Irs Form 8582 for

What is the IRS Form 8582 For

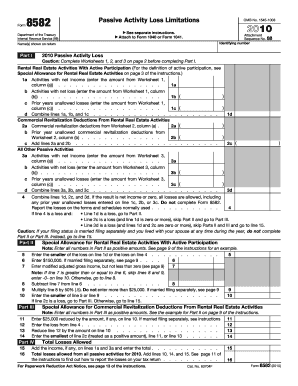

The IRS Form 8582 is used to calculate and report passive activity losses and credits. This form is essential for taxpayers who have activities that fall under the category of passive income, such as rental properties or limited partnerships. The purpose of the form is to determine how much of these losses can be deducted from your taxable income. Understanding the nuances of passive activities is crucial for accurate tax reporting and compliance with IRS regulations.

How to Use the IRS Form 8582

Using the IRS Form 8582 involves several steps. First, gather all necessary financial information related to your passive activities. This includes income, expenses, and any prior year losses. Next, complete the form by entering the relevant figures in the designated sections. It is important to follow the instructions carefully to ensure accuracy. Once completed, the form should be attached to your tax return when filing. This ensures that the IRS can review your passive activity losses in conjunction with your overall tax situation.

Steps to Complete the IRS Form 8582

Completing the IRS Form 8582 requires attention to detail. Here are the steps to follow:

- Begin by entering your personal information at the top of the form, including your name and Social Security number.

- List all passive activities in which you participated during the tax year.

- Calculate the income and losses for each activity. This includes any rental income and associated expenses.

- Determine the total passive losses and any credits that apply.

- Follow the instructions to calculate the allowable losses that can offset other income.

- Review the form for accuracy before submission.

Legal Use of the IRS Form 8582

The IRS Form 8582 is legally binding when completed accurately and submitted according to IRS guidelines. It is important to ensure that all information is truthful and reflects your actual financial situation. Misrepresentation or errors can lead to penalties or audits. The form must be filed by the appropriate deadlines to maintain compliance with tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 8582 align with the general tax return deadlines. Typically, individual taxpayers must submit their forms by April 15 of the following year. If you file for an extension, you may have until October 15 to submit your completed tax return, including Form 8582. It is crucial to stay informed about any changes to these dates to avoid late filing penalties.

Required Documents

To complete the IRS Form 8582, you will need several documents, including:

- Records of all passive income and losses from rental properties or partnerships.

- Previous year's tax returns, especially if you are carrying forward losses.

- Documentation of any credits related to passive activities.

- Any additional forms that may provide context for your passive activities.

Examples of Using the IRS Form 8582

Examples of situations where the IRS Form 8582 is applicable include:

- A taxpayer who owns multiple rental properties and needs to report losses from one or more of them.

- An investor in a limited partnership who has incurred losses that exceed their income from passive activities.

- A business owner who has passive income from investments and needs to offset it with losses from other passive activities.

Quick guide on how to complete irs form 8582 for

Complete Irs Form 8582 For effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the proper format and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents quickly without delays. Manage Irs Form 8582 For on any device with airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

How to modify and eSign Irs Form 8582 For with ease

- Locate Irs Form 8582 For and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your files or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then select the Done button to save your changes.

- Decide how you want to share your document, via email, text message (SMS), or an invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Irs Form 8582 For and ensure effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs form 8582 for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Form 8582 for?

IRS Form 8582 is used to report passive activity losses for tax purposes. It helps taxpayers determine the amount of passive activity losses they can deduct for the year, thus influencing their overall tax liability. Understanding IRS Form 8582 for your finances can aid in maximizing your deductions appropriately.

-

How can airSlate SignNow help with IRS Form 8582?

airSlate SignNow offers a streamlined process for electronically signing and sending important documents, including IRS Form 8582. By using our platform, you can quickly collaborate with tax professionals to ensure your form is completed accurately and submitted on time. This can save you both time and effort during tax season.

-

Is there a cost associated with using airSlate SignNow for IRS Form 8582?

Yes, airSlate SignNow offers various pricing plans that cater to businesses of all sizes. Our solutions are cost-effective, allowing you to choose a plan that fits your budget and needs while ensuring streamlined access to forms like IRS Form 8582. You can check our pricing page for detailed information on our plans.

-

What features does airSlate SignNow offer for managing IRS Form 8582?

airSlate SignNow provides a range of features designed to simplify document management, including eSigning, template creation, and automated workflows. With these features, submitting IRS Form 8582 becomes a hassle-free experience, making it easy to track form status and ensure compliance. Our user-friendly interface allows for quick adjustments as needed.

-

Can I integrate airSlate SignNow with other software when handling IRS Form 8582?

Absolutely! airSlate SignNow seamlessly integrates with various software platforms such as Dropbox, Google Drive, and CRM systems. This allows for consolidated document management when working with IRS Form 8582 and other related documents, enhancing efficiency and accessibility.

-

What are the benefits of using airSlate SignNow for IRS Form 8582 submissions?

Using airSlate SignNow for IRS Form 8582 submissions streamlines the process by providing an easy-to-use digital platform that ensures security and compliance. Additionally, our solution allows for real-time updates and notifications, keeping you informed throughout the process. This results in fewer errors and quicker resolutions.

-

How does airSlate SignNow ensure the security of IRS Form 8582?

airSlate SignNow takes document security seriously, employing advanced encryption and security protocols to safeguard sensitive information, including IRS Form 8582 data. Our platform ensures that only authorized individuals have access to submitted forms, which protects your personal and financial information.

Get more for Irs Form 8582 For

- Every purchaser of any interest in residential real property on which a residential dwelling was built form

- Tax property marriage and military discharge recordsmultnomah form

- Affidavit for mechanics lien form

- Sample answers to interrogatories personal injury attorneys form

- This amendment is being made on this the day of form

- How to write a codicil with sample codicil wikihow form

- Client family law amp divorce intake form

- Form 8829 worksheet 98 195 196

Find out other Irs Form 8582 For

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple