Form Il 1040 2019

What is the Form Il 1040

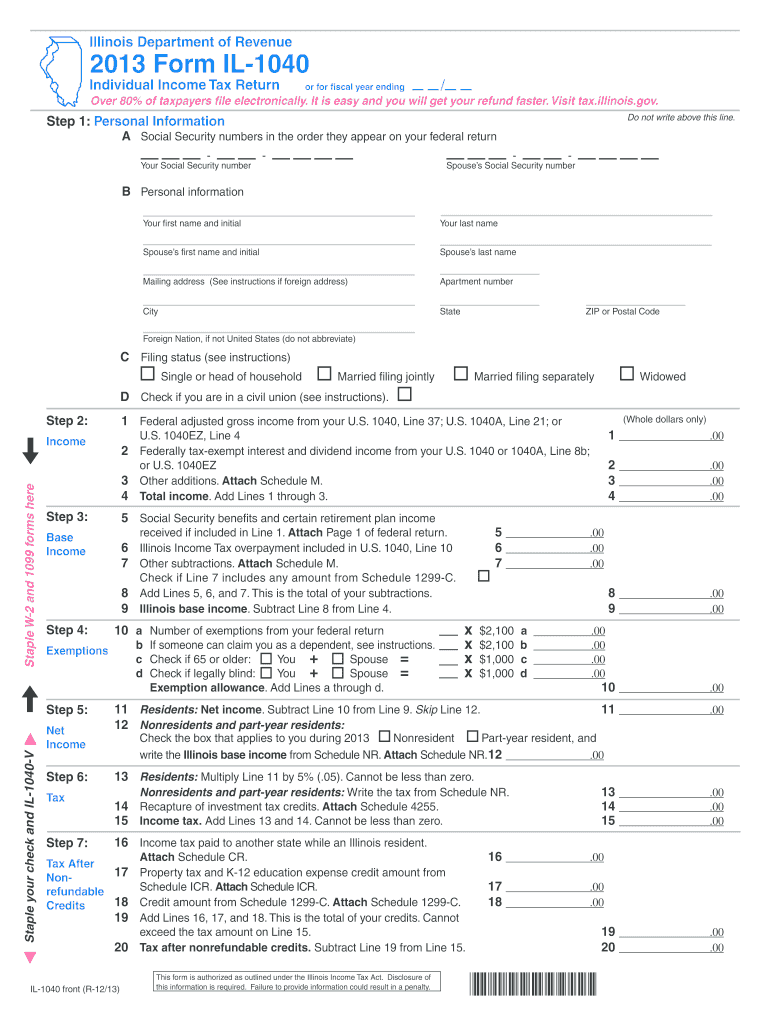

The Form Il 1040 is a tax document used by individuals in Illinois to report their income and calculate their state income tax liability. This form is essential for residents and non-residents who earn income in Illinois. The information provided on the Form Il 1040 is used to determine the amount of tax owed or the refund due to the taxpayer. It is important to complete this form accurately to ensure compliance with state tax regulations.

How to use the Form Il 1040

Using the Form Il 1040 involves several steps to ensure that all required information is accurately reported. Taxpayers must gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Once the form is obtained, individuals should fill it out by entering their personal information, income details, and any applicable deductions or credits. After completing the form, it must be reviewed for accuracy before submission.

Steps to complete the Form Il 1040

Completing the Form Il 1040 requires attention to detail. Here are the key steps to follow:

- Gather all necessary financial documents, including income statements and deduction records.

- Obtain the latest version of the Form Il 1040 from the Illinois Department of Revenue website or other official sources.

- Fill in personal information such as name, address, and Social Security number.

- Report all sources of income accurately, including wages, interest, and dividends.

- Claim any deductions or credits that apply to your situation.

- Calculate the total tax owed or refund due based on the information provided.

- Review the completed form for accuracy and completeness.

- Submit the form either electronically or by mail, following the guidelines provided.

Legal use of the Form Il 1040

The Form Il 1040 is legally binding when completed and submitted according to Illinois tax laws. It must be signed by the taxpayer to validate the information provided. Inaccuracies or omissions can lead to penalties or audits by the Illinois Department of Revenue. Therefore, it is crucial to ensure that all information is truthful and complete. Additionally, taxpayers should retain copies of their submitted forms for their records.

Filing Deadlines / Important Dates

Filing deadlines for the Form Il 1040 typically align with federal tax deadlines. Generally, taxpayers must file their state income tax returns by April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to deadlines or extensions provided by the Illinois Department of Revenue to avoid late filing penalties.

Required Documents

To complete the Form Il 1040 accurately, taxpayers should gather several key documents, including:

- W-2 forms from employers to report wages and tax withholdings.

- 1099 forms for any freelance or contract work.

- Records of other income sources, such as interest or dividends.

- Documentation for any deductions or credits claimed, such as receipts for charitable donations or medical expenses.

Form Submission Methods (Online / Mail / In-Person)

The Form Il 1040 can be submitted through various methods to accommodate taxpayer preferences. Individuals can file electronically using approved e-filing software, which often provides a faster processing time and confirmation of receipt. Alternatively, the form can be printed and mailed to the appropriate address provided by the Illinois Department of Revenue. In-person submission is also an option at designated tax offices, although it is less common.

Quick guide on how to complete 2013 form il 1040

Complete Form Il 1040 seamlessly on any device

Digital document management has become popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents swiftly without delays. Manage Form Il 1040 on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Form Il 1040 with ease

- Locate Form Il 1040 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive data with features that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal standing as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method to send your form, either via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced papers, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from your device of choice. Edit and eSign Form Il 1040 and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 form il 1040

Create this form in 5 minutes!

How to create an eSignature for the 2013 form il 1040

How to generate an eSignature for a PDF file in the online mode

How to generate an eSignature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The best way to make an eSignature from your smartphone

The best way to create an eSignature for a PDF file on iOS devices

The best way to make an eSignature for a PDF file on Android

People also ask

-

What is Form IL 1040 and who needs it?

Form IL 1040 is the individual income tax return form used by residents of Illinois. It's required for individuals who earn income in Illinois and must report their earnings for state tax purposes. Completing and filing the Form IL 1040 accurately ensures compliance with state tax laws.

-

How does airSlate SignNow assist with Form IL 1040?

airSlate SignNow streamlines the process of completing and submitting Form IL 1040 by allowing users to eSign and send documents securely. The platform simplifies workflows, enabling quick access to necessary forms and signatures, ensuring that your Form IL 1040 is filed on time. By utilizing this tool, users can save time and minimize errors.

-

Is there a cost associated with using airSlate SignNow for Form IL 1040?

Yes, airSlate SignNow offers various pricing plans, allowing businesses and individuals to choose the best fit for their needs. The cost is competitive, making it a cost-effective solution for managing documents like Form IL 1040. Be sure to check their website for the latest pricing and features.

-

Can I integrate airSlate SignNow with other software for managing Form IL 1040?

Absolutely! airSlate SignNow integrates seamlessly with a variety of software applications, including popular accounting tools. This integration facilitates easy document sharing and management, making it hassle-free when preparing and submitting your Form IL 1040. It enhances overall efficiency and productivity.

-

What are the key features of airSlate SignNow that support Form IL 1040?

airSlate SignNow offers features like electronic signatures, document templates, and real-time collaboration tools, specifically designed to support users handling Form IL 1040. These features allow for easy customization, fast execution, and a streamlined workflow, ultimately improving your document management process. Security protocols ensure that your sensitive data remains protected.

-

How does using airSlate SignNow improve the filing process for Form IL 1040?

Utilizing airSlate SignNow enhances the filing process for Form IL 1040 by making it user-friendly and efficient. The platform allows for quick electronic signatures, reducing the time spent on paperwork and enhancing accuracy. Moreover, the ability to track the status of your document ensures peace of mind during the filing process.

-

What benefits does airSlate SignNow offer for small businesses filing Form IL 1040?

For small businesses, airSlate SignNow provides a cost-effective way to manage Form IL 1040 filings without compromising quality or security. The platform’s features allow for easy collaboration between team members and clients, optimizing the workflow. Additionally, the user-friendly interface means less time spent on training and more time focused on business operations.

Get more for Form Il 1040

Find out other Form Il 1040

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple