Form 941 X Rev October Internal Revenue Service 2020

What is the Form 941 X Rev October

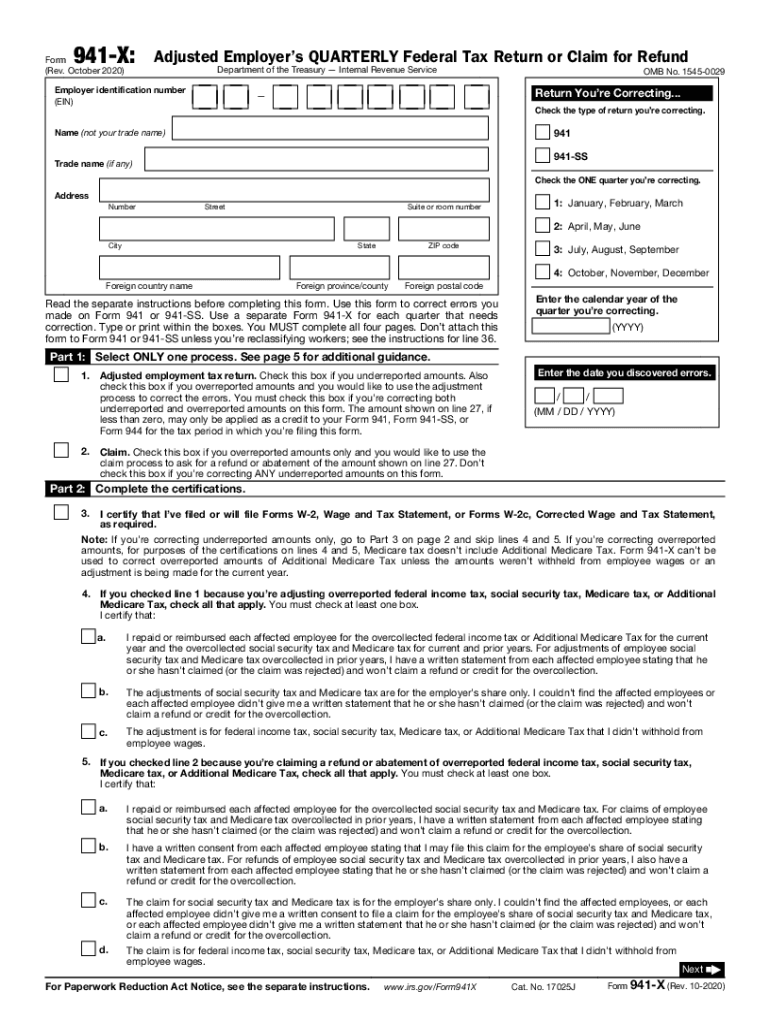

The Form 941 X Rev October is an amended version of the standard Form 941, which is used by employers in the United States to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks. The 941 X specifically allows employers to correct errors made on previously filed Forms 941. This form is essential for ensuring that the IRS has accurate records of an employer's tax obligations and payments.

How to use the Form 941 X Rev October

To use the Form 941 X, employers must first identify the specific errors in their previously filed Form 941. Once the errors are identified, the employer can fill out the 941 X to provide corrected information. This includes entering the correct amounts for wages, tips, and taxes withheld. It is important to follow the instructions carefully to ensure that all necessary corrections are made accurately.

Steps to complete the Form 941 X Rev October

Completing the Form 941 X involves several key steps:

- Obtain the latest version of the Form 941 X from the IRS website.

- Review the original Form 941 to identify the errors that need correction.

- Fill out the 941 X, providing the corrected figures in the appropriate sections.

- Include a brief explanation of the corrections made.

- Sign and date the form before submission.

Filing Deadlines / Important Dates

Employers should be aware of the filing deadlines for the Form 941 X. Generally, the form must be filed within three years from the date the original Form 941 was filed or within two years from the date the tax was paid, whichever is later. Timely filing is crucial to avoid penalties and ensure compliance with IRS regulations.

Form Submission Methods

The Form 941 X can be submitted to the IRS either by mail or electronically. Employers must choose the method that best suits their needs. For those opting to mail the form, it is important to send it to the correct IRS address based on the employer's location. Electronic submission may be available through authorized e-file providers, which can expedite processing times.

Penalties for Non-Compliance

Failure to file the Form 941 X when necessary can result in penalties from the IRS. These penalties may include fines for late filing or failure to pay the correct amount of taxes owed. It is essential for employers to stay compliant with tax regulations to avoid these potential consequences.

Quick guide on how to complete form 941 x rev october 2020 internal revenue service

Prepare Form 941 X Rev October Internal Revenue Service effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to locate the right form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Form 941 X Rev October Internal Revenue Service on any device using the airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

The simplest way to modify and eSign Form 941 X Rev October Internal Revenue Service with ease

- Obtain Form 941 X Rev October Internal Revenue Service and click Get Form to commence.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you would like to send your form, via email, text (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs with just a few clicks from your chosen device. Modify and eSign Form 941 X Rev October Internal Revenue Service to ensure smooth communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 941 x rev october 2020 internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the form 941 x rev october 2020 internal revenue service

The best way to create an eSignature for your PDF document in the online mode

The best way to create an eSignature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The best way to make an eSignature from your mobile device

The way to generate an electronic signature for a PDF document on iOS devices

The best way to make an eSignature for a PDF file on Android devices

People also ask

-

What is the 2020 941 form used for?

The 2020 941 form is used by employers to report income taxes, social security tax, and Medicare tax withheld from employee paychecks. It also helps in calculating the employer's share of social security and Medicare tax. Completing and filing your 2020 941 accurately is crucial for compliance with IRS regulations.

-

How can airSlate SignNow help with the 2020 941 form?

airSlate SignNow provides an efficient platform to eSign and manage your 2020 941 forms digitally. With our easy-to-use solution, you can streamline the signing process, ensuring that your forms are completed, signed, and submitted on time, reducing the risk of errors or late filings.

-

What features does airSlate SignNow offer for handling tax documents like the 2020 941?

Our platform offers features such as customizable templates, automatic reminders, and secure cloud storage to help you manage your tax documents like the 2020 941 efficiently. Additionally, you can track the status of your documents in real time, ensuring every step is documented and easily accessible.

-

Is airSlate SignNow a cost-effective solution for managing the 2020 941?

Yes, airSlate SignNow is considered a cost-effective solution for businesses managing documents like the 2020 941 form. Our pricing plans are designed to suit various business sizes and needs, enabling you to choose a plan that fits your budget while providing powerful features to enhance document management.

-

Can airSlate SignNow integrate with accounting software for the 2020 941?

Absolutely! airSlate SignNow offers integrations with popular accounting software that can help automate the handling of your 2020 941 forms. By integrating with your existing systems, you can reduce manual data entry and ensure that all necessary information is readily available.

-

What are the benefits of using airSlate SignNow for the 2020 941 form?

Using airSlate SignNow for your 2020 941 form brings several benefits including improved efficiency, enhanced security, and reduced paper usage. Our platform allows for quick access to forms, simplifies collaboration, and ensures that all signatures are legally binding and secure.

-

How secure is airSlate SignNow for submitting the 2020 941?

airSlate SignNow employs industry-standard encryption and security measures to protect all documents, including the 2020 941. Your data is kept secure throughout the eSigning process, ensuring that sensitive information remains confidential and compliant with regulations.

Get more for Form 941 X Rev October Internal Revenue Service

Find out other Form 941 X Rev October Internal Revenue Service

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template

- How Can I Electronic signature Missouri Unlimited Power of Attorney

- Electronic signature Montana Unlimited Power of Attorney Secure

- Electronic signature Missouri Unlimited Power of Attorney Fast

- Electronic signature Ohio Unlimited Power of Attorney Easy

- How Can I Electronic signature Oklahoma Unlimited Power of Attorney