Irs Form 944 2017

What is the Irs Form 944

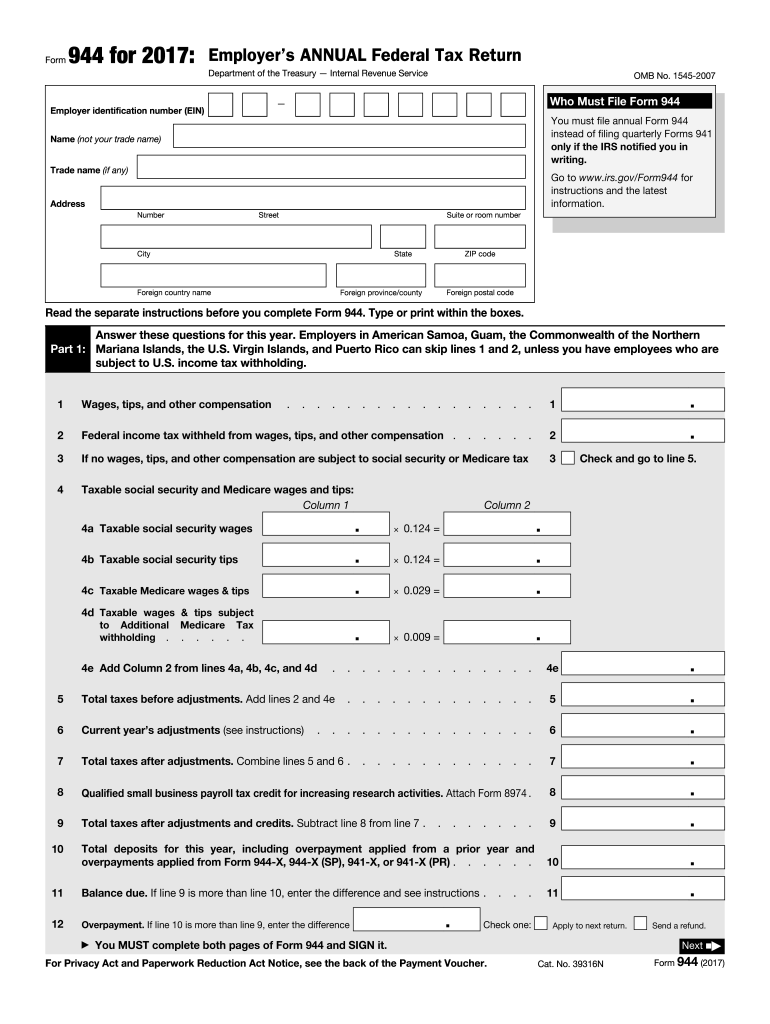

The Irs Form 944 is a tax form used by small employers in the United States to report annual payroll taxes. This form allows eligible businesses to report their federal income tax withheld, Social Security tax, and Medicare tax. Unlike the more commonly used Form 941, which is filed quarterly, Form 944 is specifically designed for businesses with a lower volume of payroll, making it easier for them to manage their tax obligations.

How to use the Irs Form 944

To use the Irs Form 944, employers must first determine their eligibility. Generally, businesses with an annual payroll tax liability of $1,000 or less may qualify to file this form. Once eligibility is confirmed, employers should fill out the form accurately, reporting total wages, tips, and other compensation, as well as the taxes withheld. After completing the form, it must be submitted to the IRS by the designated deadline, ensuring compliance with federal tax regulations.

Steps to complete the Irs Form 944

Completing the Irs Form 944 involves several key steps:

- Gather necessary information, including employee wages, tips, and tax withholdings.

- Fill out the form, ensuring all sections are completed accurately.

- Calculate the total taxes owed, including federal income tax, Social Security, and Medicare taxes.

- Review the form for any errors or omissions.

- Sign and date the form before submission.

Filing Deadlines / Important Dates

The filing deadline for the Irs Form 944 is typically January 31 of the year following the tax year being reported. If January 31 falls on a weekend or holiday, the deadline is extended to the next business day. Employers should keep track of these dates to avoid penalties for late filing.

Legal use of the Irs Form 944

The Irs Form 944 is legally binding when completed and submitted in accordance with IRS regulations. Employers must ensure that the information provided is accurate and complete, as any discrepancies can lead to penalties or audits. Additionally, using a reliable electronic signature solution can help ensure that the form is submitted securely and in compliance with eSignature laws.

Penalties for Non-Compliance

Failure to file the Irs Form 944 on time or submitting inaccurate information can result in significant penalties. The IRS may impose fines based on the length of the delay and the amount of taxes owed. It is crucial for employers to adhere to filing requirements to avoid these financial repercussions.

Quick guide on how to complete irs form 944 2017

Effortlessly Setup Irs Form 944 on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the required form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly and without delays. Handle Irs Form 944 on any device using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to edit and electronically sign Irs Form 944 with ease

- Find Irs Form 944 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that function.

- Create your signature using the Sign feature, which takes seconds and carries the same legal standing as a conventional wet ink signature.

- Review all the details and click on the Done button to save your edits.

- Select how you would like to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from a device of your choice. Edit and electronically sign Irs Form 944 and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 944 2017

Create this form in 5 minutes!

How to create an eSignature for the irs form 944 2017

How to create an eSignature for the Irs Form 944 2017 in the online mode

How to generate an electronic signature for your Irs Form 944 2017 in Chrome

How to make an electronic signature for signing the Irs Form 944 2017 in Gmail

How to make an electronic signature for the Irs Form 944 2017 from your smart phone

How to create an eSignature for the Irs Form 944 2017 on iOS devices

How to generate an eSignature for the Irs Form 944 2017 on Android devices

People also ask

-

What is IRS Form 944 and who needs to file it?

IRS Form 944 is a tax form used by eligible small employers to report their annual payroll taxes to the IRS. If your business has a low annual payroll tax obligation, typically under $1,000, you may qualify to file this form instead of the quarterly Form 941. Understanding how to complete IRS Form 944 correctly can help you avoid penalties.

-

How can airSlate SignNow help with IRS Form 944 signing?

With airSlate SignNow, you can easily send, eSign, and manage IRS Form 944 documents online. Our platform allows for a streamlined signing process, ensuring that your tax forms are completed accurately and on time. This simplifies your tax filing process, making compliance easier for your business.

-

Is there a cost associated with using airSlate SignNow for IRS Form 944?

Yes, airSlate SignNow offers various pricing plans to suit different business needs, including options for those who need to manage IRS Form 944 efficiently. Our pricing is designed to be cost-effective, providing value for businesses of all sizes looking to streamline document management and eSigning.

-

Can I integrate airSlate SignNow with my accounting software for IRS Form 944?

Absolutely! airSlate SignNow offers seamless integrations with various accounting software, allowing you to manage IRS Form 944 and other documents in one place. This integration helps automate your payroll processes, ensuring your tax documents are processed quickly and accurately.

-

What features does airSlate SignNow provide for IRS Form 944?

airSlate SignNow provides a range of features for IRS Form 944, including secure eSigning, document templates, and real-time tracking of document status. These tools make it easier to manage your forms, ensuring you have everything needed for timely filing and compliance.

-

How does eSigning IRS Form 944 work with airSlate SignNow?

eSigning IRS Form 944 with airSlate SignNow is straightforward and user-friendly. You can upload your form, add signers, and send it for signatures with just a few clicks. Our platform ensures that all signatures are legally binding, making your tax form submission hassle-free.

-

What benefits does airSlate SignNow provide for businesses filing IRS Form 944?

By using airSlate SignNow for IRS Form 944, businesses benefit from enhanced efficiency and reduced paperwork. The ability to eSign and manage documents online saves time and minimizes errors, helping you focus on your business rather than administrative tasks.

Get more for Irs Form 944

Find out other Irs Form 944

- How To Sign Massachusetts Codicil to Will

- How To Sign Arkansas Collateral Agreement

- Sign New York Codicil to Will Now

- Sign Oregon Codicil to Will Later

- How Do I Sign Oregon Bank Loan Proposal Template

- Help Me With Sign Oregon Bank Loan Proposal Template

- Sign Michigan Gift Affidavit Mobile

- How To Sign North Carolina Gift Affidavit

- How Do I Sign Oregon Financial Affidavit

- Sign Maine Revocation of Power of Attorney Online

- Sign Louisiana Mechanic's Lien Online

- How To Sign New Mexico Revocation of Power of Attorney

- How Can I Sign Ohio Revocation of Power of Attorney

- Sign Michigan Mechanic's Lien Easy

- How To Sign Texas Revocation of Power of Attorney

- Sign Virginia Revocation of Power of Attorney Easy

- Can I Sign North Carolina Mechanic's Lien

- Sign Maine Payment Guaranty Myself

- Help Me With Sign Oklahoma Mechanic's Lien

- Sign Oregon Mechanic's Lien Simple