E Ticket Itinerary, Receipt and Tax Invoice Form

What is the e ticket itinerary, receipt and tax invoice

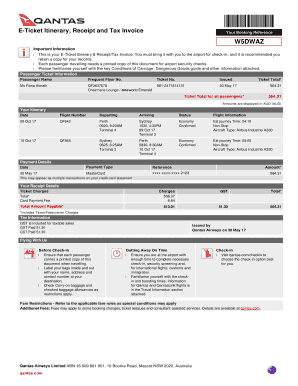

An e ticket itinerary, receipt, and tax invoice serve as essential documents for travel-related transactions. The e ticket itinerary outlines the details of your travel plans, including flight times, departure and arrival locations, and passenger information. The electronic ticket receipt confirms your purchase, providing proof of payment and ticket validity. The tax invoice, on the other hand, is necessary for accounting and tax purposes, detailing the costs associated with your ticket, including taxes and fees. Together, these documents ensure that travelers have all necessary information for their journey and financial records.

How to obtain the e ticket itinerary, receipt and tax invoice

To obtain your e ticket itinerary, receipt, and tax invoice, follow these steps:

- Purchase your ticket through an airline or travel agency's website.

- After completing your transaction, you will receive a confirmation email containing your e ticket itinerary and receipt.

- If you require a tax invoice, check the email for an option to download or request it directly from the provider's website.

- Log in to your account on the airline or travel agency's site, where you can access your booking history and download the necessary documents.

Steps to complete the e ticket itinerary, receipt and tax invoice

Completing the e ticket itinerary, receipt, and tax invoice involves several key steps:

- Ensure all passenger details are accurate, including names and contact information.

- Verify the flight details, such as dates, times, and destinations.

- Check the payment information to confirm the total amount, including taxes and fees.

- Review the terms and conditions related to cancellations, changes, and refunds.

- Once everything is correct, finalize your purchase and save or print your documents for future reference.

Legal use of the e ticket itinerary, receipt and tax invoice

The e ticket itinerary, receipt, and tax invoice are legally binding documents when they meet specific criteria. They must include essential information such as the passenger's name, flight details, and payment confirmation. Compliance with regulations like the ESIGN Act ensures that electronic documents are recognized as valid in the United States. It is crucial to retain these documents for potential audits or disputes, as they serve as proof of travel arrangements and financial transactions.

Key elements of the e ticket itinerary, receipt and tax invoice

Several key elements define the e ticket itinerary, receipt, and tax invoice:

- Passenger Information: Names, contact details, and any special requirements.

- Flight Details: Departure and arrival locations, dates, and times.

- Payment Confirmation: Total amount paid, including taxes and fees.

- Booking Reference Number: A unique identifier for your reservation.

- Terms and Conditions: Information regarding cancellations, changes, and refunds.

Examples of using the e ticket itinerary, receipt and tax invoice

Examples of using the e ticket itinerary, receipt, and tax invoice include:

- Presenting the e ticket itinerary at the airport check-in counter to receive your boarding pass.

- Using the electronic ticket receipt as proof of purchase when filing travel expenses for reimbursement.

- Referencing the tax invoice when preparing your tax returns, especially if you are self-employed or running a business.

Quick guide on how to complete e ticket itinerary receipt and tax invoice

Effortlessly Prepare E Ticket Itinerary, Receipt And Tax Invoice on Any Device

Digital document management has gained immense traction among organizations and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely archive them online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents promptly without delays. Manage E Ticket Itinerary, Receipt And Tax Invoice across any platform using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to Modify and eSign E Ticket Itinerary, Receipt And Tax Invoice with Ease

- Locate E Ticket Itinerary, Receipt And Tax Invoice and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools provided by airSlate SignNow specifically designed for this purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to confirm your modifications.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or disorganized files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow resolves all your document management needs in just a few clicks from any device you prefer. Modify and eSign E Ticket Itinerary, Receipt And Tax Invoice to ensure seamless communication at every stage of your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the e ticket itinerary receipt and tax invoice

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an e ticket invoice?

An e ticket invoice is a digital document that you can send to customers for online purchases, detailing the items or services purchased. It streamlines the billing process by providing clear information and a record of the transaction. Utilizing airSlate SignNow, you can easily create and manage your e ticket invoices.

-

How can I create an e ticket invoice using airSlate SignNow?

Creating an e ticket invoice with airSlate SignNow is straightforward. Simply start by selecting a template, fill in the necessary details, and customize the invoice to match your brand. Once completed, you can send it directly to your customers for their review and digital signature.

-

Are there any costs associated with using airSlate SignNow for e ticket invoices?

airSlate SignNow offers various pricing plans to suit different business needs. Depending on the features you require and the volume of documents you process, there are plans that provide a cost-effective solution for sending e ticket invoices. You can review the pricing page on our website for more specific details.

-

What features does airSlate SignNow offer for e ticket invoices?

airSlate SignNow comes packed with features that enhance the e ticket invoice process. You can automate invoice generation, track statuses in real-time, and send reminders for payments. Additionally, our platform ensures secure document storage and easy access for both senders and recipients.

-

Can I integrate airSlate SignNow with other platforms for e ticket invoices?

Yes, airSlate SignNow supports integrations with a variety of popular business applications. This allows you to seamlessly connect your e ticket invoices with your accounting software, CRM systems, and more. Integration simplifies your workflow and enhances the overall efficiency of your invoicing process.

-

What are the benefits of using airSlate SignNow for e ticket invoices?

Using airSlate SignNow for your e ticket invoices offers numerous benefits, including faster payment processing and reduced paperwork. The electronic signing feature also saves time and enhances convenience for both you and your clients. Additionally, our platform ensures compliance with legal regulations, providing peace of mind.

-

Is it secure to send e ticket invoices through airSlate SignNow?

Absolutely! Security is a top priority at airSlate SignNow. We use robust encryption and secure servers to protect your e ticket invoices and sensitive information throughout the entire process, ensuring that your data remains safe from unauthorized access.

Get more for E Ticket Itinerary, Receipt And Tax Invoice

- Suppliers ampamp subcontractors guide utah state construction form

- Utah alternate form

- Letter from landlord to tenant as notice to remove wild animals in premises utah form

- Letter from landlord to tenant as notice to remove unauthorized pets from premises utah form

- Letter from tenant to landlord containing notice that premises in uninhabitable in violation of law and demand immediate repair 497427433 form

- Letter from tenant to landlord containing notice that premises leaks during rain and demand for repair utah form

- Utah tenant landlord form

- Letter from tenant to landlord with demand that landlord repair broken windows utah form

Find out other E Ticket Itinerary, Receipt And Tax Invoice

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF