Ptax 342 R St Clair County Form

What is the Ptax 342 R St Clair County

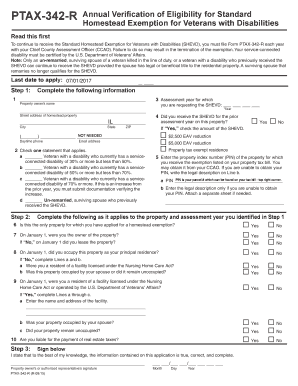

The Ptax 342 R St Clair County is a specific form used for property tax assessment in St. Clair County, Illinois. This form is essential for property owners who wish to appeal their property tax assessments. It serves as a formal request to the county assessor’s office to review and potentially adjust the assessed value of a property. Understanding the purpose and function of this form is crucial for homeowners and real estate investors looking to ensure fair taxation.

How to use the Ptax 342 R St Clair County

Using the Ptax 342 R St Clair County involves several key steps. First, gather all necessary documentation that supports your claim for a reassessment. This may include recent appraisals, sales data for comparable properties, and any other relevant evidence. Next, complete the form accurately, ensuring that all required fields are filled out. Once completed, submit the form to the appropriate county office, either electronically or via traditional mail, depending on the submission guidelines provided by St. Clair County.

Steps to complete the Ptax 342 R St Clair County

Completing the Ptax 342 R St Clair County requires careful attention to detail. Follow these steps:

- Obtain the latest version of the form from the St. Clair County Assessor's website or office.

- Fill in your personal information, including your name, address, and property details.

- Provide a clear explanation of why you believe the assessment is incorrect.

- Attach supporting documents that substantiate your appeal.

- Review the completed form for accuracy before submission.

Legal use of the Ptax 342 R St Clair County

The legal use of the Ptax 342 R St Clair County is governed by state and local property tax laws. This form must be submitted within specific time frames to be considered valid. Additionally, it must include all required information and supporting documentation to ensure compliance with local regulations. Failure to adhere to these legal requirements may result in the denial of your appeal.

Key elements of the Ptax 342 R St Clair County

Key elements of the Ptax 342 R St Clair County include:

- Property owner’s name and contact information.

- Property identification number and address.

- Details of the current assessment and the proposed assessment.

- Justification for the appeal, supported by evidence.

- Signature of the property owner or authorized representative.

Filing Deadlines / Important Dates

Filing deadlines for the Ptax 342 R St Clair County are critical to ensure your appeal is considered. Typically, property owners must submit their appeals within a specified period following the assessment notice. It is advisable to check the St. Clair County Assessor's website for the most current deadlines to avoid missing your opportunity to appeal.

Quick guide on how to complete ptax 342 r st clair county 101266543

Effortlessly Prepare Ptax 342 R St Clair County on Any Device

Digital document management has gained traction among both businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents quickly and without interruptions. Handle Ptax 342 R St Clair County on any device with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

Steps to Edit and Electronically Sign Ptax 342 R St Clair County with Ease

- Find Ptax 342 R St Clair County and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark important sections of the documents or obscure private information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Verify all details and click on the Done button to save your changes.

- Choose how you prefer to send your form: via email, SMS, an invitation link, or download it to your computer.

Eliminate issues of lost or misplaced documents, tedious form retrieval, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you select. Edit and electronically sign Ptax 342 R St Clair County to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ptax 342 r st clair county 101266543

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is PTAX 342 R St Clair County?

PTAX 342 R St Clair County is a property tax form used to report exemptions for properties located in St. Clair County. It is essential for property owners to submit this form to benefit from any tax exemptions applicable to their properties. Understanding this form can help property owners reduce their tax burden effectively.

-

How can airSlate SignNow assist with PTAX 342 R St Clair County submissions?

airSlate SignNow streamlines the process of submitting PTAX 342 R St Clair County by allowing users to eSign and send documents securely. With our user-friendly interface, you can easily fill out and submit the form without any hassle. This ensures timely submissions which can help you avoid penalties.

-

Is there a cost associated with using airSlate SignNow for PTAX 342 R St Clair County?

Yes, airSlate SignNow offers various pricing plans that are affordable and provide great value for businesses needing to manage documents like PTAX 342 R St Clair County. You can choose a plan that fits your needs, whether you’re a small business or a large enterprise. The cost is justified by the efficiency and time saved in document management.

-

What features does airSlate SignNow offer for handling PTAX 342 R St Clair County?

airSlate SignNow provides features like eSignature, document templates, and automated workflows that simplify managing PTAX 342 R St Clair County. These tools make it easier to track submissions and ensure that all documents are correctly filled out before sending. The platform enhances collaboration among team members and keeps your process organized.

-

Can I integrate airSlate SignNow with other tools for PTAX 342 R St Clair County?

Yes, airSlate SignNow integrates seamlessly with various applications that can help in the process of handling PTAX 342 R St Clair County. Integrations with CRM systems, cloud storage, and productivity tools allow for a more comprehensive solution in managing your documents. This flexibility helps streamline work processes efficiently.

-

What are the benefits of using airSlate SignNow for eSigning PTAX 342 R St Clair County?

Using airSlate SignNow for eSigning PTAX 342 R St Clair County offers multiple benefits, including faster processing times and a secure signing experience. It eliminates the need for paper-based processes, thus improving efficiency and reducing errors. With electronic signatures, documents can be signed and managed anytime and anywhere, which simplifies compliance.

-

Is the security of PTAX 342 R St Clair County documents guaranteed with airSlate SignNow?

Absolutely! airSlate SignNow prioritizes the security of your documents, including PTAX 342 R St Clair County. Our platform uses advanced encryption methods and data security protocols to protect sensitive information. Users can confidently share and sign documents knowing their data is safe.

Get more for Ptax 342 R St Clair County

Find out other Ptax 342 R St Clair County

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself