Indiana State Form 9284 2015-2026

What is the Indiana State Form 9284

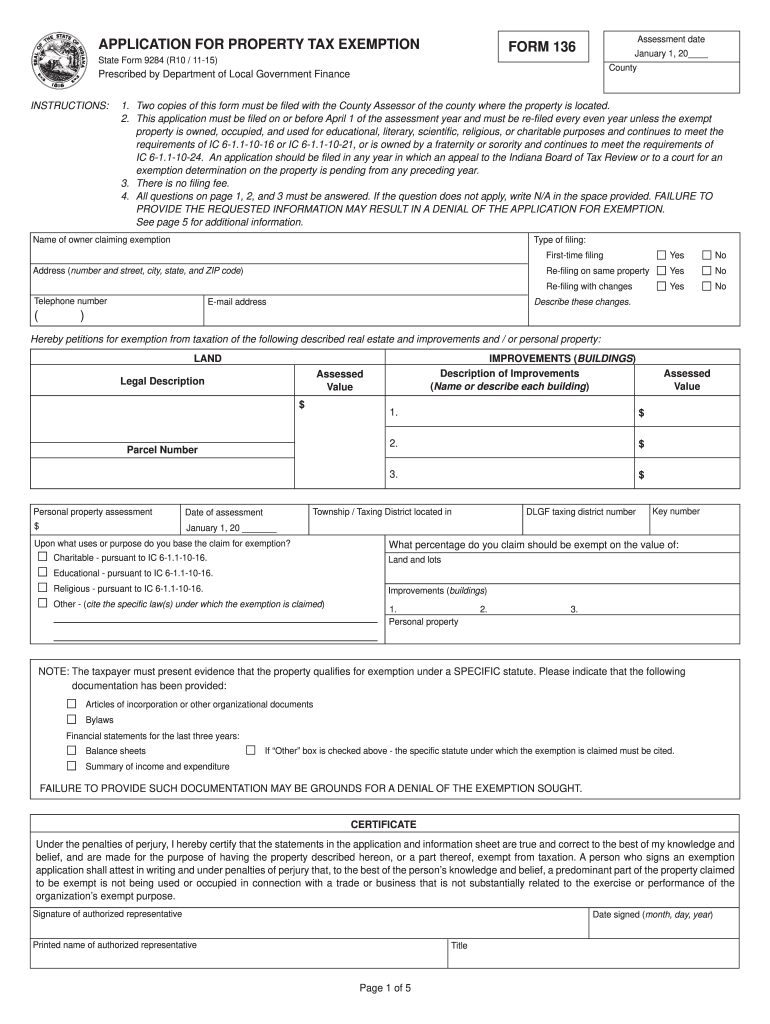

The Indiana State Form 9284 is a crucial document used to apply for property tax exemptions in the state of Indiana. This form allows eligible property owners to request a reduction in their property tax liability based on specific criteria established by state law. Understanding the purpose and requirements of this form is essential for homeowners and property investors looking to benefit from tax relief options available in Indiana.

Steps to Complete the Indiana State Form 9284

Completing the Indiana State Form 9284 involves several important steps to ensure accuracy and compliance with state regulations. First, gather all necessary information, including property details, ownership status, and any relevant supporting documents. Next, fill out the form carefully, ensuring that all fields are completed accurately. Double-check for any errors or omissions before signing the document. Finally, submit the form according to the specified submission methods, which may include online, mail, or in-person options.

Eligibility Criteria

To qualify for property tax exemption using the Indiana State Form 9284, applicants must meet specific eligibility criteria. Generally, the property must be owned and occupied by the applicant as their primary residence. Additional qualifications may include age, disability status, or income limitations, depending on the type of exemption being sought. It is important for applicants to review the eligibility requirements thoroughly to ensure they meet all necessary conditions before applying.

Required Documents

When applying for a property tax exemption using the Indiana State Form 9284, several supporting documents may be required. These documents typically include proof of ownership, such as a deed or title, and identification that verifies the applicant's residency. Additional documentation may be necessary based on the specific exemption type, such as income statements or disability verification. Ensuring that all required documents are provided can help streamline the application process.

Form Submission Methods

The Indiana State Form 9284 can be submitted through various methods, making it accessible for all applicants. Individuals may choose to file the form online through the state’s tax portal, which offers a convenient and efficient option. Alternatively, applicants can mail the completed form to their local county assessor's office or deliver it in person. Each submission method has its own guidelines, so it's important to follow the instructions carefully to avoid delays in processing.

Legal Use of the Indiana State Form 9284

The Indiana State Form 9284 is legally recognized as a valid application for property tax exemptions within the state. To ensure compliance, applicants must adhere to the guidelines set forth by the Indiana Department of Local Government Finance. Utilizing this form correctly not only helps in obtaining the desired tax benefits but also protects the rights of property owners under state law. Awareness of the legal framework surrounding this form is essential for successful application and approval.

Quick guide on how to complete application for property tax exemption form 136 2015 2019

Your assistance manual on how to prepare your Indiana State Form 9284

If you're curious about how to finish and submit your Indiana State Form 9284, here are some straightforward guidelines on how to simplify tax processing.

To start, you simply need to create an airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is a highly intuitive and robust document solution that enables you to modify, produce, and finalize your tax forms with ease. With its editor, you can toggle between text, checkboxes, and eSignatures and return to adjust information as necessary. Enhance your tax management with sophisticated PDF editing, eSigning, and easy sharing options.

Adhere to the steps below to finalize your Indiana State Form 9284 in just a few minutes:

- Create your account and begin working on PDFs within minutes.

- Utilize our directory to find any IRS tax form; browse through variants and schedules.

- Click Acquire form to launch your Indiana State Form 9284 in our editor.

- Complete the necessary fillable fields with your information (texts, numbers, check marks).

- Use the Signature Tool to affix your legally-binding eSignature (if needed).

- Review your document and correct any inaccuracies.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to submit your taxes electronically with airSlate SignNow. Be aware that submitting on paper may increase errors in returns and postpone refunds. It is essential to check the IRS website for filing regulations in your state before e-filing your taxes.

Create this form in 5 minutes or less

Find and fill out the correct application for property tax exemption form 136 2015 2019

FAQs

-

How can I fill out the application form for the JMI (Jamia Millia Islamia) 2019?

Form for jamia school have been releaseYou can fill it from jamia siteJamia Millia Islamia And for collegeMost probably the form will out end of this month or next monthBut visit the jamia site regularly.Jamia Millia Islamiacheck whether the form is out or not for the course you want to apply.when notification is out then you have to create the account for entrance and for 2 entrance same account will be used you have to check in the account that the course you want to apply is there in listed or not ….if not then you have to create the different account for that course .If you have any doubts you can freely ask me .

-

I am 2015 passed out CSE student, I am preparing for GATE2016 from a coaching, due to some reasons I do not have my provisional certificate, am I still eligible to fill application form? How?

Yes you are eligible. There is still time, application closes on October 1 this year. So if you get the provisional certificate in time you can just wait or if you know that you won't get it in time, just mail GATE organising institute at helpdesk@gate.iisc.ernet.in mentioning your problem. Hope it helps.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

Create this form in 5 minutes!

How to create an eSignature for the application for property tax exemption form 136 2015 2019

How to make an eSignature for your Application For Property Tax Exemption Form 136 2015 2019 in the online mode

How to make an electronic signature for your Application For Property Tax Exemption Form 136 2015 2019 in Chrome

How to make an eSignature for putting it on the Application For Property Tax Exemption Form 136 2015 2019 in Gmail

How to create an eSignature for the Application For Property Tax Exemption Form 136 2015 2019 from your smart phone

How to generate an electronic signature for the Application For Property Tax Exemption Form 136 2015 2019 on iOS devices

How to generate an eSignature for the Application For Property Tax Exemption Form 136 2015 2019 on Android OS

People also ask

-

What is the form application property exemption?

The form application property exemption is a crucial document that allows property owners to claim exemptions on their property taxes. This form serves as a formal request to local government authorities, potentially leading to signNow savings. Understanding how to properly fill out and submit this application is essential for maximizing your exemptions.

-

How can airSlate SignNow help with the form application property exemption process?

airSlate SignNow streamlines the form application property exemption process by enabling users to easily send, sign, and manage documents online. With its intuitive interface, you can complete and submit your exemption applications quickly and securely. By utilizing our eSignature features, you can ensure your documents are compliant and legally binding.

-

Are there any fees associated with using airSlate SignNow for form application property exemption?

Yes, airSlate SignNow offers a variety of pricing plans to suit different business needs. These plans are competitively priced, making it a cost-effective choice for those handling form application property exemptions. You can choose a plan that offers the features you need without breaking your budget.

-

What features does airSlate SignNow offer for managing form application property exemption?

AirSlate SignNow offers numerous features to assist in managing form application property exemption, including template creation, automated workflows, and secure storage. These tools help ensure that all your documents are organized and readily accessible. Additionally, real-time tracking and notifications keep you updated on the status of your applications.

-

Can I integrate airSlate SignNow with other software for my property exemption applications?

Absolutely! airSlate SignNow provides seamless integrations with a variety of popular software solutions, enhancing the efficiency of your form application property exemption process. You can connect it with CRMs, cloud storage, and other business tools to create a cohesive workflow tailored to your organization's needs.

-

How secure is the information I submit through airSlate SignNow for form application property exemption?

Security is a top priority at airSlate SignNow. We use advanced encryption protocols and comply with industry standards to ensure that all sensitive information submitted with your form application property exemption is protected. Our platform is designed to keep your data secure while allowing for easy access and management.

-

Is it easy to eSign my form application property exemption using airSlate SignNow?

Yes, airSlate SignNow makes eSigning your form application property exemption incredibly straightforward. Our user-friendly interface allows you to sign documents electronically in just a few clicks, eliminating the need for printing or faxing. This enhances the efficiency of your workflow and speeds up the application process.

Get more for Indiana State Form 9284

- Barclays stock lodgment forms

- Vehicle registration plates of utah wikipedia form

- Standardized procedure nurse practitioner physician form

- The marketing plan canvas form

- Workplace injury and disease notification form

- Aistear siolta similarities differenceswell being scribd form

- Claim form for veterinary fees before completing t

- Farm record ampamp farm account form

Find out other Indiana State Form 9284

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online