CERT 122 Refund of Tax Paid on Purchases of Meals or Lodging by Form

What is the CERT 122 Refund Of Tax Paid On Purchases Of Meals Or Lodging By

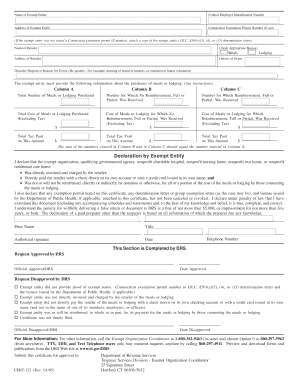

The CERT 122 Refund Of Tax Paid On Purchases Of Meals Or Lodging By is a form used in the United States to claim a refund for taxes paid on specific purchases related to meals or lodging. This form is particularly relevant for businesses and individuals who incur such expenses during their operations or travel. It allows taxpayers to recover sales tax that may have been overpaid or incorrectly assessed on qualifying purchases. Understanding the purpose and function of this form is essential for ensuring compliance and maximizing potential refunds.

Steps to complete the CERT 122 Refund Of Tax Paid On Purchases Of Meals Or Lodging By

Completing the CERT 122 Refund Of Tax Paid On Purchases Of Meals Or Lodging By involves several key steps:

- Gather necessary documentation, including receipts for meals and lodging expenses.

- Ensure that the purchases qualify for a tax refund based on state regulations.

- Fill out the form accurately, providing all required information, including your contact details and the nature of the purchases.

- Review the completed form for accuracy to avoid delays in processing.

- Submit the form according to the specified submission methods, either online, by mail, or in-person, depending on your state’s requirements.

Legal use of the CERT 122 Refund Of Tax Paid On Purchases Of Meals Or Lodging By

The legal use of the CERT 122 Refund Of Tax Paid On Purchases Of Meals Or Lodging By is governed by state tax laws and regulations. It is crucial to ensure that the form is used in accordance with these laws to avoid potential penalties or issues with tax authorities. The form must be filled out truthfully, and all claims made should be supported by valid receipts and documentation. Misuse of the form can lead to legal repercussions, including fines or audits.

Eligibility Criteria

To be eligible for a refund using the CERT 122 Refund Of Tax Paid On Purchases Of Meals Or Lodging By, certain criteria must be met:

- The purchases must be made for business purposes or during official travel.

- Receipts must be retained to substantiate the claim for the refund.

- The expenses must fall within the categories defined by the state tax authority.

- Taxpayers must be registered with the appropriate state tax agency.

Required Documents

When completing the CERT 122 Refund Of Tax Paid On Purchases Of Meals Or Lodging By, several documents are typically required:

- Receipts for meals and lodging expenses.

- A copy of the completed CERT 122 form.

- Any additional documentation that supports the claim, such as travel itineraries or invoices.

Form Submission Methods (Online / Mail / In-Person)

The CERT 122 Refund Of Tax Paid On Purchases Of Meals Or Lodging By can be submitted through various methods, depending on state guidelines:

- Online submission through the state tax authority's website.

- Mailing the completed form to the designated tax office.

- In-person submission at local tax offices or designated locations.

Quick guide on how to complete cert 122 refund of tax paid on purchases of meals or lodging by

Complete CERT 122 Refund Of Tax Paid On Purchases Of Meals Or Lodging By effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, enabling you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly without any lag. Handle CERT 122 Refund Of Tax Paid On Purchases Of Meals Or Lodging By on any gadget with airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

How to modify and electronically sign CERT 122 Refund Of Tax Paid On Purchases Of Meals Or Lodging By smoothly

- Locate CERT 122 Refund Of Tax Paid On Purchases Of Meals Or Lodging By and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere moments and holds the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Modify and electronically sign CERT 122 Refund Of Tax Paid On Purchases Of Meals Or Lodging By and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cert 122 refund of tax paid on purchases of meals or lodging by

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CERT 122 Refund Of Tax Paid On Purchases Of Meals Or Lodging By?

The CERT 122 Refund Of Tax Paid On Purchases Of Meals Or Lodging By is a form that businesses can use to request a refund for taxes paid on meals and lodging expenses. This process helps organizations recover costs for eligible transactions, ensuring they maximize their financial efficiency.

-

How can airSlate SignNow assist with the CERT 122 Refund Of Tax Paid On Purchases Of Meals Or Lodging By?

airSlate SignNow provides an easy-to-use platform for businesses to manage and eSign the CERT 122 Refund Of Tax Paid On Purchases Of Meals Or Lodging By form. Our solution streamlines the document workflow, making it faster and more efficient to submit your refund claims.

-

What are the benefits of using airSlate SignNow for tax refund documentation?

Using airSlate SignNow for your CERT 122 Refund Of Tax Paid On Purchases Of Meals Or Lodging By documentation offers numerous benefits, including time-saving features, enhanced security, and the ability to access documents from anywhere. This ensures that your refund claims are processed smoothly and professionally.

-

Is there a cost associated with using airSlate SignNow for filing the CERT 122 Refund Of Tax Paid On Purchases Of Meals Or Lodging By?

Yes, there is a subscription cost for using airSlate SignNow, but it is designed to be cost-effective. Evaluating our pricing model can help your business determine the best plan for your needs while efficiently managing the CERT 122 Refund Of Tax Paid On Purchases Of Meals Or Lodging By submissions.

-

Can airSlate SignNow integrate with other tools for managing tax documents?

Absolutely, airSlate SignNow integrates with various tools and software solutions, making it easier to manage tax documentation, including the CERT 122 Refund Of Tax Paid On Purchases Of Meals Or Lodging By. This integration enhances your workflow, allowing for seamless data transfer and better document organization.

-

How secure is my information when using airSlate SignNow for tax forms?

Your security is our top priority at airSlate SignNow. When you use our platform to handle the CERT 122 Refund Of Tax Paid On Purchases Of Meals Or Lodging By and other documents, we employ advanced encryption and authentication methods to ensure that your sensitive information is protected throughout the process.

-

How do I get started with airSlate SignNow for filing the CERT 122 Refund Of Tax Paid On Purchases Of Meals Or Lodging By?

To get started with airSlate SignNow, simply sign up for an account and explore our user-friendly interface. You can quickly access templates for the CERT 122 Refund Of Tax Paid On Purchases Of Meals Or Lodging By and begin eSigning within minutes, making the process hassle-free.

Get more for CERT 122 Refund Of Tax Paid On Purchases Of Meals Or Lodging By

- Authorization for payoff vermont dmv vermontgov form

- Form i 918 supplement a petition for qualifying family

- Wdiir form revised pmd 03 02 18 ks bk ap vcdoc

- Re 552 california department of real estate state of california form

- Articles of amendment print form clear form arizona

- Any adult person may use this form to petition the court to appoint a voluntary conservator of the

- Florida motion return 2015 2019 form

- Regent soccer club form

Find out other CERT 122 Refund Of Tax Paid On Purchases Of Meals Or Lodging By

- How To eSign New York Home Loan Application

- How To eSign Texas Home Loan Application

- eSignature Indiana Prenuptial Agreement Template Now

- eSignature Indiana Prenuptial Agreement Template Simple

- eSignature Ohio Prenuptial Agreement Template Safe

- eSignature Oklahoma Prenuptial Agreement Template Safe

- eSignature Kentucky Child Custody Agreement Template Free

- eSignature Wyoming Child Custody Agreement Template Free

- eSign Florida Mortgage Quote Request Online

- eSign Mississippi Mortgage Quote Request Online

- How To eSign Colorado Freelance Contract

- eSign Ohio Mortgage Quote Request Mobile

- eSign Utah Mortgage Quote Request Online

- eSign Wisconsin Mortgage Quote Request Online

- eSign Hawaii Temporary Employment Contract Template Later

- eSign Georgia Recruitment Proposal Template Free

- Can I eSign Virginia Recruitment Proposal Template

- How To eSign Texas Temporary Employment Contract Template

- eSign Virginia Temporary Employment Contract Template Online

- eSign North Dakota Email Cover Letter Template Online