Indiana Form E 6 2012

What is the Indiana Form E 6

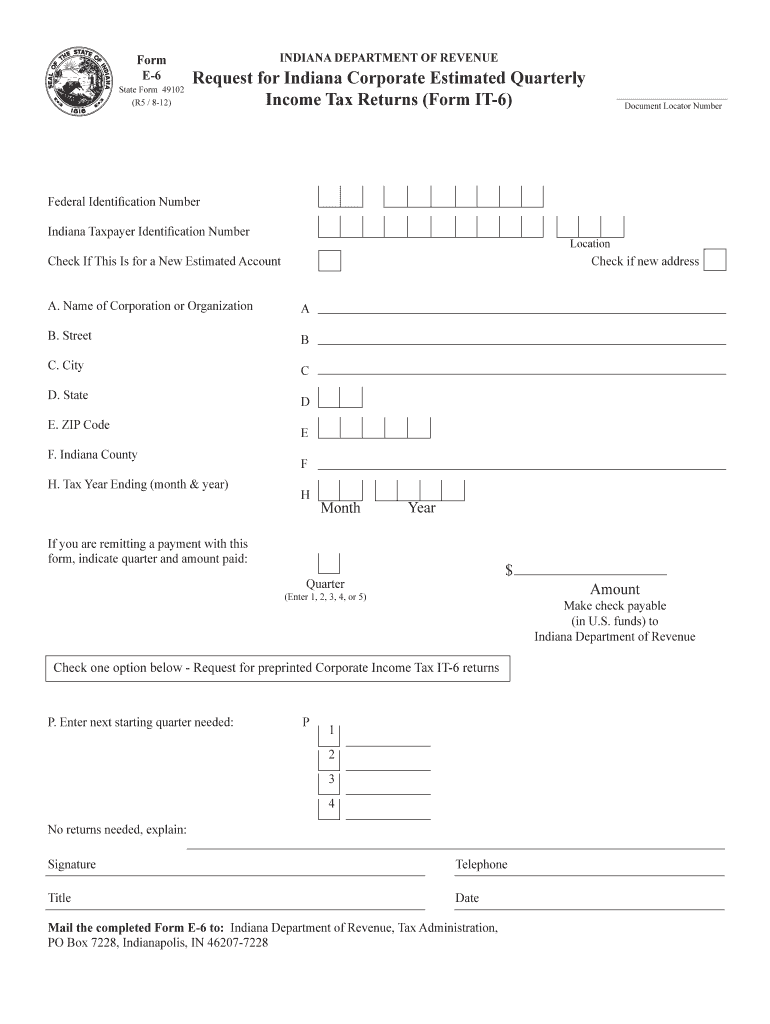

The Indiana Form E 6 is a tax document used by businesses and individuals to report estimated income tax obligations to the Indiana Department of Revenue. This form is particularly relevant for those who expect to owe tax of one thousand dollars or more when filing their annual tax return. The E 6 form allows taxpayers to make estimated payments throughout the year, ensuring compliance with state tax regulations and avoiding potential penalties for underpayment.

How to use the Indiana Form E 6

Using the Indiana Form E 6 involves several straightforward steps. First, gather all necessary financial information, including income sources and any applicable deductions. Next, calculate your estimated tax liability based on your expected income for the year. Once you have this information, you can complete the form by entering your estimated income and the corresponding tax amount. After filling out the form, submit it along with your payment to the Indiana Department of Revenue by the specified deadlines.

Steps to complete the Indiana Form E 6

Completing the Indiana Form E 6 requires careful attention to detail. Follow these steps:

- Collect your financial documents, including previous tax returns and income statements.

- Determine your estimated income for the current tax year.

- Calculate your estimated tax liability using the current Indiana tax rates.

- Fill out the form, ensuring all fields are completed accurately.

- Review the form for any errors or omissions.

- Submit the completed form along with your payment to the Indiana Department of Revenue.

Legal use of the Indiana Form E 6

The Indiana Form E 6 is legally recognized as a valid method for reporting estimated tax payments. It complies with state tax laws and regulations, allowing taxpayers to fulfill their obligations in a timely manner. Proper use of this form helps prevent penalties associated with underpayment or late payment of taxes. It is essential to keep a copy of the submitted form for your records, as it serves as proof of compliance with state tax requirements.

Filing Deadlines / Important Dates

Filing deadlines for the Indiana Form E 6 are crucial to avoid penalties. Generally, estimated tax payments are due on the 15th of April, June, September, and January of the following year. It is important to mark these dates on your calendar and ensure that your payments are submitted on time. Late submissions may incur interest and penalties, which can increase your overall tax liability.

Form Submission Methods (Online / Mail / In-Person)

The Indiana Form E 6 can be submitted using various methods to accommodate different preferences. Taxpayers can file the form online through the Indiana Department of Revenue's website, ensuring a quick and efficient process. Alternatively, the form can be mailed to the appropriate address provided by the department. For those who prefer in-person interactions, visiting a local tax office is also an option. Regardless of the method chosen, ensure that the form is submitted by the deadline to avoid penalties.

Quick guide on how to complete indiana fillable e 6 2012 2019 form

Your assistance manual on how to prepare your Indiana Form E 6

If you’re curious about how to finalize and submit your Indiana Form E 6, here are some quick suggestions on how to make tax filing less challenging.

To start, you simply need to create your airSlate SignNow account to change how you manage documents online. airSlate SignNow is a highly user-friendly and powerful document solution that enables you to modify, produce, and complete your tax documents with ease. Utilizing its editor, you can alternate between text, checkboxes, and eSignatures and return to modify answers as necessary. Optimize your tax handling with advanced PDF editing, eSigning, and seamless sharing.

Follow the steps below to complete your Indiana Form E 6 in just a few minutes:

- Create your account and start editing PDFs in no time.

- Utilize our directory to find any IRS tax form; explore various versions and schedules.

- Click Get form to access your Indiana Form E 6 in our editor.

- Input the necessary fillable fields with your information (text, numbers, checkmarks).

- Employ the Sign Tool to add your legally-recognized eSignature (if required).

- Examine your document and correct any errors.

- Save changes, print your copy, submit it to your recipient, and download it to your device.

Use this guide to electronically file your taxes with airSlate SignNow. Keep in mind that submitting on paper can increase return errors and delay refunds. Certainly, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct indiana fillable e 6 2012 2019 form

FAQs

-

How many forms are filled out in the JEE Main 2019 to date?

You should wait till last date to get these type of statistics .NTA will release how much application is received by them.

-

How do I create a fillable HTML form online that can be downloaded as a PDF? I have made a framework for problem solving and would like to give people access to an online unfilled form that can be filled out and downloaded filled out.

Create PDF Form that will be used for download and convert it to HTML Form for viewing on your website.However there’s a lot of PDF to HTML converters not many can properly convert PDF Form including form fields. If you plan to use some calculations or validations it’s even harder to find one. Try PDFix Form Converter which works fine to me.

-

How do I fill out Form 16 if I'm not eligible for IT returns and just want to receive the TDS cut for the 6 months that I've worked?

use File Income Tax Return Online in India: ClearTax | e-Filing Income Tax in 15 minutes | Tax filing | Income Tax Returns | E-file Tax Returns for 2014-15It is free and simple.

-

After filling out Form 6, how many days does it require to get your voter ID? Should I download it online?

I think it takes 2-3 months to verify your application and further other process then will get registered as voter in electoral roll. Then the voter Id will dispatch to you through BLO of your part of constituency.If you fill the form 6 on nvsp.in then you can check or track the status of your application.You will not supposed to get the digital copy of your voter Id online.I hope this will help you…..

-

How much time does it take to get a yes/no answer for Canada Express Entry after filling out all the form & signing up? How many points are needed for a positive answer, i.e. how many points do the people that are getting accepted have on average?

The minimum that I know people got accepted is from 450 to 470 points.Usually when you fill up the information it tells you straight up if you are in the pool or not.By experience Canada’a express entry system is THE WORST THING EVER happened to the Canada’s immigration. It is literally a nightmare! The portal crashes, and sometimes only open between midnight and 3am. You literally need to be the luckiest person to have it work normally. What is worst about it: Is that the Canadian government keeps on saying they will fix issues, and in the same time calling it the best system ever, where it is the worst system I have ever seen. NO technical support whatsoever.Good luck in your application.My advice also, Canada is not as it advertises. It s quite hard out there, and people are racist (not to your face, but we a smile and in their mind, which is to the worst).I do not recommend Canada as a land for immigration, but I recommend Canada for studying. Schools there are pretty multicultural, and you do not feel the racism only when you go in the labour market or create your company.

Create this form in 5 minutes!

How to create an eSignature for the indiana fillable e 6 2012 2019 form

How to make an electronic signature for the Indiana Fillable E 6 2012 2019 Form online

How to generate an eSignature for the Indiana Fillable E 6 2012 2019 Form in Google Chrome

How to generate an electronic signature for signing the Indiana Fillable E 6 2012 2019 Form in Gmail

How to make an electronic signature for the Indiana Fillable E 6 2012 2019 Form right from your smart phone

How to generate an electronic signature for the Indiana Fillable E 6 2012 2019 Form on iOS devices

How to create an eSignature for the Indiana Fillable E 6 2012 2019 Form on Android OS

People also ask

-

What is an Indiana posting notice fillable and how is it used?

An Indiana posting notice fillable is a digital document that landlords use to inform tenants about eviction or lease violations. This fillable format allows landlords to input necessary details easily, ensuring compliance with Indiana rental laws. By using an Indiana posting notice fillable through airSlate SignNow, you can streamline the process and ensure that your notices are legally sound.

-

How can I create an Indiana posting notice fillable with airSlate SignNow?

Creating an Indiana posting notice fillable with airSlate SignNow is quite straightforward. You can start by selecting one of our templates or uploading your own document, then use our intuitive editor to fill in the required details. Once completed, you can easily save and send the document for electronic signatures.

-

Is the Indiana posting notice fillable compliant with state laws?

Yes, the Indiana posting notice fillable available on airSlate SignNow is designed to comply with Indiana state laws. Our templates are regularly updated to reflect any legal changes, ensuring that your postings are always valid. This compliance helps protect landlords and serves as a reliable method of notifying tenants.

-

What are the pricing options for using airSlate SignNow for Indiana posting notice fillable?

airSlate SignNow offers a variety of pricing plans to accommodate different business needs. Whether you need a basic plan for a few documents or a more extensive plan for bulk processing, we have a solution that fits your budget. Check our pricing page to find the plan that includes the Indiana posting notice fillable features.

-

Can I integrate airSlate SignNow with other tools to manage my Indiana posting notice fillable?

Absolutely! airSlate SignNow seamlessly integrates with various applications like CRM systems and email platforms. This integration facilitates efficient management of your Indiana posting notice fillables, allowing you to send, track, and store your important documents without hassle.

-

What are the benefits of using an Indiana posting notice fillable?

Using an Indiana posting notice fillable simplifies the process of notifying tenants and increases efficiency. It ensures that all necessary information is included and minimizes the risk of errors. Additionally, with airSlate SignNow, you can quickly obtain electronic signatures, making the entire process faster and legally binding.

-

Can multiple users access and use the Indiana posting notice fillable in airSlate SignNow?

Yes, multiple users can access and collaborate on the Indiana posting notice fillable using airSlate SignNow. This collaborative feature is especially useful for property management teams, as it allows for effective communication and document management. Each user can contribute to the document, ensuring all input is captured before finalizing.

Get more for Indiana Form E 6

- Client profile and history dona international dona form

- Ambulance transfer form pcs huron valley ambulance hva 39848503

- Distinta raccomandate excel form

- M 522 rev 0510 form

- Letter writing competition form

- Bn 2 form rev 01 pdf form bn 2 rev 1

- About the planning process ampamp application form

- Permanent tsb 56 59 st form

Find out other Indiana Form E 6

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors