Substitute 5754 Form

What is the Substitute 5754 Form

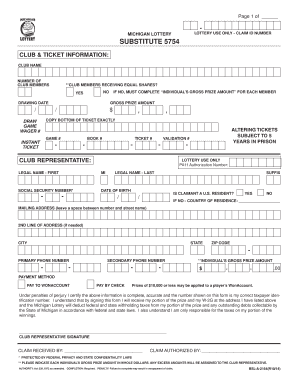

The Substitute 5754 form is a document used primarily for claiming lottery winnings in Michigan. This form serves as a substitute for the official Michigan Lottery claim form when the original is not available. It is essential for individuals who have won a lottery prize and need to report their winnings for tax purposes. By utilizing this form, winners can ensure that their claims are processed correctly and efficiently, aligning with state regulations.

How to use the Substitute 5754 Form

Using the Substitute 5754 form involves a few straightforward steps. First, gather all necessary information, including details about the lottery ticket, personal identification, and any required supporting documents. Next, fill out the form accurately, ensuring that all fields are completed. It's crucial to double-check the information for accuracy to avoid delays in processing. Finally, submit the form according to the instructions provided, which may include mailing it to the appropriate lottery office or submitting it in person.

Steps to complete the Substitute 5754 Form

Completing the Substitute 5754 form requires careful attention to detail. Follow these steps:

- Obtain the form from a reliable source, such as the Michigan Lottery website or authorized retailers.

- Provide your personal information, including your name, address, and social security number.

- Detail the lottery ticket information, including the date of the draw and the amount won.

- Attach any necessary documentation, such as identification and proof of purchase.

- Review the completed form for accuracy and completeness.

- Submit the form as instructed, ensuring it reaches the lottery office within the required timeframe.

Legal use of the Substitute 5754 Form

The legal use of the Substitute 5754 form is governed by Michigan state law regarding lottery winnings. This form must be filled out and submitted in compliance with the regulations set forth by the Michigan Lottery. Failure to adhere to these legal requirements may result in delays or denial of the claim. It is essential to understand that this form is legally binding and should be completed with accurate and truthful information to avoid potential legal repercussions.

Required Documents

When submitting the Substitute 5754 form, specific documents are required to support your claim. These typically include:

- A valid government-issued photo ID, such as a driver's license or passport.

- Proof of purchase for the lottery ticket, which may include the original ticket or a receipt.

- Any additional documentation as specified by the Michigan Lottery guidelines.

Having these documents ready will help facilitate a smooth claims process.

Form Submission Methods

The Substitute 5754 form can be submitted through various methods, depending on the preferences of the claimant. Common submission methods include:

- Mail: Send the completed form and required documents to the designated Michigan Lottery office address.

- In-Person: Visit a Michigan Lottery office to submit the form directly and receive immediate assistance.

Each method has its advantages, so choose one that best fits your needs and timeline.

Quick guide on how to complete substitute 5754 form

Effortlessly Prepare Substitute 5754 Form on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly and without hassle. Manage Substitute 5754 Form on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-centric workflow today.

How to Edit and eSign Substitute 5754 Form Effortlessly

- Locate Substitute 5754 Form and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then hit the Done button to save your changes.

- Choose your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your choice. Edit and eSign Substitute 5754 Form to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the substitute 5754 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a substitute 5754 form and why do I need it?

The substitute 5754 form is a document that allows companies to report certain tax information accurately. Businesses use this form to ensure compliance with IRS regulations when they substitute or amend a standard 5754 form. Understanding its usage is essential for proper tax reporting and avoidance of penalties.

-

How can airSlate SignNow help me with my substitute 5754 form?

airSlate SignNow simplifies the process of preparing and eSigning your substitute 5754 form. Our platform allows you to create, edit, and securely send documents, ensuring that your form is always in compliance with IRS requirements. The user-friendly interface makes it easy to manage your paperwork efficiently.

-

Is there a cost to use the airSlate SignNow service for the substitute 5754 form?

Yes, there is a cost associated with using airSlate SignNow, but our pricing is flexible and affordable for all businesses. We offer various plans to fit your needs, ensuring you have access to the tools necessary for managing your substitute 5754 form and other documents without breaking the bank. Check our website for detailed pricing information.

-

What features does airSlate SignNow offer for managing the substitute 5754 form?

airSlate SignNow provides features like document templates, eSignature capabilities, and secure cloud storage specifically for handling your substitute 5754 form. You can easily customize templates to fit your business requirements and streamline the signing process, reducing the time required for document management.

-

Can I integrate airSlate SignNow with other software to manage my substitute 5754 form?

Absolutely! airSlate SignNow offers integrations with various third-party applications, allowing you to streamline your workflow while managing your substitute 5754 form. Our API and direct integrations with tools like Google Workspace and Microsoft Office enhance your productivity.

-

How secure is airSlate SignNow when handling my substitute 5754 form?

Security is a top priority at airSlate SignNow. We utilize advanced encryption methods and secure data storage practices to keep your substitute 5754 form and other documents safe. Our compliance with industry standards ensures your sensitive information is protected at all times.

-

Can I track the status of my substitute 5754 form once it's sent?

Yes, airSlate SignNow allows you to track the status of your substitute 5754 form throughout the signing process. You can receive real-time notifications when the document is viewed, signed, and completed, providing you with peace of mind and transparency.

Get more for Substitute 5754 Form

Find out other Substitute 5754 Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors