforms. This means you can effortlessly connect your existing systems to facilitate the processing of In 111 Forms. Check our integration options to see all compatible applications and streamline your workflow.

-

What are the benefits of using airSlate SignNow for In 111 Form eSigning?

Using airSlate SignNow for In 111 Form eSigning provides signNow benefits, including faster turnaround times and reduced paper usage. This not only streamlines your operations but also supports eco-friendly practices. Additionally, you can enhance security and compliance with built-in encryption and authentication measures.

-

Is it easy to use airSlate SignNow for In 111 Form?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it simple for anyone to navigate and utilize for In 111 Forms. The intuitive interface allows users to quickly create, send, and track documents without needing extensive training or technical skills.

-

What security measures are in place for In 111 Form transactions in airSlate SignNow?

airSlate SignNow prioritizes security, offering features such as encryption, secure storage, and customizable access controls for In 111 Form transactions. These measures ensure that your documents remain confidential and compliant with industry standards. Our commitment to security helps protect sensitive information during the signing process.

Get more for In 111 Form

- Biosolids annual report form

- Point source application department of environmental quality deq state or form

- Sgt vernon walker acc form

- Fictitious firm name clark county nevada clarkcountynv form

- Received flu shot fillable form

- A 0361 a0 2013 form

- Disability extension form

- On builders letterhead us this form to certify the residence and heirs of a deceased nsli policyholder or beneficiary benefits

Find out other In 111 Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors