Net Loss from Federal Column of Your Michigan MI 1040D or MI 4797 Form

Understanding the Net Loss From Federal Column of Your Michigan MI 1040D or MI 4797

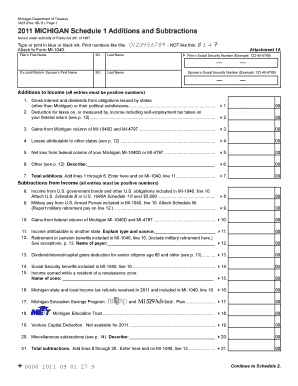

The Net Loss From Federal Column on the Michigan MI 1040D or MI 4797 is an essential component for taxpayers who have incurred losses that can affect their state tax liability. This column allows taxpayers to report losses from federal income tax returns, which can then be used to offset state income. Understanding how to accurately report these losses is crucial for ensuring compliance and maximizing potential tax benefits.

Steps to Complete the Net Loss From Federal Column of Your Michigan MI 1040D or MI 4797

Completing the Net Loss From Federal Column requires careful attention to detail. Start by gathering your federal tax documents, specifically the IRS Form 1040 and any related schedules that detail your loss. Next, transfer the net loss amount from your federal return to the appropriate section of the MI 1040D or MI 4797. Ensure that you provide accurate figures, as discrepancies can lead to delays or penalties. Finally, review your entries for accuracy before submitting the form.

Legal Use of the Net Loss From Federal Column of Your Michigan MI 1040D or MI 4797

The legal use of the Net Loss From Federal Column is governed by specific tax regulations. Taxpayers must ensure that the losses reported are legitimate and substantiated by proper documentation. This includes retaining copies of federal tax returns and any supporting documents that validate the reported losses. Compliance with state laws is necessary to avoid potential legal issues or audits.

Examples of Using the Net Loss From Federal Column of Your Michigan MI 1040D or MI 4797

Consider a scenario where a taxpayer has reported a net loss of five thousand dollars on their federal return due to business expenses. When completing the MI 1040D, this taxpayer can transfer the five thousand dollars to the Net Loss From Federal Column, potentially reducing their taxable income and resulting in a lower state tax liability. Such examples illustrate how understanding and utilizing this column can lead to significant tax savings.

State-Specific Rules for the Net Loss From Federal Column of Your Michigan MI 1040D or MI 4797

Michigan has specific rules regarding how net losses can be applied to state taxes. Taxpayers must be aware of the limitations and requirements set forth by the Michigan Department of Treasury. For instance, certain types of losses may not be eligible for deduction, and there may be caps on the amount that can be claimed in a given tax year. Familiarity with these rules is essential for effective tax planning.

Filing Deadlines / Important Dates

Filing deadlines for the Michigan MI 1040D and MI 4797 are typically aligned with federal tax deadlines. For most taxpayers, the due date is April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Staying informed about these important dates ensures that taxpayers can file their forms on time and avoid penalties.

Quick guide on how to complete form 1040d

Fill out form 1040d seamlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, enabling you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without delays. Manage 1040d on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign 1040 mi effortlessly

- Locate 1040d form and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and electronically sign 1040d instructions to ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to mi 1040d

Create this form in 5 minutes!

How to create an eSignature for the mi 4797

How to create an electronic signature for your Net Loss From Federal Column Of Your Michigan Mi 1040d Or Mi 4797 online

How to generate an electronic signature for your Net Loss From Federal Column Of Your Michigan Mi 1040d Or Mi 4797 in Chrome

How to generate an eSignature for putting it on the Net Loss From Federal Column Of Your Michigan Mi 1040d Or Mi 4797 in Gmail

How to generate an electronic signature for the Net Loss From Federal Column Of Your Michigan Mi 1040d Or Mi 4797 right from your smartphone

How to generate an electronic signature for the Net Loss From Federal Column Of Your Michigan Mi 1040d Or Mi 4797 on iOS

How to generate an eSignature for the Net Loss From Federal Column Of Your Michigan Mi 1040d Or Mi 4797 on Android OS

People also ask michigan 1040d

-

What is the 1040d form and how can airSlate SignNow help with it?

The 1040d form is a vital document for reporting income and calculating taxes owed to the IRS. airSlate SignNow streamlines the eSigning process, allowing you to complete and send your 1040d form quickly and securely. With our easy-to-use platform, you can collect signatures, track document status, and ensure compliance without hassle.

-

How does airSlate SignNow simplify the completion of the 1040d form?

airSlate SignNow simplifies the completion of the 1040d form by offering a user-friendly interface and guided steps for signing and filling out your documents. You can easily upload your 1040d form, add relevant fields for signatures, and share it with clients or collaborators. This ensures timely and accurate submissions.

-

What are the pricing options for using airSlate SignNow for my 1040d form needs?

airSlate SignNow offers flexible pricing plans designed to fit various business sizes and needs. You can choose a monthly or annual subscription, with packages that cater specifically to users frequently dealing with 1040d forms. This cost-effective solution ensures you only pay for the features you need.

-

Can I integrate airSlate SignNow with other applications for my 1040d processing?

Yes, airSlate SignNow provides seamless integrations with popular applications like Google Drive, Dropbox, and Microsoft Office. This allows you to easily manage your 1040d documents and streamline workflows by importing or exporting data from other software. Efficient integration means a smooth process for eSigning your 1040d forms.

-

What security measures does airSlate SignNow implement for 1040d forms?

airSlate SignNow prioritizes the security of your documents, including the 1040d forms. We utilize advanced encryption, secure servers, and multi-factor authentication to protect your data throughout the signing process. This ensures compliant and secure handling of sensitive tax documents.

-

How can airSlate SignNow improve my business's efficiency when handling 1040d forms?

By using airSlate SignNow for your 1040d forms, you can signNowly improve efficiency through automation and real-time tracking. The platform eliminates the need for paper documents, reducing turnaround time for obtaining signatures and approvals. This leads to faster processing and helps maintain compliance.

-

What features does airSlate SignNow offer that are specifically beneficial for 1040d form management?

airSlate SignNow offers a range of features that enhance 1040d form management, including customizable templates, bulk sending, and automated reminders. These features help ensure that your documents are completed promptly and reduce the risk of errors. Users can manage their 1040d forms with ease, improving overall productivity.

Get more for michigan mi 1040

Find out other 1040d

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online

- eSign Utah Sales Receipt Template Free