Deldot Mv213 2003-2026

What is the Deldot Mv213

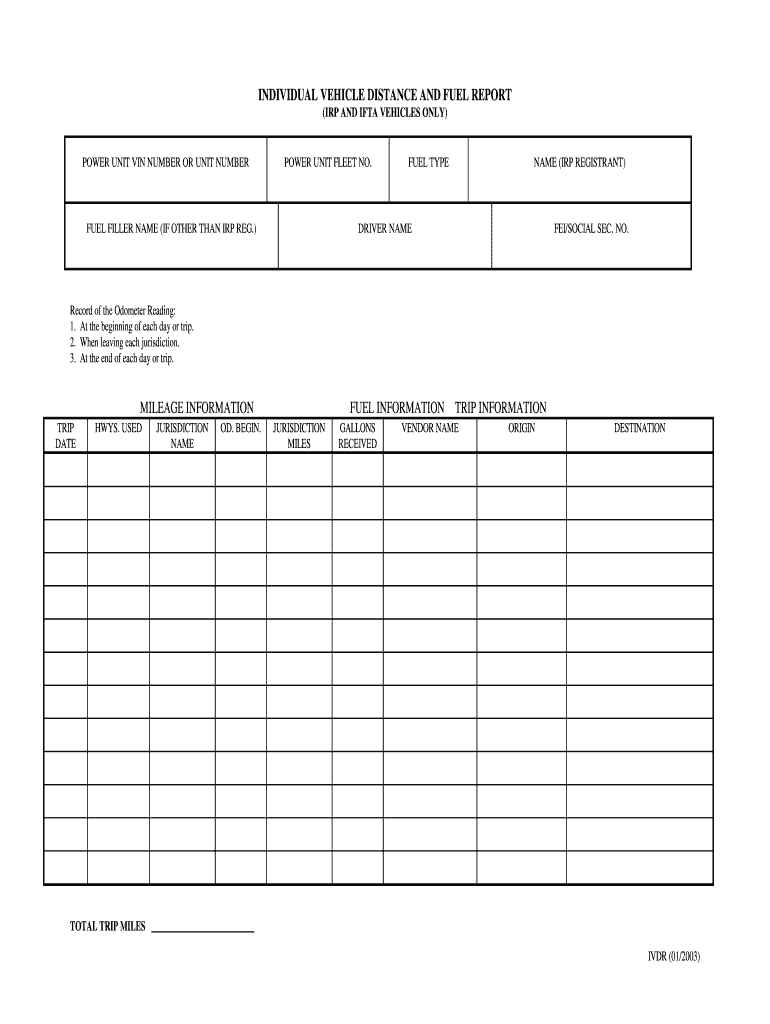

The Deldot Mv213, also known as the Individual Vehicle Distance Record, is a crucial document used in the state of Delaware for tracking the distance traveled by a vehicle. This form is particularly important for businesses and individuals who need to maintain accurate records for tax purposes, vehicle registration, and compliance with state regulations. The Mv213 serves as an official record that details the mileage and fuel consumption of a vehicle, making it essential for those involved in transportation and logistics.

How to complete the Deldot Mv213

Completing the Deldot Mv213 requires careful attention to detail. Start by entering your personal information, including your name and contact details. Next, provide accurate data regarding the vehicle, such as its make, model, and year. It is essential to record the total distance traveled during the reporting period, along with the amount of fuel consumed. Ensure that all sections are filled out completely and accurately to avoid any issues with compliance. Once completed, sign and date the form to validate it.

Legal use of the Deldot Mv213

The Deldot Mv213 must be used in accordance with Delaware state laws and regulations. This form is legally binding and serves as an official record of vehicle usage. It is important to ensure that the information provided is truthful and accurate, as discrepancies can lead to penalties or legal issues. The Mv213 should be retained for record-keeping purposes and may be requested during audits or inspections by state authorities.

Key elements of the Deldot Mv213

Several key elements are essential for the Deldot Mv213 to be considered complete and valid. These include:

- Personal Information: Name, address, and contact information of the vehicle owner.

- Vehicle Information: Details about the vehicle, including make, model, and year.

- Mileage Record: Total distance traveled during the reporting period.

- Fuel Consumption: Amount of fuel used during the same period.

- Signature and Date: Required to validate the document.

Steps to obtain the Deldot Mv213

Obtaining the Deldot Mv213 is a straightforward process. You can acquire the form through the Delaware Division of Motor Vehicles (DMV) website or by visiting a local DMV office. The form is available in both printable and digital formats, allowing for easy access. Ensure that you have all necessary information ready before filling out the form to streamline the process.

Form Submission Methods

The Deldot Mv213 can be submitted through various methods, providing flexibility for users. You may choose to submit the form online through the DMV's digital platform, or you can opt for traditional methods such as mailing the completed form or delivering it in person to a DMV office. Each submission method has its own processing times, so consider your needs when deciding how to submit the form.

Quick guide on how to complete individual vehicle distance record ivdr deldot

Simplify your life by filling out Deldot Mv213 form with airSlate SignNow

Whether you need to title a new vehicle, register for obtaining a driver’s license, transfer ownership, or carry out any other tasks related to automobiles, handling such RMV documents as Deldot Mv213 is an unavoidable necessity.

There are various methods to access them: through mail, at the RMV service center, or by downloading them online from your local RMV website and printing them. Each of these methods takes considerable time. If you’re seeking a quicker way to fill them out and sign them with a legally-recognized eSignature, airSlate SignNow is your optimal choice.

How to complete Deldot Mv213 with ease

- Click on Show details to view a brief summary of the document you are interested in.

- Select Get document to initiate and access the document.

- Follow the green marker indicating the required fields if applicable to you.

- Utilize the top toolbar and employ our advanced features to modify, annotate, and enhance your document.

- Add text, your initials, shapes, images, and other elements.

- Click Sign in in the same toolbar to generate a legally-recognized eSignature.

- Review the document text to ensure it contains no errors or inconsistencies.

- Click on Done to complete the document completion process.

Using our solution to fill out your Deldot Mv213 and other related documents will save you a signNow amount of time and hassle. Streamline your RMV document completion tasks from the very beginning!

Create this form in 5 minutes or less

FAQs

-

Which ITR form should I fill for payments received from the USA to a salaried individual in India for freelancing work, and how should I declare this in ITR? There is no TDS record of this payment as it is outside India.

You can use ITR-1 to show it as Income from Other SOurcesIf you want to claim expense against this income, then you are better off showing it in ITR-2 again as Income from Other Sources. In this case dont claim too many expenses against Income from Other Sources because that usually triggers a scrutinyIf this is going to be regular, then you will need to fill ITR-3 and show this as Income from Business/Profession. The negative of this ITR is that it is quite voluminous and you will have to prepare a Balance Sheet and Profit and loss account even if your income from this source exceeds an amount as low as Rs. 1,20,000/-.

-

Why should it be so complicated just figuring out how much tax to pay? (record keeping, software, filling out forms . . . many times cost much more than the amount of taxes due) The cost of compliance makes the U.S. uncompetitive and costs jobs and lowers our standard of living.

Taxes can be viewed as having 4 uses (or purposes) in our (and most) governments:Revenue generation (to pay for public services).Fiscal policy control (e.g., If the government wishes to reduce the money supply in order to reduce the risk of inflation, they can raise interest rates, sell fewer bonds, burn money, or raise taxes. In the last case, this represents excess tax revenue over the actual spending needs of the government).Wealth re-distribution. One argument for this is that the earnings of a country can be perceived as belonging to all of its citizens since the we all have a stake in the resources of the country (natural resources, and intangibles such as culture, good citizenship, civic duties). Without some tax policy complexity, the free market alone does not re-distribute wealth according to this "shared" resources concept. However, this steps into the boundary of Purpose # 4...A way to implement Social Policy (and similar government mandated policies, such as environmental policy, health policy, savings and debt policy, etc.). As Government spending can be use to implement policies (e.g., spending money on public health care, environmental cleanup, education, etc.), it is equivalent to provide tax breaks (income deductions or tax credits) for the private sector to act in certain ways -- e.g., spend money on R&D, pay for their own education or health care, avoid spending money on polluting cars by having a higher sales tax on these cars or offering a credit for trade-ins [ref: Cash for Clunkers]).Uses # 1 & 2 are rather straight-forward, and do not require a complex tax code to implement. Flat income and/or consumption (sales) taxes can easily be manipulated up or down overall for these top 2 uses. Furthermore, there is clarity when these uses are invoked. For spending, we publish a budget. For fiscal policy manipulation, the official economic agency (The Fed) publishes their outlook and agenda.Use # 3 is controversial because there is no Constitutional definition for the appropriate level of wealth re-distribution, and the very concept of wealth re-distribution is considered by some to be inappropriate and unconstitutional. Thus, the goal of wealth re-distribution is pretty much hidden in with the actions and policies of Use #4 (social policy manipulation).Use # 4, however, is where the complexity enters the Taxation system. Policy implementation through taxation (or through spending) occurs via legislation. Legislation (law making) is inherently complex and subject to gross manipulation by special interests during formation and amendments. Legislation is subject to interpretation, is prone to errors (leading to loopholes) and both unintentional or intentional (criminal / fraudulent) avoidance.The record keeping and forms referred to in the question are partially due to the basic formula for calculating taxes (i.e., percentage of income, cost of property, amount of purchase for a sales tax, ...). However, it is the complexity (and associated opportunities for exploitation) of taxation legislation for Use # 4 (Social Policy implementation) that naturally leads to complexity in the reporting requirements for the tax system.

Create this form in 5 minutes!

How to create an eSignature for the individual vehicle distance record ivdr deldot

How to make an eSignature for your Individual Vehicle Distance Record Ivdr Deldot in the online mode

How to make an eSignature for the Individual Vehicle Distance Record Ivdr Deldot in Google Chrome

How to create an electronic signature for signing the Individual Vehicle Distance Record Ivdr Deldot in Gmail

How to make an electronic signature for the Individual Vehicle Distance Record Ivdr Deldot right from your smartphone

How to generate an eSignature for the Individual Vehicle Distance Record Ivdr Deldot on iOS devices

How to create an electronic signature for the Individual Vehicle Distance Record Ivdr Deldot on Android devices

People also ask

-

What is an individual vehicle distance record?

An individual vehicle distance record is a detailed log that tracks the distance driven by a specific vehicle over a given time period. This record is essential for businesses to monitor vehicle usage, fuel efficiency, and for tax or compliance purposes. Using airSlate SignNow, you can easily manage and eSign these records to keep everything official and organized.

-

How does airSlate SignNow facilitate managing individual vehicle distance records?

airSlate SignNow simplifies the process of documenting individual vehicle distance records by allowing users to create, send, and eSign necessary forms hassle-free. With a user-friendly interface, businesses can quickly input mileage data, reducing time spent on paperwork. This ensures that tracking your vehicle distance records is both efficient and reliable.

-

What features does airSlate SignNow offer for tracking individual vehicle distance records?

airSlate SignNow offers features like customizable templates for distance logs, automated reminders for record submissions, and seamless eSigning capabilities. These features ensure that your individual vehicle distance records are always up to date and easily accessible. Additionally, you can integrate with various accounting tools to streamline your data management.

-

Is airSlate SignNow cost-effective for managing individual vehicle distance records?

Yes, airSlate SignNow provides a cost-effective solution for managing individual vehicle distance records, especially for businesses. With flexible pricing plans tailored to different organizational sizes, you can choose what fits best for your needs without compromising on quality. The savings on time and paper can signNowly enhance your ROI.

-

How can I integrate airSlate SignNow with my existing software for distance records?

airSlate SignNow offers robust integrations with various business software, making it easy to sync your individual vehicle distance records with existing systems. Whether it’s accounting software or fleet management solutions, you can easily connect airSlate SignNow to streamline data flow. Integration helps avoid data entry errors and saves time.

-

What are the benefits of using airSlate SignNow for vehicle distance logs?

Using airSlate SignNow for individual vehicle distance records offers numerous benefits, including enhanced accuracy, easier compliance tracking, and boosted efficiency. By digitizing the logging process, businesses can minimize human error and keep detailed, organized records. The eSigning feature also simplifies approvals and enhances accountability.

-

Can I access my individual vehicle distance records on mobile devices?

Absolutely! airSlate SignNow is fully optimized for mobile use, allowing you to manage your individual vehicle distance records on the go. This flexibility means that whether you’re in the office or out in the field, you can easily log distances, send documents, and collect eSignatures. This enhances productivity and keeps your operations running smoothly.

Get more for Deldot Mv213

- Residual chlorin test templeat form

- Power of attorney affidavit form

- Affidavit of parentage 380714074 form

- Ckyc form

- Pleiadian perspectives on human evolution pdf form

- Residential building permit application henrico county co henrico va form

- Occupancy loudoun form

- Building permit application scott county virginia form

Find out other Deldot Mv213

- Sign New Mexico Legal Cease And Desist Letter Mobile

- Sign Texas Insurance Business Plan Template Later

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online