it Form 2017

What is the IT Form?

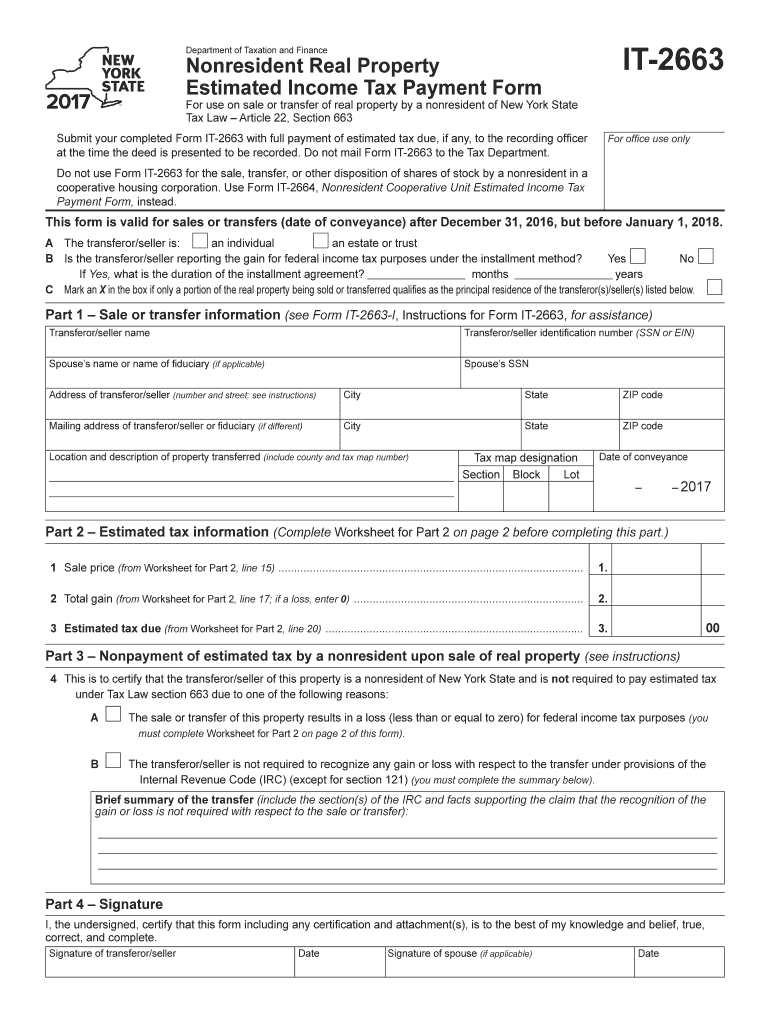

The 2017 IT Form, officially known as the New York State Income Tax Return, is a crucial document for individuals and businesses filing their state taxes. This form is used to report income, calculate taxes owed, and determine eligibility for various credits and deductions. It is essential for residents and non-residents earning income in New York State to accurately complete this form to comply with state tax laws.

How to Obtain the IT Form

To obtain the 2017 IT Form, individuals can visit the New York State Department of Taxation and Finance website, where the form is available for download. Additionally, physical copies can often be requested through local tax offices or public libraries. Ensuring that you have the correct version of the form for the tax year is important for accurate filing.

Steps to Complete the IT Form

Completing the 2017 IT Form involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Fill in personal information, including your name, address, and Social Security number.

- Report your total income from all sources accurately.

- Calculate your deductions and credits to determine your taxable income.

- Complete the tax calculation section to find out how much tax you owe or your refund amount.

- Sign and date the form before submission.

Legal Use of the IT Form

The 2017 IT Form is legally binding once it is signed and submitted to the New York State Department of Taxation and Finance. To ensure compliance with state tax regulations, it is important to provide accurate information and retain copies of all submitted documents. Electronic submissions are also accepted, provided they meet the necessary legal standards for eSignatures.

Filing Deadlines / Important Dates

For the 2017 tax year, the deadline for filing the IT Form was April 15, 2018. It is crucial for taxpayers to be aware of these deadlines to avoid penalties and interest on late payments. Extensions may be available, but they must be filed before the original deadline to be valid.

Form Submission Methods

The 2017 IT Form can be submitted in several ways:

- Online through the New York State Department of Taxation and Finance website using their e-filing system.

- By mail, sending the completed form to the appropriate address as specified in the form instructions.

- In-person at designated tax offices, where assistance may also be available for completing the form.

Quick guide on how to complete form it 214 department of taxation and finance

Complete It Form effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It offers an ideal environmentally-friendly alternative to conventional printed and signed papers, allowing you to find the correct form and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, alter, and eSign your documents promptly without hindrances. Handle It Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and eSign It Form with ease

- Find It Form and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize important sections of your documents or obscure sensitive data using tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then press the Done button to save your updates.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses your needs in document management in just a few clicks from your preferred device. Adjust and eSign It Form and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 214 department of taxation and finance

Create this form in 5 minutes!

How to create an eSignature for the form it 214 department of taxation and finance

How to make an eSignature for the Form It 214 Department Of Taxation And Finance online

How to generate an electronic signature for your Form It 214 Department Of Taxation And Finance in Chrome

How to make an eSignature for putting it on the Form It 214 Department Of Taxation And Finance in Gmail

How to make an eSignature for the Form It 214 Department Of Taxation And Finance straight from your smart phone

How to create an electronic signature for the Form It 214 Department Of Taxation And Finance on iOS devices

How to make an eSignature for the Form It 214 Department Of Taxation And Finance on Android OS

People also ask

-

What is the 2017 IT form used for?

The 2017 IT form is primarily used for filing IT tax returns for businesses and individuals. It ensures compliance with tax regulations and allows for accurate reporting of income and deductions.

-

How can airSlate SignNow help with the 2017 IT form?

airSlate SignNow streamlines the process of completing the 2017 IT form by allowing users to fill out, sign, and send documents electronically. This enhances efficiency and reduces the chances of errors in submission.

-

Is there a cost associated with using airSlate SignNow for the 2017 IT form?

Yes, airSlate SignNow offers various pricing plans designed to meet the needs of businesses handling the 2017 IT form. These plans are competitive and provide value by simplifying document management and eSigning.

-

What features does airSlate SignNow offer for the 2017 IT form?

Key features include customizable templates for the 2017 IT form, secure eSigning, real-time tracking of document status, and integrations with popular productivity tools. These features enhance the entire document workflow.

-

Can I integrate airSlate SignNow with other software for the 2017 IT form?

Absolutely! airSlate SignNow seamlessly integrates with various other software applications, making it easier to manage the 2017 IT form alongside your existing tools. This ensures a smooth workflow and better productivity.

-

What benefits do I get from using airSlate SignNow for the 2017 IT form?

Using airSlate SignNow for the 2017 IT form simplifies document management and reduces processing time. It also mitigates the risk of errors and provides a secure way to handle sensitive tax-related documents.

-

Is airSlate SignNow user-friendly for completing the 2017 IT form?

Yes, airSlate SignNow is designed to be user-friendly, making it easy for anyone to complete the 2017 IT form without prior experience in eSigning or document management. Its intuitive interface ensures a smooth user experience.

Get more for It Form

Find out other It Form

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney