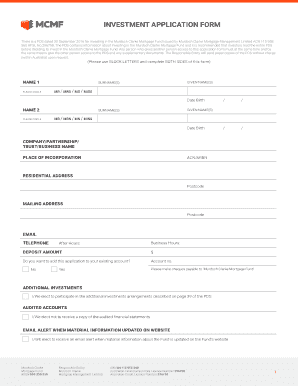

Murdoch Clarke Mortgage Fund Form

What is the Murdoch Clarke Mortgage Fund

The Murdoch Clarke Mortgage Fund is a financial product designed to assist individuals and businesses in obtaining mortgage financing. This fund pools resources from various investors to provide loans secured by real estate. It aims to offer competitive interest rates and flexible terms, making it an attractive option for borrowers seeking to purchase or refinance property. The fund typically focuses on residential and commercial real estate, ensuring a diverse portfolio that can mitigate risks while providing potential returns for investors.

How to use the Murdoch Clarke Mortgage Fund

Using the Murdoch Clarke Mortgage Fund involves several steps. First, potential borrowers should assess their financial situation and determine how much they need to borrow. Next, they can apply for a loan through the fund by submitting the required documentation, which may include proof of income, credit history, and details about the property being financed. After the application is reviewed, the fund will provide a loan offer outlining the terms, including interest rates and repayment schedules. Once accepted, the borrower can proceed with the financing process.

Steps to complete the Murdoch Clarke Mortgage Fund

Completing the Murdoch Clarke Mortgage Fund application requires careful attention to detail. Start by gathering necessary documentation, such as tax returns, bank statements, and identification. Then, fill out the application form accurately, ensuring all information is current and complete. After submission, monitor the application status and be prepared to respond to any requests for additional information. Once approved, review the loan agreement thoroughly before signing to ensure all terms are understood and acceptable.

Legal use of the Murdoch Clarke Mortgage Fund

The Murdoch Clarke Mortgage Fund must be utilized in compliance with applicable laws and regulations. This includes adhering to federal and state lending laws, which govern interest rates, disclosure requirements, and borrower rights. It is essential for borrowers to understand these regulations to ensure that their use of the fund is legal and that they are protected throughout the borrowing process. Consulting with legal or financial advisors can provide additional clarity on compliance issues.

Eligibility Criteria

Eligibility for the Murdoch Clarke Mortgage Fund typically depends on several factors, including creditworthiness, income level, and the type of property being financed. Borrowers may need to meet specific credit score thresholds and demonstrate sufficient income to support loan repayments. Additionally, the property must meet certain criteria, such as being located in an approved area and having a clear title. Understanding these criteria can help potential borrowers assess their chances of approval before applying.

Required Documents

To apply for the Murdoch Clarke Mortgage Fund, borrowers must prepare a set of required documents. Commonly requested items include:

- Proof of income (e.g., pay stubs, tax returns)

- Credit report

- Identification (e.g., driver's license, Social Security number)

- Property details (e.g., purchase agreement, property appraisal)

- Bank statements

Having these documents ready can streamline the application process and improve the chances of a timely approval.

Form Submission Methods

Submitting the Murdoch Clarke Mortgage Fund application can typically be done through various methods. Borrowers may have the option to apply online, which often provides the fastest processing time. Alternatively, applications can be submitted via mail or in person at designated locations. Each method has its advantages, and borrowers should choose the one that best fits their needs and preferences.

Quick guide on how to complete murdoch clarke mortgage fund

Effortlessly Prepare Murdoch Clarke Mortgage Fund on Any Device

Online document management has become increasingly popular among companies and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, allowing you to find the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly and without delays. Manage Murdoch Clarke Mortgage Fund on any device with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to Edit and eSign Murdoch Clarke Mortgage Fund with Ease

- Obtain Murdoch Clarke Mortgage Fund and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select relevant portions of the documents or cover sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form: by email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow meets all your document management needs within a few clicks from any device you prefer. Modify and eSign Murdoch Clarke Mortgage Fund and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the murdoch clarke mortgage fund

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Murdoch Clarke Mortgage Fund?

The Murdoch Clarke Mortgage Fund is an investment program designed to provide investors with competitive returns while supporting first-class mortgage portfolios. It allows participants to diversify their investment through a well-managed real estate focus and aims to deliver consistent income.

-

What are the benefits of investing in the Murdoch Clarke Mortgage Fund?

Investing in the Murdoch Clarke Mortgage Fund offers numerous benefits, including potential capital growth, regular income distributions, and lower risk compared to direct property investments. This fund is managed by professionals who ensure stringent due diligence and asset management.

-

How are fees structured for the Murdoch Clarke Mortgage Fund?

The fees associated with the Murdoch Clarke Mortgage Fund typically include management fees and performance fees, which are detailed in the fund's offering documents. These fees are designed to ensure the fund remains cost-effective while providing investors with maximum returns.

-

What types of investments are included in the Murdoch Clarke Mortgage Fund?

The Murdoch Clarke Mortgage Fund primarily invests in residential and commercial mortgage assets, focusing on high-quality loans that are secured by real estate. This strategy helps mitigate risk while providing income generation opportunities for investors.

-

How does the Murdoch Clarke Mortgage Fund compare to traditional mortgage investments?

Unlike traditional mortgage investments, the Murdoch Clarke Mortgage Fund offers investors a diversified portfolio managed by professionals, reducing the risks associated with individual mortgage investments. This fund is an attractive option for those looking for pooled resources and expert management.

-

Is the Murdoch Clarke Mortgage Fund suitable for all investors?

While the Murdoch Clarke Mortgage Fund is designed to suit a broad range of investors, potential participants should consider their individual financial goals and risk tolerance. Consulting with a financial advisor is recommended to determine if this fund aligns with your investment strategy.

-

What are the liquidity options for investors in the Murdoch Clarke Mortgage Fund?

The Murdoch Clarke Mortgage Fund typically offers specific liquidity options based on the fund's structure, which may include regular redemption periods or lock-in phases. It's essential to review these terms before investing to ensure they fit your financial needs.

Get more for Murdoch Clarke Mortgage Fund

- True blue gala sponsorship form dctc

- Application for readmission in college form

- Shelter insurance scholarships form

- School behavior report form a louisiana department of education

- Out state exemption 2013 2019 form

- Affidavit of review alaska bar rule 64 alaska bar association form

- Title and registration application form

- Rehabilitation agreement letter form

Find out other Murdoch Clarke Mortgage Fund

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document