Content Domicile 2007-2026

What is the domicile statement?

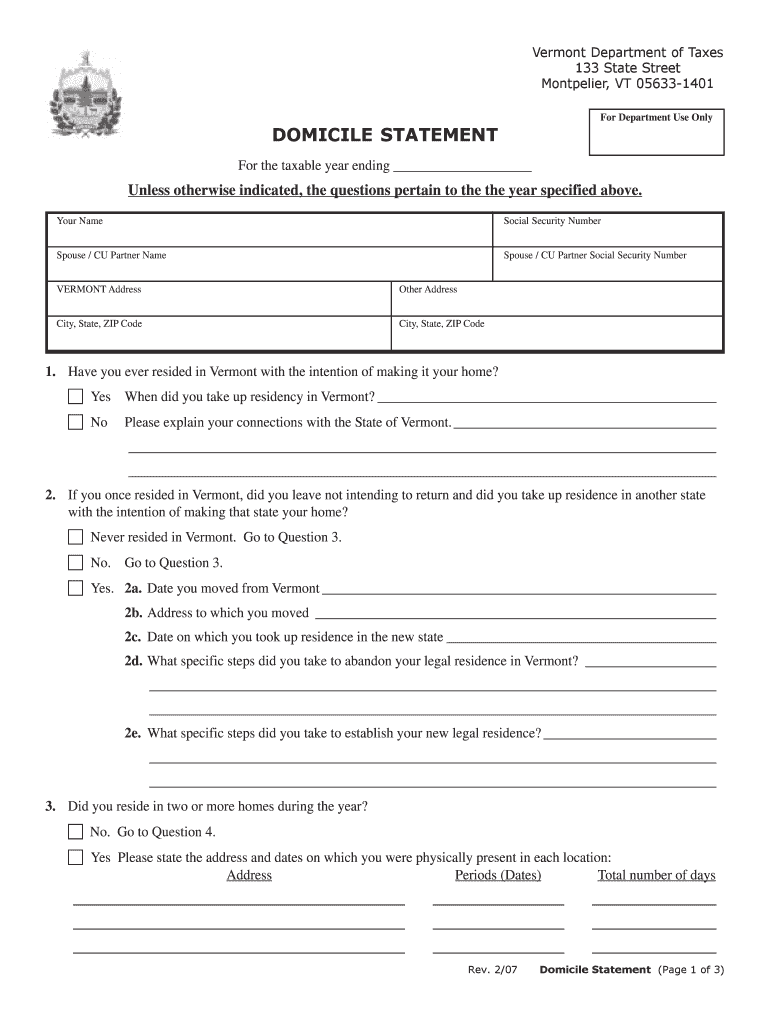

The domicile statement is a legal document that establishes an individual's primary residence for tax purposes. In Vermont, this form is essential for individuals who are changing their domicile to another state, such as Florida. It serves as proof of residency and is often required for tax filings and other legal matters. The domicile statement outlines the individual's intent to establish a new permanent residence and may be used to support claims for tax benefits or exemptions in the new state.

Steps to complete the domicile statement

Completing the domicile statement involves several key steps to ensure accuracy and compliance with Vermont regulations. Follow these steps:

- Gather necessary information: Collect personal details, including your current address, the new address, and dates relevant to your move.

- Fill out the form: Complete the domicile statement form accurately, providing all required information in the designated fields.

- Review the form: Double-check all entries for accuracy to avoid delays in processing.

- Sign the document: Ensure that you sign the form, as a signature is often required for legal validation.

- Submit the form: Choose your preferred submission method, whether online, by mail, or in person, and ensure it is sent to the appropriate Vermont department.

Required documents for the domicile statement

When filing a domicile statement in Vermont, certain documents may be required to support your application. These documents can include:

- Proof of residency: This may include utility bills, lease agreements, or mortgage documents showing your name and new address.

- Identification: A government-issued ID, such as a driver's license or passport, may be necessary to verify your identity.

- Tax documents: Previous tax returns may be required to demonstrate your tax history and compliance.

Legal use of the domicile statement

The domicile statement is legally binding and must be used in accordance with state laws. It is crucial for establishing residency for tax purposes and can impact your tax obligations in both Vermont and the new state. Misuse or fraudulent claims regarding domicile can lead to penalties, including fines or legal action. Therefore, it is important to ensure that all information provided is truthful and accurate.

Form submission methods

There are several methods available for submitting the domicile statement in Vermont. These methods include:

- Online submission: Many forms can be completed and submitted electronically through the Vermont Department of Taxes website.

- Mail: You can print the completed form and send it to the appropriate address provided by the Vermont Department of Taxes.

- In-person submission: If preferred, you can deliver the form directly to a local tax office for processing.

IRS guidelines for domicile statements

The IRS has specific guidelines regarding domicile statements, particularly how they relate to tax residency. Understanding these guidelines is essential for ensuring compliance. Generally, the IRS looks for evidence of a taxpayer's primary residence, which can include domicile statements. It is advisable to consult IRS publications or a tax professional to understand how your domicile status may affect your tax obligations.

Quick guide on how to complete vermont domicile statement form

Your assistance manual on how to prepare your Content Domicile

If you’re interested in understanding how to finalize and submit your Content Domicile, here are some quick pointers on how to simplify tax submission.

Initially, you only need to set up your airSlate SignNow profile to revolutionize how you manage documents online. airSlate SignNow is a highly user-friendly and powerful document solution that enables you to modify, create, and finalize your tax forms effortlessly. Utilizing its editor, you can alternate between text, checkboxes, and electronic signatures and revisit to adjust answers as necessary. Streamline your tax management with advanced PDF editing, eSigning, and user-friendly sharing.

Follow these procedures to complete your Content Domicile in no time:

- Establish your account and start working on PDFs shortly.

- Utilize our directory to find any IRS tax form; explore different versions and schedules.

- Click Get form to access your Content Domicile in our editor.

- Provide the required fillable fields with your details (text, numbers, checkmarks).

- Utilize the Sign Tool to include your legally-binding eSignature (if necessary).

- Review your document and correct any errors.

- Save modifications, print your version, send it to your recipient, and download it to your device.

Refer to this manual to file your taxes electronically with airSlate SignNow. Be advised that submitting in paper form can elevate return errors and delay reimbursements. Certainly, before electronically filing your taxes, check the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

FAQs

-

Can I use broker statements to fill out form 8949 instead of a 1099-B?

Yes you can. Should you? Perhaps, but remember that the 1099 is what the IRS is going to receive. There could be differences.You may receive a 1099 which is missing basis information. You will indicate that, and use your records to fill in the missing information.My suggestion is to use the 1099, cross-referencing to your statements.

-

Do I need to fill out a financial statement form if I get a full tuition waiver and RA/TA?

If that is necessary, the university or the faculty will inform you of that. These things can vary from university to university. Your best option would be to check your university website, financial services office or the Bursar office in your university.

Create this form in 5 minutes!

How to create an eSignature for the vermont domicile statement form

How to make an eSignature for your Vermont Domicile Statement Form in the online mode

How to make an eSignature for your Vermont Domicile Statement Form in Google Chrome

How to create an electronic signature for signing the Vermont Domicile Statement Form in Gmail

How to make an eSignature for the Vermont Domicile Statement Form from your mobile device

How to generate an electronic signature for the Vermont Domicile Statement Form on iOS devices

How to generate an electronic signature for the Vermont Domicile Statement Form on Android

People also ask

-

What is Content Domicile in the context of airSlate SignNow?

Content Domicile refers to the secure location where your documents are stored within the airSlate SignNow platform. This ensures that your important files are easily accessible and protected, giving you peace of mind when managing your eSignatures and documents.

-

How does airSlate SignNow ensure the security of documents in Content Domicile?

airSlate SignNow employs advanced encryption methods and strict access controls to secure your documents in Content Domicile. We prioritize data protection and comply with industry standards to keep your sensitive information safe from unauthorized access.

-

What features does Content Domicile offer for document management?

Content Domicile within airSlate SignNow offers features such as document organization, search functionality, and easy sharing options. These tools help streamline your workflow, making it simple to find and manage your signed documents efficiently.

-

Is there a free trial available for airSlate SignNow’s Content Domicile features?

Yes, airSlate SignNow offers a free trial that allows you to explore all the features of Content Domicile without any commitment. This trial period lets you experience the ease of eSigning and document management firsthand before making a decision.

-

What are the pricing options for airSlate SignNow’s Content Domicile services?

airSlate SignNow offers various pricing plans tailored to different business needs, all of which include access to Content Domicile features. You can choose a plan that fits your budget while benefiting from our user-friendly eSignatures and document management solutions.

-

Can I integrate other applications with airSlate SignNow’s Content Domicile?

Absolutely! airSlate SignNow supports numerous integrations with popular applications, enhancing your experience with Content Domicile. You can connect your favorite CRM, cloud storage, and productivity tools to streamline your document workflows.

-

What are the benefits of using airSlate SignNow’s Content Domicile for my business?

Using airSlate SignNow’s Content Domicile can signNowly improve your business efficiency by simplifying document management and speeding up the eSigning process. This cost-effective solution helps reduce paperwork and enhances collaboration among team members.

Get more for Content Domicile

- Vat1614a_02_09 form for notification of an option to tax opting to tax land and buildings

- Facility request form shelby county schools scsk12

- Online scs transfer forms

- Approval field trip form

- Home equity notice concerning extensions of credit home equity notice concerning extensions of credit ig libertyonline form

- Application hoa form

- Pre application conference request form clackamas county clackamas

- Indiana declaration form

Find out other Content Domicile

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document