Nystr Loan Application Form

What is the Nystr Loan Application

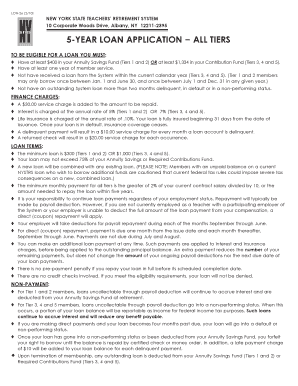

The Nystr Loan Application is a formal document used to request financial assistance from the New York State Teachers' Retirement System (NYSTRS). This application is specifically designed for eligible members seeking loans against their retirement contributions. It outlines the terms, conditions, and eligibility criteria for obtaining a loan, ensuring that applicants understand their responsibilities and the implications of borrowing against their retirement savings.

Steps to Complete the Nystr Loan Application

Completing the Nystr Loan Application involves several key steps to ensure accuracy and compliance. First, gather necessary personal information, including your NYSTRS membership number and employment details. Next, carefully review the loan terms, including interest rates and repayment schedules. Fill out the application form completely, ensuring all required fields are addressed. Once completed, double-check for any errors or missing information before submitting. Finally, choose your submission method, whether online or by mail, to ensure timely processing.

Legal Use of the Nystr Loan Application

The Nystr Loan Application is legally binding once signed and submitted. It is essential for applicants to understand that by signing the application, they agree to the terms outlined within the document. This includes acknowledging the repayment obligations and any potential penalties for non-compliance. The application must adhere to relevant state laws and regulations governing loans against retirement funds, ensuring that both the borrower and the lender are protected under the law.

Required Documents

When applying for a loan through the Nystr Loan Application, certain documents are typically required to support your request. These may include:

- Proof of identity, such as a government-issued ID

- Recent pay stubs or proof of income

- Documentation of any existing loans or debts

- Any additional forms specified by NYSTRS

Having these documents ready can streamline the application process and increase the likelihood of a successful loan approval.

Eligibility Criteria

To qualify for a loan through the Nystr Loan Application, applicants must meet specific eligibility criteria set by NYSTRS. Generally, these criteria include being an active member of the retirement system, having a minimum period of service, and maintaining a positive account balance. Additionally, applicants should not have any outstanding loans that exceed the allowable limits. Understanding these criteria is crucial for ensuring that your application is valid and stands a good chance of approval.

Form Submission Methods

Applicants can submit the Nystr Loan Application through various methods, depending on their preference and convenience. The primary submission methods include:

- Online submission via the NYSTRS member portal

- Mailing the completed application to the designated NYSTRS office

- In-person submission at a NYSTRS office location

Each method has its processing times and requirements, so it's advisable to choose the one that best fits your needs and timeline.

Quick guide on how to complete nystr loan application

Prepare Nystr Loan Application seamlessly on any device

Digital document management has become widely adopted by businesses and individuals alike. It offers an ideal eco-friendly alternative to printed and signed documents, allowing you to access the necessary form and store it securely online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your files swiftly without delays. Manage Nystr Loan Application on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to edit and eSign Nystr Loan Application with ease

- Locate Nystr Loan Application and click on Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign Nystr Loan Application and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nystr loan application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the nystr loan application process like?

The nystr loan application process is streamlined with airSlate SignNow. Users can easily fill out and submit their applications online, ensuring a quick and efficient experience. Our platform allows you to eSign documents, reducing the time spent on paperwork signNowly.

-

How much does using airSlate SignNow for the nystr loan application cost?

airSlate SignNow offers competitive pricing plans that cater to a variety of business needs. Depending on your requirements, you can choose from different tiers that provide essential features for processing nystr loan applications. Our affordable plans make it easier for businesses to manage their paperwork costs.

-

What features does airSlate SignNow offer for the nystr loan application?

For the nystr loan application, airSlate SignNow provides key features like document templates, eSignature capabilities, and real-time collaboration. These tools streamline the application process, ensuring all your documents are securely signed and stored. Additionally, users can track document status for increased visibility.

-

How can airSlate SignNow help with the security of the nystr loan application?

Security is a priority for airSlate SignNow, especially for sensitive documents like the nystr loan application. Our platform uses bank-level encryption to ensure data protection and has compliance with various regulations. This gives users peace of mind knowing their information is safeguarded.

-

Are there integrations available for airSlate SignNow when processing nystr loan applications?

Yes, airSlate SignNow offers various integrations that enhance the processing of nystr loan applications. You can seamlessly connect with CRM systems, cloud storage solutions, and other business tools to create a more efficient workflow. This eliminates the need for manual data entry and accelerates the loan application process.

-

Can I customize the nystr loan application using airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize your nystr loan application according to your business requirements. You can add fields, adjust the layout, and include branding to ensure a professional presentation. This flexibility helps create a personalized experience for your applicants.

-

What are the benefits of using airSlate SignNow for the nystr loan application?

Using airSlate SignNow for the nystr loan application offers numerous benefits, including reduced processing time and enhanced customer satisfaction. With eSigning capabilities, you can expedite approvals, leading to faster loan disbursements. Additionally, the user-friendly interface makes it easy for both applicants and staff members to navigate.

Get more for Nystr Loan Application

Find out other Nystr Loan Application

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple