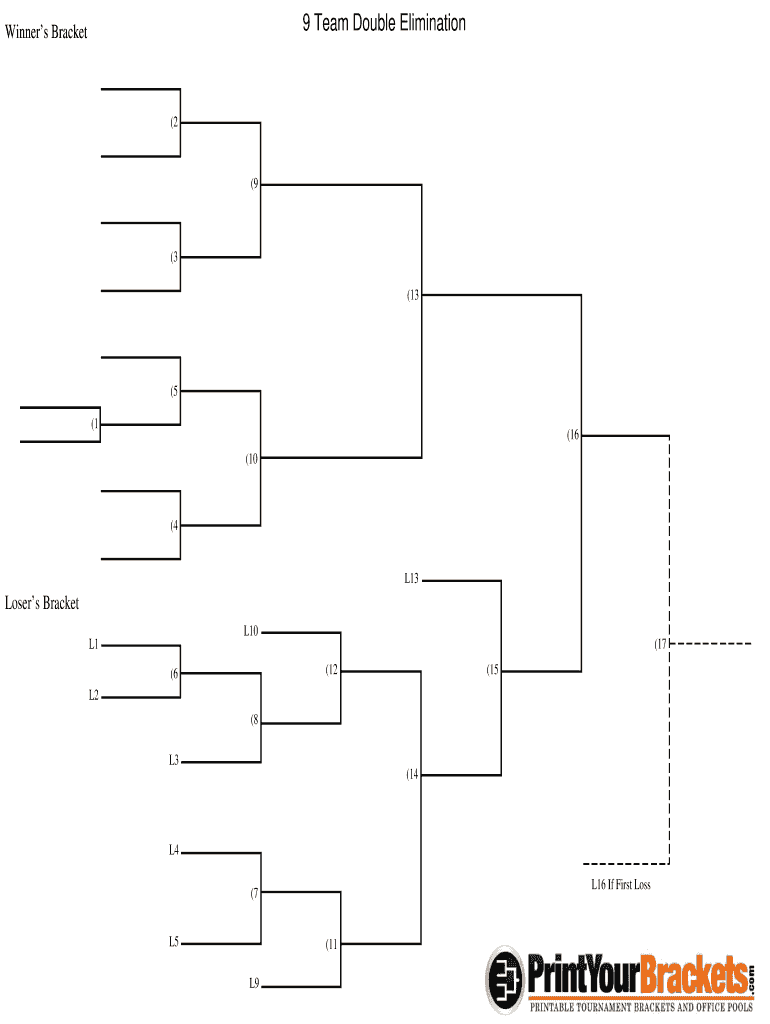

9 Team Double Elimination Bracket Form

Understanding the 9 Team Single Elimination Bracket

The 9 team single elimination bracket is a popular format used in tournaments where teams compete in a knockout style. In this format, each match eliminates one team, leading to a final winner. The structure allows for a straightforward progression through the rounds, making it easy for organizers and participants to follow. Typically, the first round features four matches, with one team receiving a bye to advance directly to the second round. This format is particularly effective for sports events, gaming tournaments, and other competitive scenarios.

How to Use the 9 Team Single Elimination Bracket

To effectively use the 9 team single elimination bracket, begin by clearly defining the tournament rules and format. Next, fill out the bracket with the participating teams, ensuring that each team is placed in a position according to the draw. As matches are played, record the winners in the subsequent rounds. This process continues until a champion is determined. Utilizing digital tools can streamline this process, allowing for easy updates and sharing of results.

Steps to Complete the 9 Team Single Elimination Bracket

Completing a 9 team single elimination bracket involves several key steps:

- Gather the names of all participating teams.

- Determine the match schedule, including which teams will face each other in the first round.

- Fill in the bracket with the team names, ensuring to leave space for match results.

- Conduct the matches and record the winners in the appropriate slots.

- Continue this process until the final match is played and a winner is declared.

Legal Use of the 9 Team Single Elimination Bracket

When organizing a tournament using the 9 team single elimination bracket, it is essential to ensure compliance with local regulations. This includes obtaining any necessary permits and adhering to safety guidelines. Additionally, if the tournament involves entry fees or prizes, it may be subject to specific legal requirements. Consulting with legal professionals can help clarify these obligations and ensure a smooth event.

Key Elements of the 9 Team Single Elimination Bracket

The key elements of a 9 team single elimination bracket include:

- Match Structure: Clearly defined match pairings and progression.

- Bye Rounds: A mechanism to accommodate the odd number of teams.

- Results Tracking: A system for recording match outcomes and advancing teams.

- Clear Rules: Guidelines that outline tournament procedures and eligibility.

Examples of Using the 9 Team Single Elimination Bracket

Examples of the 9 team single elimination bracket can be found in various competitive settings, such as:

- Local sports leagues organizing playoff tournaments.

- Esports competitions where teams face off in knockout rounds.

- Community events, such as trivia nights or game tournaments.

Quick guide on how to complete 9 teams double elimination form

Discover how to effortlessly navigate the 9 Team Double Elimination Bracket implementation with this simple guide

Electronic filing and certification of documents through the internet is gaining popularity and becoming the preferred choice for numerous clients. It offers various advantages over conventional printed materials, such as convenience, time savings, enhanced accuracy, and improved security.

With tools like airSlate SignNow, you can find, modify, sign, and send your 9 Team Double Elimination Bracket without the hassle of endless printing and scanning. Follow this brief guide to initiate and complete your form.

Follow these steps to retrieve and complete 9 Team Double Elimination Bracket

- Begin by clicking the Get Form button to access your form in our editor.

- Pay attention to the green label on the left indicating required fields to ensure you don’t miss any.

- Utilize our advanced features to annotate, modify, endorse, secure, and enhance your form.

- Protect your document or convert it into a fillable format using the options in the right panel.

- Review the form thoroughly to identify any errors or inconsistencies.

- Select DONE to conclude your editing.

- Rename your form or keep the original title.

- Select the storage option you prefer for your form, send it via USPS, or click the Download Now button to save your document.

If 9 Team Double Elimination Bracket does not meet your needs, you can explore our comprehensive collection of pre-loaded forms that require minimal effort to complete. Experience our platform today!

Create this form in 5 minutes or less

FAQs

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

Why did my employer give me a W-9 Form to fill out instead of a W-4 Form?

I wrote about the independent-contractor-vs-employee issue last year, see http://nctaxpro.wordpress.com/20...Broadly speaking, you are an employee when someone else - AKA the employer - has control over when and where you work and the processes by which you perform the work that you do for that individual. A DJ or bartender under some circumstances, I suppose, might qualify as an independent contractor at a restaurant, but the waitstaff, bus help, hosts, kitchen aides, etc. almost certainly would not.There's always risk in confronting an employer when faced with a situation like yours - my experience is that most employers know full well that they are violating the law when they treat employees as independent contractors, and for that reason they don't tolerate questions about that policy very well - so you definitely should tread cautiously if you want to keep this position. Nonetheless, I think you owe it to yourself to ask whether or not the restaurant intends to withhold federal taxes from your checks - if for no other reason than you don't want to get caught short when it comes to filing your own return, even if you don't intend to challenge the policy.

-

I received my late husband's W-9 form to fill out for what I believe were our stocks. How am I supposed to fill this out or am I even supposed to?

You do not sound as a person who handles intricasies of finances on daily basis, this is why you should redirect the qustion to your family’s tax professional who does hte filings for you.The form itself, W-9 form, is a form created and approved by the IRS, if that’s your only inquiry.Whether the form applies to you or to your husband’s estate - that’s something only a person familiar with the situation would tell you about; there is no generic answer to this.

-

Why does my property management ask me to fill out a W-9 form?

To collect data on you in case they want to sue you and enforce a judgment.If the management co is required to pay inerest on security deposits then they need to account to ou for that interest income.If you are in a coop or condo they may apportion tax benefits or capital costs to you for tax purposes.

-

Do I need to fill out Form W-9 (US non-resident alien with an LLC in the US)?

A single-member LLC is by default a disregarded entity. Assuming you have not made a “check-the-box” election to have it treated as a corporation, this means for tax purposes, you are a sole proprietor.As a non-resident alien, you would not complete form W-9. You would likely provide form W-8ECI; possibly W-8BEN.

Create this form in 5 minutes!

How to create an eSignature for the 9 teams double elimination form

How to create an eSignature for the 9 Teams Double Elimination Form in the online mode

How to create an eSignature for your 9 Teams Double Elimination Form in Google Chrome

How to make an electronic signature for signing the 9 Teams Double Elimination Form in Gmail

How to generate an electronic signature for the 9 Teams Double Elimination Form straight from your smart phone

How to make an electronic signature for the 9 Teams Double Elimination Form on iOS

How to make an electronic signature for the 9 Teams Double Elimination Form on Android devices

People also ask

-

What is a 9 Team Double Elimination Bracket?

A 9 Team Double Elimination Bracket is a tournament format that allows teams to compete in a way that ensures each team has at least two chances before being eliminated. This structure is ideal for ensuring fair play and maximizing participation among teams. Utilizing a 9 Team Double Elimination Bracket can lead to more exciting matches and a better overall experience for both players and fans.

-

How can I create a 9 Team Double Elimination Bracket using airSlate SignNow?

Creating a 9 Team Double Elimination Bracket with airSlate SignNow is simple and efficient. Our platform allows you to design, share, and manage your tournament brackets digitally, ensuring that all teams are informed and engaged. With user-friendly templates and eSigning options, you can streamline the organization of your tournament.

-

What are the benefits of using a 9 Team Double Elimination Bracket in my tournament?

Using a 9 Team Double Elimination Bracket offers several benefits, including increased engagement and the chance for teams to recover from early losses. This format maintains excitement through multiple rounds and allows more teams to showcase their skills. Additionally, it can help in building a stronger community around your tournament.

-

Are there any templates available for a 9 Team Double Elimination Bracket?

Yes, airSlate SignNow provides easy-to-use templates for creating a 9 Team Double Elimination Bracket. These templates are customizable, allowing you to add your tournament details and branding. You can quickly adapt them to suit your needs and share them with participants.

-

Can I integrate airSlate SignNow with other tools to manage my 9 Team Double Elimination Bracket?

Absolutely! airSlate SignNow integrates seamlessly with various tools and platforms to help you manage your 9 Team Double Elimination Bracket more effectively. Whether you are using scheduling software or communication apps, our integrations ensure that you can coordinate your tournament with ease.

-

What is the pricing model for using airSlate SignNow for a 9 Team Double Elimination Bracket?

airSlate SignNow offers a cost-effective pricing model that caters to different needs, whether you're an individual organizer or part of a larger organization. You can choose from various plans that provide access to all necessary features to manage your 9 Team Double Elimination Bracket efficiently. Check our website for the most current pricing details.

-

Is airSlate SignNow user-friendly for creating a 9 Team Double Elimination Bracket?

Yes, airSlate SignNow is designed to be user-friendly, making it easy for anyone to create a 9 Team Double Elimination Bracket. With intuitive navigation and clear instructions, even those new to tournament organization can quickly set up and manage their brackets. Our platform simplifies the process, so you can focus more on the tournament itself.

Get more for 9 Team Double Elimination Bracket

Find out other 9 Team Double Elimination Bracket

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure