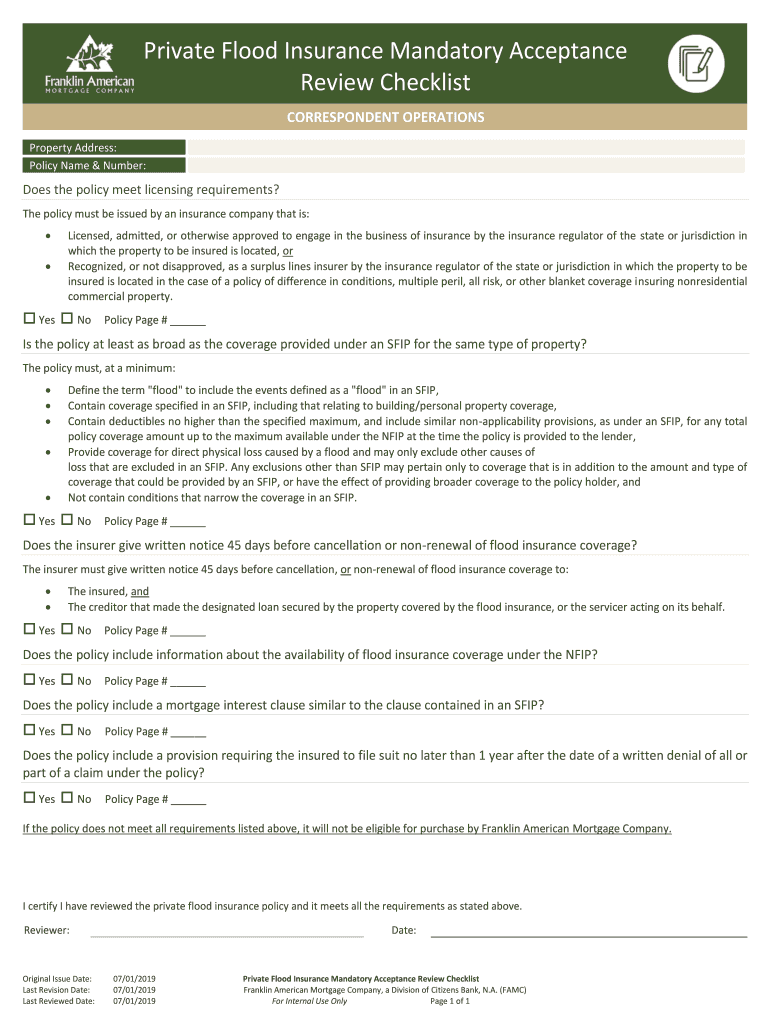

Private Flood Insurance Checklist Form

What is the Private Flood Insurance Checklist

The private flood insurance checklist is a comprehensive tool designed to assist property owners in evaluating their flood insurance needs. This checklist outlines essential factors to consider when selecting a flood insurance policy, ensuring that individuals are adequately protected against potential flood-related damages. It serves as a guide to understanding coverage options, policy limits, and exclusions, making it easier for homeowners to make informed decisions regarding their flood insurance.

How to Use the Private Flood Insurance Checklist

Utilizing the private flood insurance checklist involves a systematic approach to assessing your flood insurance requirements. Begin by gathering information about your property, including its location, elevation, and proximity to flood zones. Next, review the checklist to identify key components such as coverage limits, deductibles, and additional endorsements. This structured evaluation will help you compare different insurance policies and choose one that best fits your needs.

Steps to Complete the Private Flood Insurance Checklist

Completing the private flood insurance checklist involves several straightforward steps. Start by listing your property details, including the address and type of structure. Then, assess your risk level based on local flood maps and historical data. After that, identify your desired coverage level and any specific endorsements that may apply to your situation. Finally, document your findings and use this information to consult with insurance agents or providers for tailored advice.

Key Elements of the Private Flood Insurance Checklist

The private flood insurance checklist includes several key elements essential for evaluating flood insurance options. Important components to consider are:

- Coverage Amount: Determine the total value of your property and the necessary coverage to protect against potential losses.

- Deductibles: Understand the deductibles associated with different policies and how they affect your out-of-pocket expenses.

- Exclusions: Review any exclusions in the policy that may limit coverage, such as specific types of flooding.

- Endorsements: Identify any additional coverage options that may be beneficial, such as coverage for personal belongings or additional living expenses.

Legal Use of the Private Flood Insurance Checklist

The private flood insurance checklist is a legal document that can assist in ensuring compliance with insurance requirements. It is important to understand that while the checklist itself does not constitute an insurance policy, it can serve as a valuable resource in discussions with insurance providers. By documenting your evaluations and decisions, you can create a record that may be useful in legal contexts, particularly if disputes arise regarding coverage or claims.

State-Specific Rules for the Private Flood Insurance Checklist

Each state in the U.S. may have specific regulations and requirements regarding flood insurance. When using the private flood insurance checklist, it is crucial to consider these state-specific rules. This may include understanding the National Flood Insurance Program (NFIP) guidelines applicable in your area, as well as any additional state mandates or recommendations for flood insurance coverage. Familiarizing yourself with these regulations can help ensure that your insurance policy meets all necessary legal standards.

Quick guide on how to complete private flood insurance checklist

Complete Private Flood Insurance Checklist effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can easily find the right form and securely save it online. airSlate SignNow equips you with the necessary tools to create, modify, and electronically sign your files quickly without delays. Manage Private Flood Insurance Checklist on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven workflow today.

How to modify and eSign Private Flood Insurance Checklist effortlessly

- Find Private Flood Insurance Checklist and click Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you'd like to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or mistakes that lead to printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Modify and eSign Private Flood Insurance Checklist and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the private flood insurance checklist

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a private flood insurance checklist?

A private flood insurance checklist is a comprehensive guide designed to help property owners ensure they have the necessary coverage to protect their assets from flood damage. This checklist typically includes key factors to consider, such as policy limits, deductibles, and additional coverage options to enhance financial security.

-

Why is a private flood insurance checklist important?

Having a private flood insurance checklist is crucial for identifying all aspects of flood risk management and making informed decisions about coverage. It ensures that property owners are well-prepared and comply with insurance requirements, ultimately reducing the risk of costly surprises during a flood event.

-

How can I create an effective private flood insurance checklist?

To create an effective private flood insurance checklist, start by assessing your property's flood risk, understanding local regulations, and evaluating current insurance policies. Include key elements like coverage limits, policy exclusions, cost estimates, and any additional riders to comprehensively protect your assets.

-

What features should I look for in flood insurance policies with a checklist?

When choosing flood insurance policies using a private flood insurance checklist, look for features such as comprehensive coverage options, competitive pricing, and clear definitions of covered damages. Additionally, consider policies that offer customizable plans to fit your specific needs for maximum protection.

-

How does private flood insurance differ from government-backed insurance?

Private flood insurance often provides more coverage options, faster claims processing, and may be more flexible than government-backed insurance. Using a private flood insurance checklist can help you compare these differences and select a policy that best suits your needs and risk level.

-

What are the costs associated with a private flood insurance checklist?

The costs associated with a private flood insurance checklist primarily depend on the type and amount of coverage you choose. When completing the checklist, consider both the premium costs and potential deductibles to get a complete picture of your financial commitments regarding flood insurance.

-

Can I integrate a private flood insurance checklist into my existing insurance plan?

Yes, you can integrate a private flood insurance checklist into your existing insurance plan. This checklist serves as an excellent tool to review your current coverage and identify any gaps that may need to be filled to ensure you are adequately protected against flood risks.

Get more for Private Flood Insurance Checklist

Find out other Private Flood Insurance Checklist

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate