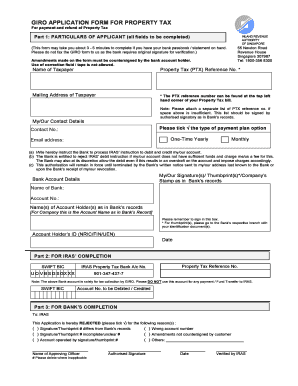

Giro Application for Property Tax Form

What is the giro application for property tax?

The giro application for property tax is a formal document that allows property owners to manage their tax payments through automatic deductions from their bank accounts. This method simplifies the payment process, ensuring timely submissions and reducing the risk of late fees. By opting for a giro application, taxpayers can streamline their financial obligations related to property taxes, making it easier to maintain compliance with local regulations.

How to use the giro application for property tax

Using the giro application for property tax involves several straightforward steps. First, property owners need to obtain the appropriate form, which is typically available from their local tax authority's website or office. After filling out the required information, including personal details and bank account information, the form must be signed. Once completed, it can be submitted electronically or via mail, depending on local guidelines. This process ensures that property tax payments are deducted automatically, providing peace of mind for homeowners.

Steps to complete the giro application for property tax

Completing the giro application for property tax requires careful attention to detail. Follow these steps for a successful submission:

- Obtain the giro application form from your local tax authority.

- Fill in your personal information, including your name, address, and property details.

- Provide your bank account information, ensuring accuracy to avoid payment issues.

- Review the completed form for any errors or omissions.

- Sign the form to validate your application.

- Submit the form according to your local authority's instructions, either online or by mail.

Legal use of the giro application for property tax

The legal validity of the giro application for property tax hinges on compliance with local regulations and proper execution. When completed correctly, this form serves as a binding agreement between the property owner and the tax authority. It is essential to ensure that all information is accurate and that the form is signed appropriately. Digital signatures are typically accepted, provided they comply with relevant eSignature laws, such as the ESIGN Act and UETA.

Required documents for the giro application for property tax

When preparing to submit the giro application for property tax, certain documents may be required to support your application. These typically include:

- Proof of property ownership, such as a deed or tax bill.

- Identification documents, like a driver's license or Social Security number.

- Bank account information, including account and routing numbers.

Having these documents ready can facilitate a smoother application process and ensure compliance with local requirements.

Form submission methods for the giro application for property tax

Submitting the giro application for property tax can be done through various methods, depending on local regulations. Common submission options include:

- Online submission via the local tax authority's website, which may offer a secure portal for electronic forms.

- Mailing the completed form to the designated tax office address.

- In-person submission at a local tax office, where assistance may be available if needed.

Choosing the appropriate submission method can enhance the efficiency of your application and ensure timely processing.

Quick guide on how to complete giro application for property tax

Effortlessly Complete Giro Application For Property Tax on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents quickly without delays. Handle Giro Application For Property Tax on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven workflow today.

How to Edit and eSign Giro Application For Property Tax with Ease

- Obtain Giro Application For Property Tax and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and has the same legal standing as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Giro Application For Property Tax and ensure effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the giro application for property tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the property tax giro form?

The property tax giro form is a document used by property owners to arrange automatic payments for property taxes. This form ensures that payments are made on time, helping to avoid late fees and penalties. Utilizing airSlate SignNow makes it easy to eSign and send your property tax giro form securely.

-

How can I use airSlate SignNow to fill out a property tax giro form?

You can easily fill out a property tax giro form with airSlate SignNow by uploading the document to our platform. Once uploaded, you can complete the required fields and sign electronically. This process simplifies the management of your property tax obligations.

-

Is airSlate SignNow cost-effective for handling property tax giro forms?

Yes, airSlate SignNow offers a cost-effective solution for managing property tax giro forms. Our pricing plans are designed to fit various business needs, making it accessible for individuals and organizations alike. You'll save time and reduce costs associated with traditional paperwork.

-

What features does airSlate SignNow offer for property tax giro forms?

airSlate SignNow provides several features for property tax giro forms, including templates for quick reuse, secure eSignature capabilities, and document tracking. You'll also benefit from automated reminders for payments, ensuring that you never miss a deadline.

-

Can I integrate airSlate SignNow with other applications for property tax giro forms?

Yes, airSlate SignNow allows for integration with various applications, enhancing the management of property tax giro forms. You can connect with tools like CRMs and accounting software, simplifying workflows and keeping all your documents in sync.

-

What are the benefits of using airSlate SignNow for property tax giro forms?

Using airSlate SignNow for property tax giro forms provides you with convenient electronic signing, faster processing times, and a secure platform for managing sensitive information. These benefits help streamline your operations and enhance your overall efficiency.

-

Is it safe to send my property tax giro form through airSlate SignNow?

Absolutely! airSlate SignNow employs robust security measures to ensure that your property tax giro form and all documents are transmitted safely. We utilize encryption and compliance with industry standards to protect your data.

Get more for Giro Application For Property Tax

- Fl 100 2015 2019 form

- Wmu post office change of address form wmich

- Navajo gaming enterprise form

- United healthcare disclosure of ownership control interest and management statement form

- Scecomcarerecert form

- Backflow prevention assembly test and maintenance form

- Chase insurance claim package form

- Credit card payment information

Find out other Giro Application For Property Tax

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online