Foreign Earned Income Tax Worksheet PDF Form

What is the Foreign Earned Income Tax Worksheet PDF

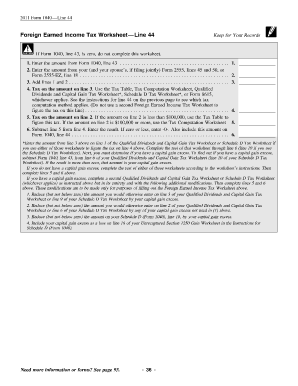

The Foreign Earned Income Tax Worksheet is a crucial document for U.S. citizens and resident aliens who earn income while living abroad. This worksheet helps individuals calculate their foreign earned income exclusion, which can significantly reduce their taxable income. By using this worksheet, taxpayers can determine the amount of foreign income that qualifies for exclusion under the Internal Revenue Code. The worksheet is available in PDF format, making it easy to download, print, and fill out as needed.

How to use the Foreign Earned Income Tax Worksheet PDF

Using the Foreign Earned Income Tax Worksheet involves several straightforward steps. First, download the PDF from a reliable source, ensuring you have the most current version. Next, gather all necessary financial documents, including your income statements from foreign employers. As you fill out the worksheet, input your total foreign earned income and any applicable deductions. The worksheet will guide you through the calculations needed to determine your exclusion amount. After completing it, you can use the results to fill out your Form 1040 accurately.

Steps to complete the Foreign Earned Income Tax Worksheet PDF

Completing the Foreign Earned Income Tax Worksheet requires careful attention to detail. Here are the steps to follow:

- Download the latest version of the worksheet in PDF format.

- Gather your income documentation, including W-2 forms and foreign income statements.

- Fill in your total foreign earned income in the designated section.

- Calculate any deductions or exclusions applicable to your situation.

- Follow the worksheet’s instructions to determine your eligible foreign earned income exclusion.

- Review your calculations for accuracy before transferring the information to your Form 1040.

Key elements of the Foreign Earned Income Tax Worksheet PDF

The Foreign Earned Income Tax Worksheet includes several key elements essential for accurate tax reporting. These elements typically consist of:

- Total Foreign Earned Income: The sum of all income earned from foreign sources.

- Foreign Housing Exclusion: Deductions related to housing expenses incurred while living abroad.

- Exclusion Calculation: A formula used to determine the amount of income that can be excluded from U.S. taxation.

- Signature and Date: Required fields to validate the worksheet upon completion.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the Foreign Earned Income Tax Worksheet. These guidelines outline eligibility criteria, including residency requirements and income limits. Taxpayers must adhere to these regulations to ensure compliance and avoid penalties. It is important to review the IRS instructions for Form 2555, which details the foreign earned income exclusion and provides further context for completing the worksheet accurately.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Foreign Earned Income Tax Worksheet is crucial for timely tax submission. Generally, U.S. taxpayers living abroad must file their taxes by June fifteenth, with the possibility of an extension to October fifteenth. However, any taxes owed are still due by April fifteenth. It is advisable to keep track of these dates to avoid late fees and penalties associated with delayed filings.

Quick guide on how to complete foreign earned income tax worksheet pdf

Complete Foreign Earned Income Tax Worksheet Pdf effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to locate the suitable form and securely keep it online. airSlate SignNow provides all the resources necessary to create, modify, and eSign your documents promptly without delays. Manage Foreign Earned Income Tax Worksheet Pdf on any device with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Foreign Earned Income Tax Worksheet Pdf with ease

- Obtain Foreign Earned Income Tax Worksheet Pdf and then click Get Form to begin.

- Make use of the tools available to complete your form.

- Highlight signNow sections of your documents or conceal sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Select how you wish to submit your form: via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your preferred device. Edit and eSign Foreign Earned Income Tax Worksheet Pdf and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the foreign earned income tax worksheet pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the foreign earned income tax worksheet, and why is it important?

The foreign earned income tax worksheet is a crucial tool for expatriates to determine eligibility for the Foreign Earned Income Exclusion. It helps individuals calculate the amount of foreign income that may be excluded from U.S. taxation, ensuring they do not pay double taxes. Understanding this worksheet is essential for accurate tax reporting.

-

How can I access the foreign earned income tax worksheet using airSlate SignNow?

You can easily access the foreign earned income tax worksheet by utilizing airSlate SignNow’s document creation features. Our platform allows you to customize and generate tax worksheets quickly and securely. Simply log in, and you can start the process of creating your necessary forms.

-

Is there a cost associated with using the foreign earned income tax worksheet on airSlate SignNow?

Yes, there is a subscription fee associated with using airSlate SignNow, which provides access to all features, including the foreign earned income tax worksheet. However, our pricing is competitive and offers great value for businesses looking for an efficient document management solution. Check our pricing page for details on different plans.

-

What features does airSlate SignNow offer for managing the foreign earned income tax worksheet?

airSlate SignNow provides a range of features for managing the foreign earned income tax worksheet, including eSigning, secure document storage, and collaboration tools. These features ensure that you can complete your tax documents efficiently and share them with colleagues or tax professionals securely. Our platform also supports any necessary revisions with ease.

-

Can I integrate airSlate SignNow with other tax preparation software for the foreign earned income tax worksheet?

Absolutely! airSlate SignNow integrates seamlessly with various tax preparation software, enabling you to import and export your foreign earned income tax worksheets easily. This integration simplifies your workflow, ensuring that all your tax documents are organized and accessible in one place.

-

What are the benefits of using airSlate SignNow for the foreign earned income tax worksheet?

Using airSlate SignNow for the foreign earned income tax worksheet streamlines your tax preparation process. It provides a user-friendly interface for creating, signing, and managing documents, which saves time and minimizes errors. Additionally, you enjoy secure cloud storage and the ability to collaborate with tax professionals in real-time.

-

How does airSlate SignNow ensure the security of my foreign earned income tax worksheet?

airSlate SignNow prioritizes the security of your documents, including the foreign earned income tax worksheet, by using advanced encryption and secure access protocols. Our platform complies with industry standards to ensure your sensitive information is protected. You can trust that your data is safe with us.

Get more for Foreign Earned Income Tax Worksheet Pdf

Find out other Foreign Earned Income Tax Worksheet Pdf

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free