The ASSAM VALUE ADDED TAX RULES, FORM 63 See

What is the Assam Value Added Tax Rules, Form 63 See

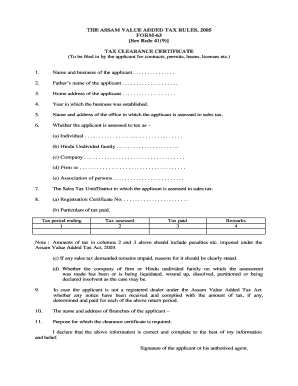

The Assam Value Added Tax Rules, Form 63 See is a specific document used in the context of value-added tax (VAT) compliance within the state of Assam, India. This form is essential for businesses operating in Assam as it outlines the necessary details related to VAT transactions. It serves as a formal declaration of sales and purchases, ensuring that businesses adhere to the tax regulations set forth by the state government. Understanding this form is crucial for maintaining compliance and avoiding penalties associated with VAT obligations.

Steps to complete the Assam Value Added Tax Rules, Form 63 See

Completing the Assam Value Added Tax Rules, Form 63 See involves several key steps to ensure accuracy and compliance. First, gather all necessary financial records, including sales invoices and purchase receipts. Next, accurately fill in the required fields on the form, which typically include details such as the taxpayer's identification number, transaction dates, and amounts. It is also important to double-check the calculations to ensure that the VAT amounts are correctly computed. Once completed, the form should be submitted to the appropriate tax authority, either electronically or via mail, depending on the submission guidelines provided by the state.

How to obtain the Assam Value Added Tax Rules, Form 63 See

Obtaining the Assam Value Added Tax Rules, Form 63 See can be done through several channels. The form is generally available on the official website of the Assam government’s tax department. Additionally, businesses may request the form directly from local tax offices or through authorized tax consultants. It is advisable to ensure that the most recent version of the form is being used to comply with current regulations.

Legal use of the Assam Value Added Tax Rules, Form 63 See

The legal use of the Assam Value Added Tax Rules, Form 63 See is critical for businesses to ensure compliance with state tax laws. This form must be completed accurately and submitted within the specified deadlines to avoid penalties. The information provided in the form is used by tax authorities to assess VAT liabilities and ensure that businesses are fulfilling their tax obligations. Failure to properly use this form can result in legal repercussions, including fines and audits.

Key elements of the Assam Value Added Tax Rules, Form 63 See

Key elements of the Assam Value Added Tax Rules, Form 63 See include the taxpayer’s identification details, transaction descriptions, and the corresponding VAT amounts. Additionally, the form may require information on the nature of goods sold or services rendered, as well as the applicable tax rates. Accurate completion of these elements is essential for the form to be considered valid and for tax compliance to be maintained.

Form Submission Methods (Online / Mail / In-Person)

The Assam Value Added Tax Rules, Form 63 See can be submitted through various methods to accommodate different business needs. Businesses may choose to submit the form online via the Assam government’s tax portal, which often provides a streamlined process. Alternatively, the form can be mailed to the appropriate tax office, ensuring that it is sent well before any deadlines. In-person submissions may also be possible at local tax offices, allowing for direct interaction with tax officials if clarification or assistance is needed.

Quick guide on how to complete the assam value added tax rules form 63 see

Effortlessly Manage THE ASSAM VALUE ADDED TAX RULES, FORM 63 See on Any Device

Digital document management has become increasingly favored by companies and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to generate, modify, and electronically sign your documents promptly without delays. Manage THE ASSAM VALUE ADDED TAX RULES, FORM 63 See on any device with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to Modify and Electronically Sign THE ASSAM VALUE ADDED TAX RULES, FORM 63 See with Ease

- Obtain THE ASSAM VALUE ADDED TAX RULES, FORM 63 See and select Get Form to begin.

- Utilize the tools available to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your updates.

- Choose your method of sending the form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns of lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Update and electronically sign THE ASSAM VALUE ADDED TAX RULES, FORM 63 See and guarantee excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the the assam value added tax rules form 63 see

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are THE ASSAM VALUE ADDED TAX RULES, FORM 63 See?

THE ASSAM VALUE ADDED TAX RULES, FORM 63 See is a regulatory framework that outlines the procedures and requirements for businesses to comply with VAT regulations in Assam. This form is essential for accurate tax reporting and helps ensure compliance with local tax laws, making it crucial for businesses operating in the region.

-

How can airSlate SignNow assist in managing THE ASSAM VALUE ADDED TAX RULES, FORM 63 See?

airSlate SignNow provides a streamlined platform for sending and eSigning documents related to THE ASSAM VALUE ADDED TAX RULES, FORM 63 See. By utilizing our easy-to-use solution, businesses can efficiently manage their documentation processes, reducing the time spent on VAT compliance and ensuring accuracy in submissions.

-

What are the pricing options for using airSlate SignNow in relation to THE ASSAM VALUE ADDED TAX RULES, FORM 63 See?

airSlate SignNow offers flexible pricing plans that cater to various business needs while ensuring compliance with THE ASSAM VALUE ADDED TAX RULES, FORM 63 See. Our cost-effective solutions include features that enhance document management, making our platform accessible for businesses of all sizes.

-

Can I integrate airSlate SignNow with existing accounting software for managing THE ASSAM VALUE ADDED TAX RULES, FORM 63 See?

Yes, airSlate SignNow supports integrations with various accounting software that facilitate the management of THE ASSAM VALUE ADDED TAX RULES, FORM 63 See. This integration allows businesses to seamlessly combine their document signing processes with accounting, ensuring comprehensive financial management.

-

What benefits does airSlate SignNow offer for businesses concerned about THE ASSAM VALUE ADDED TAX RULES, FORM 63 See?

Using airSlate SignNow helps businesses save time and reduce errors when handling THE ASSAM VALUE ADDED TAX RULES, FORM 63 See. Our platform automates the document signing process, enabling faster turnaround times and improving compliance with VAT regulations, ultimately enhancing operational efficiency.

-

Is airSlate SignNow suitable for businesses of all sizes dealing with THE ASSAM VALUE ADDED TAX RULES, FORM 63 See?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes that need to comply with THE ASSAM VALUE ADDED TAX RULES, FORM 63 See. Our scalable solutions ensure that small startups and large enterprises alike can benefit from our document management and eSigning capabilities.

-

How secure is airSlate SignNow when handling documents related to THE ASSAM VALUE ADDED TAX RULES, FORM 63 See?

airSlate SignNow prioritizes the security of your documents, including those related to THE ASSAM VALUE ADDED TAX RULES, FORM 63 See. Our platform employs advanced encryption and security protocols to protect sensitive information, ensuring that all transactions and document flows are safe and compliant.

Get more for THE ASSAM VALUE ADDED TAX RULES, FORM 63 See

- Prometric renewal form michigan

- Anthem prescription drug prior authorization request form for missouri

- Minnesota uniform credentialing application 2005

- Mississippi medicaid age bind disable application form

- Rn examination application form

- Pearl carroll disability insurance 2012 form

- Printable physical examination form 2014

- Application copy form

Find out other THE ASSAM VALUE ADDED TAX RULES, FORM 63 See

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free

- Help Me With eSign Nevada Software Development Agreement Template

- eSign Arkansas IT Consulting Agreement Computer

- How To eSignature Connecticut Living Will

- eSign Alaska Web Hosting Agreement Computer

- eSign Alaska Web Hosting Agreement Now

- eSign Colorado Web Hosting Agreement Simple

- How Do I eSign Colorado Joint Venture Agreement Template

- How To eSign Louisiana Joint Venture Agreement Template