E 500 Form 2010

What is the E 500 Form

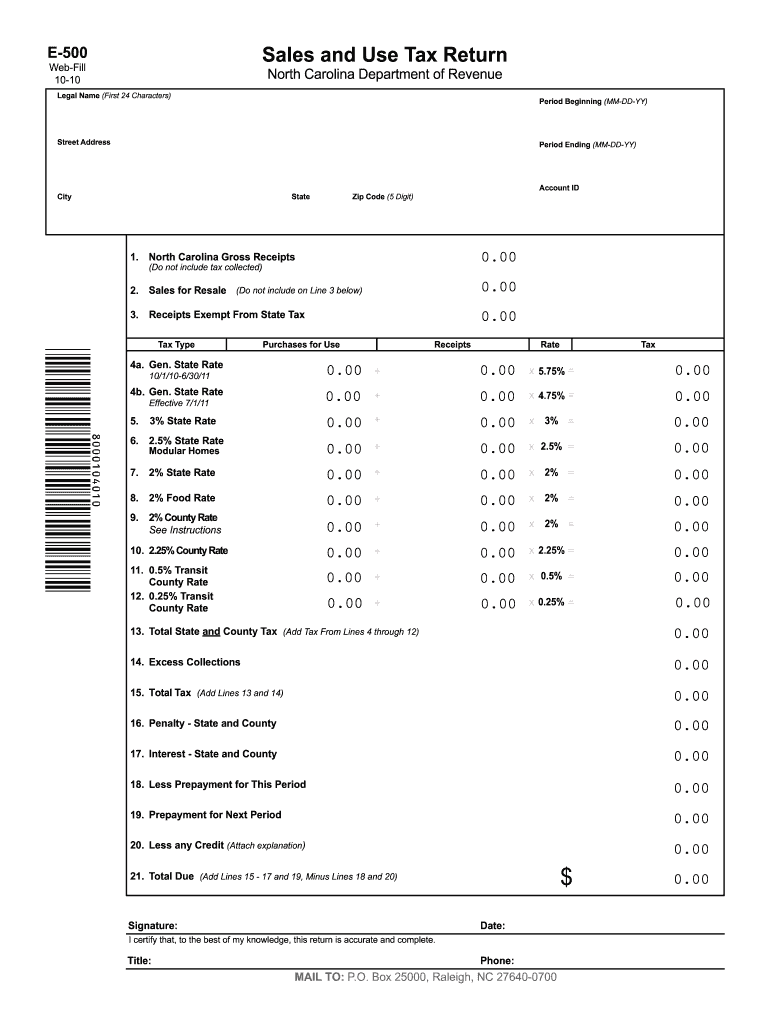

The E 500 Form is a tax-related document used primarily for reporting specific financial information to the Internal Revenue Service (IRS). This form is essential for individuals and businesses that need to disclose income, deductions, or credits that pertain to their tax obligations. Understanding the purpose and requirements of the E 500 Form is crucial for compliance and accurate reporting.

How to use the E 500 Form

Using the E 500 Form involves several steps to ensure that all necessary information is accurately reported. First, gather all relevant financial documents, such as income statements and receipts for deductions. Next, fill out the form with precise details, ensuring that all fields are completed according to the guidelines provided by the IRS. After completing the form, review it for accuracy before submission to avoid delays or penalties.

Steps to complete the E 500 Form

Completing the E 500 Form requires careful attention to detail. Follow these steps:

- Begin by downloading the latest version of the E 500 Form from the IRS website.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Report your income by entering the amounts from your financial documents in the appropriate sections.

- Include any deductions or credits you are eligible for, ensuring you have supporting documentation.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the E 500 Form

The E 500 Form is legally binding when filled out correctly and submitted to the IRS. To ensure its legality, it must comply with all IRS regulations regarding tax reporting. This includes providing accurate information and maintaining records that support the claims made on the form. Failure to adhere to these regulations can result in penalties or audits.

Who Issues the Form

The E 500 Form is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and enforcement of tax laws in the United States. The IRS provides guidelines on how to complete the form, as well as updates on any changes to the requirements or procedures associated with it.

Filing Deadlines / Important Dates

Filing deadlines for the E 500 Form are critical to avoid penalties. Typically, the form must be submitted by April 15 of the tax year, unless an extension has been granted. It is important to stay informed about any changes to these deadlines, as they can vary based on specific circumstances, such as natural disasters or changes in tax law.

Required Documents

To complete the E 500 Form accurately, certain documents are required. These may include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Receipts for deductible expenses

- Bank statements and investment income records

- Any other relevant financial documentation

Quick guide on how to complete e 500 2010 form

Effortlessly Prepare E 500 Form on Any Device

Managing documents online has become increasingly popular among businesses and individuals alike. It offers an ideal environmentally-friendly alternative to traditional printed and signed papers, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, adjust, and eSign your documents rapidly without any holdups. Manage E 500 Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Edit and eSign E 500 Form with Ease

- Find E 500 Form and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Select how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, laborious form hunting, or mistakes that require reprinting new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choosing. Edit and eSign E 500 Form to ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct e 500 2010 form

Create this form in 5 minutes!

How to create an eSignature for the e 500 2010 form

How to make an electronic signature for the E 500 2010 Form in the online mode

How to create an eSignature for your E 500 2010 Form in Google Chrome

How to make an electronic signature for putting it on the E 500 2010 Form in Gmail

How to make an eSignature for the E 500 2010 Form right from your smartphone

How to generate an eSignature for the E 500 2010 Form on iOS

How to generate an electronic signature for the E 500 2010 Form on Android OS

People also ask

-

What is the E 500 Form and how can I use it with airSlate SignNow?

The E 500 Form is a specific document used in certain transactions, and airSlate SignNow allows you to seamlessly send and eSign this form. With its user-friendly interface, you can quickly upload, customize, and share the E 500 Form with interested parties for fast approval. This automation helps enhance productivity and accuracy in your document management process.

-

How does airSlate SignNow ensure the security of my E 500 Form?

When using airSlate SignNow, your E 500 Form is protected through advanced encryption protocols. All documents, including the E 500 Form, are stored securely, ensuring that sensitive data remains confidential. Furthermore, airSlate SignNow complies with industry-standard security policies to safeguard your information.

-

Is there a free trial available for airSlate SignNow to try the E 500 Form features?

Yes, airSlate SignNow offers a free trial period for users to explore its various features, including the ability to handle the E 500 Form effectively. This allows you to familiarize yourself with the platform's capabilities without any initial investment. Getting started is easy, and you can evaluate whether the solution meets your needs.

-

What are the pricing plans for using airSlate SignNow with the E 500 Form?

airSlate SignNow provides a variety of pricing plans to suit different organizational needs, all of which include features for managing documents like the E 500 Form. The plans are competitively priced, offering value based on the features included. For detailed pricing information, visit the airSlate SignNow website and choose the plan that best fits your requirements.

-

Can I customize the E 500 Form using airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize the E 500 Form to fit your specific business needs. You can add your branding, change the layout, and include personalized fields, making the form more relevant to your use case. Customization options enhance user experience and streamline the signing process.

-

Does airSlate SignNow integrate with other software for managing the E 500 Form?

Yes, airSlate SignNow offers seamless integrations with various third-party applications that can help you manage the E 500 Form more efficiently. This includes popular platforms like Google Drive, Salesforce, and more. These integrations facilitate easier access to your documents and enhance workflow processes.

-

What are the benefits of using airSlate SignNow for the E 500 Form?

Using airSlate SignNow for the E 500 Form provides multiple benefits including faster turnaround times, improved accuracy, and simplified workflow management. By digitizing the signing process, you can minimize delays and errors associated with traditional paper methods. Moreover, it helps maintain a clear audit trail, improving compliance and traceability.

Get more for E 500 Form

Find out other E 500 Form

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer