Il 1040 Form 2019

What is the Il 1040 Form

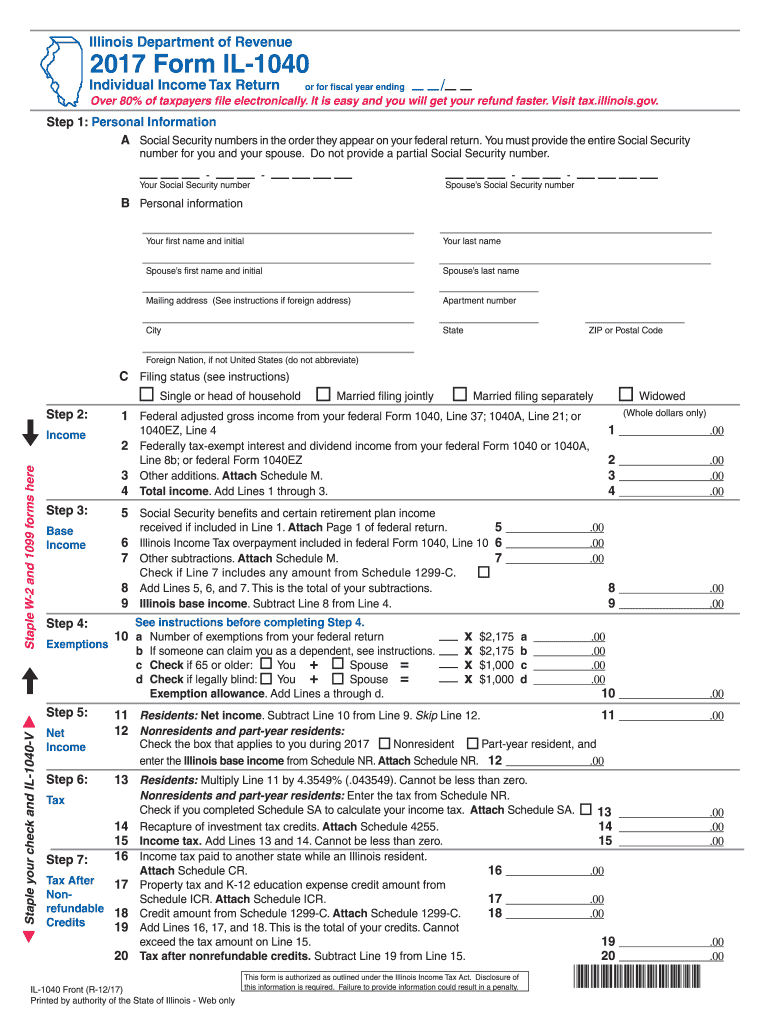

The Il 1040 Form is a tax document used by individuals in the United States to report their annual income to the Internal Revenue Service (IRS). This form is essential for calculating the amount of tax owed or the refund due based on the taxpayer's financial situation for the year. It encompasses various income sources, deductions, and credits that can affect the overall tax liability. Understanding the Il 1040 Form is crucial for compliance with federal tax laws and for ensuring accurate reporting of personal finances.

Steps to complete the Il 1040 Form

Completing the Il 1040 Form involves several key steps that ensure accurate reporting of income and deductions. Here’s a streamlined approach:

- Gather necessary documents: Collect all relevant financial documents, including W-2s, 1099s, and records of any other income.

- Determine your filing status: Identify whether you are single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

- Report income: Fill in your total income from various sources on the form.

- Claim deductions: Identify and enter any deductions you are eligible for, such as standard or itemized deductions.

- Calculate tax liability: Use the information provided to determine your tax owed or refund due.

- Review and sign: Double-check all entries for accuracy and sign the form before submission.

How to obtain the Il 1040 Form

The Il 1040 Form can be obtained through several convenient methods. Taxpayers can download the form directly from the IRS website, where it is available in PDF format. Additionally, many tax preparation software programs include the Il 1040 Form as part of their services, allowing users to fill it out digitally. For those who prefer a physical copy, local IRS offices and public libraries often provide printed versions of the form. It is important to ensure you are using the correct version for the applicable tax year.

Filing Deadlines / Important Dates

Filing deadlines for the Il 1040 Form are crucial for taxpayers to keep in mind to avoid penalties. Typically, the deadline for submitting the form is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers can also file for an extension, which grants an additional six months to submit the form, though any taxes owed must still be paid by the original deadline to avoid interest and penalties. Being aware of these dates helps ensure compliance with tax obligations.

Legal use of the Il 1040 Form

The Il 1040 Form is legally binding when completed and submitted according to IRS regulations. It must be signed by the taxpayer, affirming that the information provided is accurate to the best of their knowledge. Electronic submissions are also legally valid, provided they comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and other relevant laws. Understanding the legal implications of the Il 1040 Form helps taxpayers maintain compliance and avoid potential issues with the IRS.

Examples of using the Il 1040 Form

There are various scenarios in which individuals may use the Il 1040 Form. For instance, a full-time employee receiving a W-2 would report their salary and any withholdings directly on the form. Freelancers or self-employed individuals would report their income from 1099 forms and may also claim business-related deductions. Additionally, individuals who qualify for tax credits, such as the Earned Income Tax Credit (EITC), would use the Il 1040 Form to claim these benefits. Each situation requires careful consideration of income sources and potential deductions.

Quick guide on how to complete 2011 il 1040 form

Complete Il 1040 Form seamlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, edit, and electronically sign your documents quickly and without delays. Handle Il 1040 Form on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

The easiest way to modify and electronically sign Il 1040 Form effortlessly

- Find Il 1040 Form and click Get Form to start.

- Utilize the tools we offer to complete your document.

- Mark important sections of the documents or conceal sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select how you wish to share your form: via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Modify and electronically sign Il 1040 Form to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 il 1040 form

Create this form in 5 minutes!

How to create an eSignature for the 2011 il 1040 form

How to generate an eSignature for a PDF in the online mode

How to generate an eSignature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The best way to make an eSignature right from your smart phone

The best way to create an eSignature for a PDF on iOS devices

The best way to make an eSignature for a PDF on Android OS

People also ask

-

What is the Il 1040 Form, and who needs to file it?

The Il 1040 Form is an individual income tax return form used by residents of Illinois. This form is required for those earning income in Illinois to report their income, claim deductions, and calculate their tax responsibilities for the year. If you are a resident or a part-year resident of Illinois, you need to file it.

-

How can airSlate SignNow help with the Il 1040 Form?

airSlate SignNow simplifies the process of eSigning your Il 1040 Form by offering an intuitive platform that enables quick document handling. With our electronic signature capabilities, you can easily sign your tax documents from anywhere and ensure they are securely stored. This saves you time and effort compared to traditional paper methods.

-

What features does airSlate SignNow offer for managing the Il 1040 Form?

Our platform provides essential features such as document templates, secure storage, and mobile access, specifically designed to streamline the eSigning process for your Il 1040 Form. You can easily collaborate with tax professionals or family members, track document status, and receive notifications for signed documents. These features enhance productivity and reduce the likelihood of errors.

-

Is there a cost associated with using airSlate SignNow for the Il 1040 Form?

Yes, airSlate SignNow operates on a subscription model with various pricing tiers to accommodate different needs. The cost is competitive compared to traditional signing methods, and it provides excellent value considering the features offered. You can see signNow savings in time and resources, especially during tax season.

-

Are there any integrations available for airSlate SignNow when dealing with the Il 1040 Form?

Absolutely! airSlate SignNow integrates seamlessly with numerous third-party applications, including popular tax software and cloud storage solutions. This interoperability allows for efficient document management and easy access to all your tax forms, including the Il 1040 Form, ensuring a smooth workflow across different platforms.

-

What are the benefits of using airSlate SignNow for eSigning tax documents like the Il 1040 Form?

Using airSlate SignNow for eSigning the Il 1040 Form offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Electronic signatures are legally recognized and expedite the signing process, allowing you to focus on what matters most during tax season. Our platform also ensures that your documents are safely stored and easily retrievable.

-

Can I use airSlate SignNow on mobile devices for my Il 1040 Form?

Yes, airSlate SignNow is fully mobile-compatible, allowing you to manage and eSign your Il 1040 Form easily from your smartphone or tablet. This mobility is ideal for individuals on the go who need instant access to their tax documents. You can complete the eSigning process from anywhere, ensuring that you meet all tax deadlines.

Get more for Il 1040 Form

Find out other Il 1040 Form

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile