Form 3903 Moving Expenses Irs Ustreas

What is the Form 3903 Moving Expenses IRS USTreas

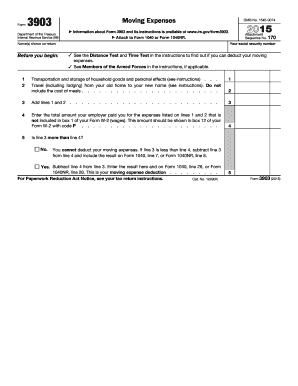

The Form 3903 is a tax form used by individuals to claim moving expenses related to a job change. This form allows taxpayers to deduct certain costs associated with relocating for work, which can include expenses for transportation, storage, and travel. The IRS provides this form to help taxpayers accurately report their moving expenses and ensure they receive the appropriate tax benefits.

How to use the Form 3903 Moving Expenses IRS USTreas

To use Form 3903, taxpayers must first determine their eligibility for the moving expense deduction. This typically applies to individuals who have moved due to a job change or starting a new job. Once eligibility is confirmed, the form must be filled out with detailed information about the move, including the new job's location and the dates of the move. After completing the form, it should be attached to the taxpayer's annual tax return.

Steps to complete the Form 3903 Moving Expenses IRS USTreas

Completing Form 3903 involves several steps:

- Gather all necessary documentation, including receipts for moving expenses.

- Fill out the personal information section, including your name, address, and Social Security number.

- Provide details about your old and new addresses, as well as the reason for your move.

- List your qualifying moving expenses in the appropriate sections of the form.

- Calculate the total deduction and ensure all information is accurate before submission.

Legal use of the Form 3903 Moving Expenses IRS USTreas

The legal use of Form 3903 is governed by IRS regulations. Taxpayers must ensure that their claims for moving expenses comply with IRS guidelines, which include maintaining proper documentation and only claiming eligible expenses. Failure to adhere to these regulations may result in penalties or disallowance of the deduction.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for Form 3903. Typically, this form must be submitted along with your annual tax return, which is due on April fifteenth of each year. If you are unable to meet this deadline, you may request an extension, but it is important to ensure that all forms are filed accurately and on time to avoid penalties.

Eligibility Criteria

To be eligible to claim moving expenses using Form 3903, individuals must meet specific criteria set by the IRS. Generally, this includes having moved due to a job change, meeting the distance test, and having incurred qualified moving expenses. Understanding these criteria is essential for ensuring that your claim is valid and that you receive the appropriate tax benefits.

Quick guide on how to complete form 3903 moving expenses irs ustreas

Easily Prepare Form 3903 Moving Expenses Irs Ustreas on Any Device

The management of online documents has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed paperwork, as you can access the necessary form and store it securely online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly and without complications. Handle Form 3903 Moving Expenses Irs Ustreas on any platform using the airSlate SignNow apps for Android or iOS, and streamline any document-related process today.

The Simplest Method to Edit and Electronically Sign Form 3903 Moving Expenses Irs Ustreas

- Find Form 3903 Moving Expenses Irs Ustreas and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select your preferred method for sharing your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate the worries of lost or misfiled documents, laborious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks, from any device you prefer. Modify and electronically sign Form 3903 Moving Expenses Irs Ustreas, ensuring effective communication throughout any step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 3903 moving expenses irs ustreas

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 3903 Moving Expenses Irs Ustreas?

Form 3903 Moving Expenses Irs Ustreas is a tax form used to deduct certain moving expenses from your taxable income. It is primarily for military members and certain other taxpayers who have incurred qualified moving expenses due to a job change. Filling out this form correctly can help reduce your tax burden.

-

How can airSlate SignNow help with Form 3903 Moving Expenses Irs Ustreas?

airSlate SignNow streamlines the document signing process, allowing you to easily prepare and send your Form 3903 Moving Expenses Irs Ustreas for electronic signatures. This simplifies the process of gathering the necessary signatures and ensures that your form is submitted promptly. Our platform helps businesses manage their moving expense documentation efficiently.

-

Is there a cost associated with using airSlate SignNow for Form 3903 Moving Expenses Irs Ustreas?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. These plans are designed to be cost-effective, allowing you to manage your Form 3903 Moving Expenses Irs Ustreas without breaking the bank. You can choose a plan that fits your budget and the volume of documents you handle.

-

What features does airSlate SignNow offer for handling Form 3903 Moving Expenses Irs Ustreas?

airSlate SignNow provides features such as customizable templates, easy document editing, and secure eSignature capabilities, specifically for forms like Form 3903 Moving Expenses Irs Ustreas. These features make it easier for users to create, modify, and send documents securely. Our platform also allows for tracking the signing process in real time.

-

Can I integrate airSlate SignNow with other applications for Form 3903 Moving Expenses Irs Ustreas?

Yes, airSlate SignNow offers integrations with a variety of applications, enhancing your workflow for managing Form 3903 Moving Expenses Irs Ustreas. You can connect to popular services such as Google Drive, Dropbox, and various CRMs. This enables you to organize and access your documents more conveniently.

-

What are the benefits of using airSlate SignNow for tax documents like Form 3903 Moving Expenses Irs Ustreas?

Using airSlate SignNow for tax documents such as Form 3903 Moving Expenses Irs Ustreas offers numerous advantages, including improved efficiency, reduced paperwork, and quicker turnaround times. The platform's user-friendly interface means users can easily navigate document preparation and signing. Additionally, the secure process ensures that your sensitive information is protected.

-

Is airSlate SignNow suitable for small businesses handling Form 3903 Moving Expenses Irs Ustreas?

Indeed, airSlate SignNow is perfect for small businesses that need to manage documents like Form 3903 Moving Expenses Irs Ustreas efficiently. Our cost-effective solutions and intuitive design make it easy for small teams to stay organized and compliant. Small businesses can take advantage of our features to streamline their document workflows.

Get more for Form 3903 Moving Expenses Irs Ustreas

Find out other Form 3903 Moving Expenses Irs Ustreas

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online