Mary Kay Tax Worksheet Form

What is the Mary Kay Tax Worksheet

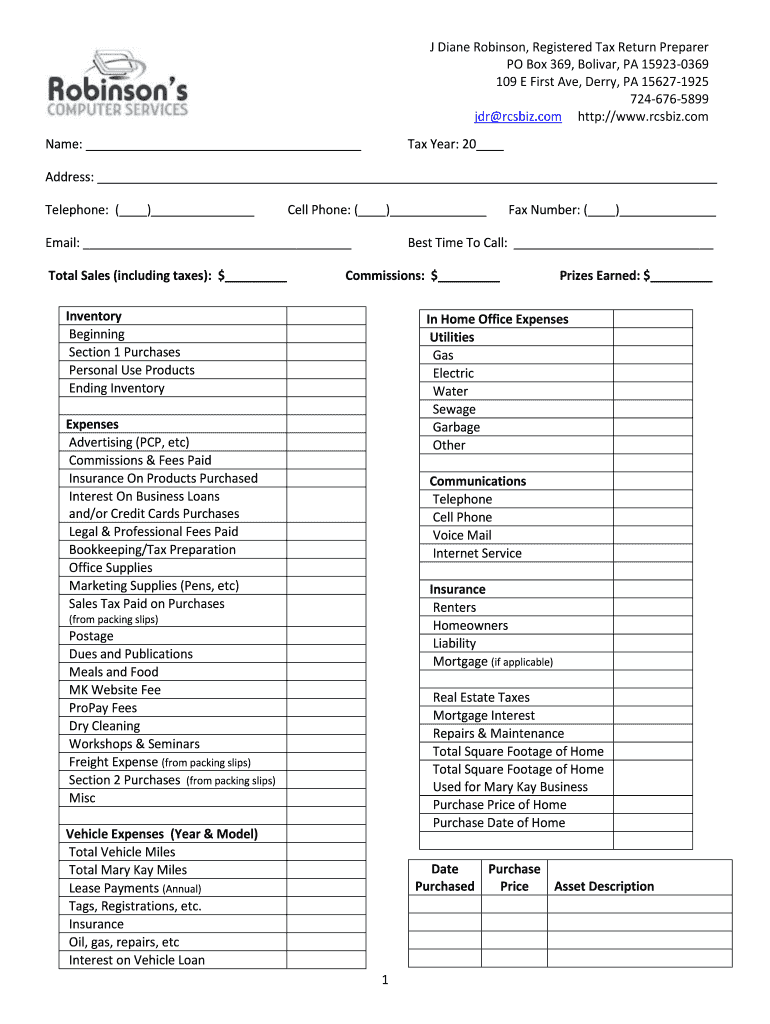

The Mary Kay Tax Worksheet is a specialized document designed for independent beauty consultants to track their income and expenses related to their Mary Kay business. This worksheet simplifies the process of preparing for tax season by organizing financial information in a clear and concise manner. It typically includes sections for reporting sales, expenses, and other relevant financial data necessary for accurate tax filing.

How to use the Mary Kay Tax Worksheet

Using the Mary Kay Tax Worksheet involves several straightforward steps. First, gather all financial records, including receipts and invoices. Next, enter your total sales figures in the designated section. Then, categorize your expenses, such as product purchases, marketing costs, and operational expenses. Finally, review the completed worksheet to ensure all information is accurate and complete before submitting it with your tax return.

Steps to complete the Mary Kay Tax Worksheet

Completing the Mary Kay Tax Worksheet requires careful attention to detail. Start by downloading the latest version of the worksheet, ensuring it is the 2024 edition. Fill in your personal information at the top, followed by your total sales for the year. Next, list all deductible expenses, categorizing them as needed. After entering all data, calculate your net income by subtracting total expenses from total sales. Double-check all entries for accuracy before finalizing the document.

Legal use of the Mary Kay Tax Worksheet

The Mary Kay Tax Worksheet is legally recognized as a valid financial document for tax purposes when completed accurately. It is essential to ensure that all entries reflect true and verifiable information to comply with IRS regulations. Additionally, maintaining records that support the figures reported on the worksheet is crucial in case of an audit. Utilizing a secure platform for electronic signatures can further enhance the legal standing of the completed worksheet.

Filing Deadlines / Important Dates

Filing deadlines for the Mary Kay Tax Worksheet align with the standard tax deadlines set by the IRS. Typically, individual tax returns must be filed by April fifteenth each year. However, if you require additional time, you may file for an extension, which usually grants an additional six months. It is important to stay updated on any changes to tax deadlines that may occur, especially in response to legislative changes or natural disasters.

Required Documents

To accurately complete the Mary Kay Tax Worksheet, several documents are necessary. These include your sales records, receipts for all business-related expenses, bank statements, and any prior year tax returns for reference. Additionally, if you have employees or independent contractors, you will need their W-2 or 1099 forms. Having these documents organized and accessible will streamline the completion process and ensure accuracy.

Quick guide on how to complete mary kay tax worksheet 62385032

Complete Mary Kay Tax Worksheet effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the resources needed to create, edit, and eSign your documents swiftly without delays. Manage Mary Kay Tax Worksheet on any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

How to modify and eSign Mary Kay Tax Worksheet with ease

- Locate Mary Kay Tax Worksheet and then click Get Form to begin.

- Utilize the tools available to fill in your form.

- Highlight pertinent sections of your documents or redact sensitive information using the tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature with the Sign tool, which takes just seconds and holds the same legal authority as a standard wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you want to send your form—via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Mary Kay Tax Worksheet and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mary kay tax worksheet 62385032

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Mary Kay inventory spreadsheet, and how can it benefit my business?

The Mary Kay inventory spreadsheet is a tool designed for Mary Kay consultants to effectively manage and track their inventory. It simplifies the process of organizing products, tracking sales, and monitoring stock levels. By using this spreadsheet, you can save time and reduce errors in your inventory management.

-

How much does the Mary Kay inventory spreadsheet cost?

The Mary Kay inventory spreadsheet is available as a part of airSlate SignNow's offering, which provides cost-effective solutions tailored to small businesses. Pricing varies depending on the specific plan you choose, so it's best to check our website for the most current rates and features. Investing in this tool can lead to better productivity and sales management.

-

What features does the Mary Kay inventory spreadsheet include?

The Mary Kay inventory spreadsheet offers features like product tracking, real-time inventory updates, and automated calculations for sales. It also allows you to categorize products easily, set reorder reminders, and generate reports for insightful analysis. These features make inventory management straightforward and efficient.

-

Can I integrate the Mary Kay inventory spreadsheet with other tools?

Yes, the Mary Kay inventory spreadsheet can be integrated with a variety of other business tools and software, enhancing its functionality. This integration allows you to synchronize data across platforms, making inventory management and sales processes more streamlined. Check our integrations page for a list of compatible applications.

-

Is the Mary Kay inventory spreadsheet easy to use for beginners?

Absolutely! The Mary Kay inventory spreadsheet is designed to be user-friendly, allowing even beginners to navigate it with ease. Its intuitive interface and clear instructions make it accessible for all users, ensuring you can start managing your inventory without extensive training or experience.

-

How does the Mary Kay inventory spreadsheet help with sales tracking?

The Mary Kay inventory spreadsheet aids in sales tracking by automatically updating inventory levels and recording sales transactions. This real-time tracking ensures you always have accurate data at your fingertips, enabling you to make informed decisions about restocking and sales strategies. Better sales tracking leads to increased efficiency and revenue.

-

What are the benefits of using a digital Mary Kay inventory spreadsheet?

Using a digital Mary Kay inventory spreadsheet provides numerous benefits, including accuracy, accessibility, and automation. Digital spreadsheets reduce the likelihood of human error, allow for easy access from multiple devices, and can automatically generate reports. This results in improved efficiency and better business insights.

Get more for Mary Kay Tax Worksheet

- 05 158 texas franchise tax 2019 annual report 05 158 texas franchise tax 2019 annual report form

- Form 1716 application for missouri personalized and

- Dmv form 1528

- Missouri form 8821 authorization for release of confidential information

- Affidavit of affixation form 5312 missouri department of revenue dor mo

- Affidavit mo 2018 2019 form

- R 1096 sales tax exemption certificate certcapture form

- Tax alaska 6967165 form

Find out other Mary Kay Tax Worksheet

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form

- Help Me With eSign Kansas Business Operations PPT

- How Can I eSign Mississippi Car Dealer Form

- Can I eSign Nebraska Car Dealer Document

- Help Me With eSign Ohio Car Dealer Document

- How To eSign Ohio Car Dealer Document

- How Do I eSign Oregon Car Dealer Document

- Can I eSign Oklahoma Car Dealer PDF

- How Can I eSign Oklahoma Car Dealer PPT

- Help Me With eSign South Carolina Car Dealer Document

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document