Inward Remittance Letter to Bank Form

What is the inward remittance letter to bank

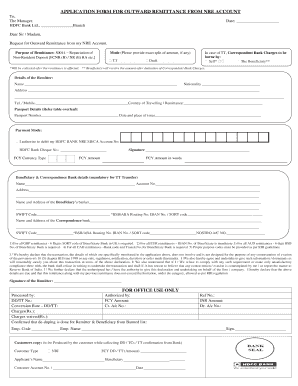

The inward remittance letter to bank is a formal document used to request the processing of funds received from abroad. This letter serves as a means to inform the bank about the details of the foreign inward remittance, ensuring that the transaction is recorded accurately. It typically includes information such as the sender's details, the amount received, the purpose of the remittance, and any relevant transaction references. This letter is essential for compliance with banking regulations and helps facilitate the proper handling of international funds.

Key elements of the inward remittance letter to bank

When drafting an inward remittance letter, certain key elements must be included to ensure clarity and compliance:

- Sender Information: Full name, address, and contact details of the sender.

- Recipient Information: Your name, address, and account details where the funds should be credited.

- Transaction Details: Amount received, currency type, and date of receipt.

- Purpose of Remittance: A clear statement explaining the reason for the funds being sent.

- Reference Number: Any transaction or reference number provided by the sender or financial institution.

How to use the inward remittance letter to bank

Using the inward remittance letter is straightforward. Begin by filling in the required information accurately. Once completed, you can submit the letter to your bank through various methods:

- In-Person: Visit your bank branch and hand over the letter to a bank representative.

- Online Submission: If your bank offers online services, you may be able to upload the letter through their secure portal.

- Mail: Send the letter via postal service to your bank’s designated address.

Steps to complete the inward remittance letter to bank

Completing the inward remittance letter involves several steps to ensure all necessary information is included:

- Gather Information: Collect all relevant details such as sender information, transaction amount, and purpose.

- Draft the Letter: Use a clear and professional format to write the letter, ensuring all key elements are included.

- Review for Accuracy: Double-check all information for accuracy to avoid delays in processing.

- Submit the Letter: Choose your preferred submission method and send the letter to your bank.

Legal use of the inward remittance letter to bank

The inward remittance letter is legally recognized as part of the documentation required for processing international funds. It helps banks comply with regulations related to foreign currency transactions. By providing a clear and detailed request, you ensure that your remittance is handled according to legal standards, which may include anti-money laundering laws and reporting requirements. It is important to keep a copy of the letter for your records, as it may be needed for future reference or compliance verification.

Examples of using the inward remittance letter to bank

Examples of scenarios where an inward remittance letter is utilized include:

- Receiving Funds from Family Abroad: A family member sends money to support living expenses.

- Business Transactions: A company receives payment for goods or services rendered to an international client.

- Investment Income: An individual receives dividends or interest payments from foreign investments.

Quick guide on how to complete inward remittance letter to bank

Effortlessly complete Inward Remittance Letter To Bank on any device

Online document management has gained traction with businesses and individuals alike. It serves as a perfect environmentally friendly alternative to conventional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Inward Remittance Letter To Bank on any device with airSlate SignNow's Android or iOS applications and simplify any document-centric process today.

The easiest way to modify and eSign Inward Remittance Letter To Bank without hassle

- Find Inward Remittance Letter To Bank and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes moments and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, time-consuming form searches, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Modify and eSign Inward Remittance Letter To Bank and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the inward remittance letter to bank

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is foreign inward remittance HDFC?

Foreign inward remittance HDFC refers to the process of receiving funds from abroad through HDFC Bank. It allows individuals and businesses to seamlessly transfer money from international sources, ensuring a secure and efficient transaction experience.

-

How can I initiate a foreign inward remittance through HDFC?

To initiate a foreign inward remittance HDFC, you can visit your nearest HDFC Bank branch or use their online banking platform. Simply provide the necessary documentation, such as the sender's details and purpose of remittance, and follow the instructions provided by the bank.

-

What are the fees associated with foreign inward remittance HDFC?

HDFC Bank charges a nominal fee for processing foreign inward remittance. The exact fee may vary depending on the amount being transferred and the method of remittance. It's advisable to check HDFC's official website or contact customer service for the most accurate and current fee structure.

-

What are the benefits of using foreign inward remittance HDFC?

Using foreign inward remittance HDFC offers multiple benefits, including quick access to funds, competitive exchange rates, and a reliable transaction process. Additionally, HDFC provides excellent customer support to help guide you through any queries during the remittance process.

-

Can businesses utilize foreign inward remittance HDFC?

Yes, foreign inward remittance HDFC is not just for individuals; businesses can also leverage this service to receive payments from international clients. This feature is especially beneficial for companies involved in global trade or services, enhancing their cash flow.

-

What documents are required for foreign inward remittance HDFC?

To complete a foreign inward remittance HDFC, you typically need to present your identification, bank account details, and purpose of remittance documentation. Additional paperwork may vary based on the remittance source and amount, so it's best to confirm with HDFC Bank.

-

Does HDFC support multiple currencies for foreign inward remittance?

Yes, HDFC Bank supports a range of currencies for foreign inward remittance, allowing you to receive funds from various countries hassle-free. This flexibility helps cater to diverse business requirements and personal transactions from around the world.

Get more for Inward Remittance Letter To Bank

- Claimant request for appeal of unemployment insurance determination form

- To veterans their eligible dependents and members of the selected reserve form

- In personmail filing office of the new york city comptroller form

- Char500 charities bureau form

- Check only one notice of claim only request hearing notice of claim request for mediation notice of claim form

- Youth services center juvenile court form

- You can do either one or both of form

- One to four family residential contract resale trec texas form

Find out other Inward Remittance Letter To Bank

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free