Motion to Withdraw Motion 2007-2026

What is the motion to withdraw as counsel?

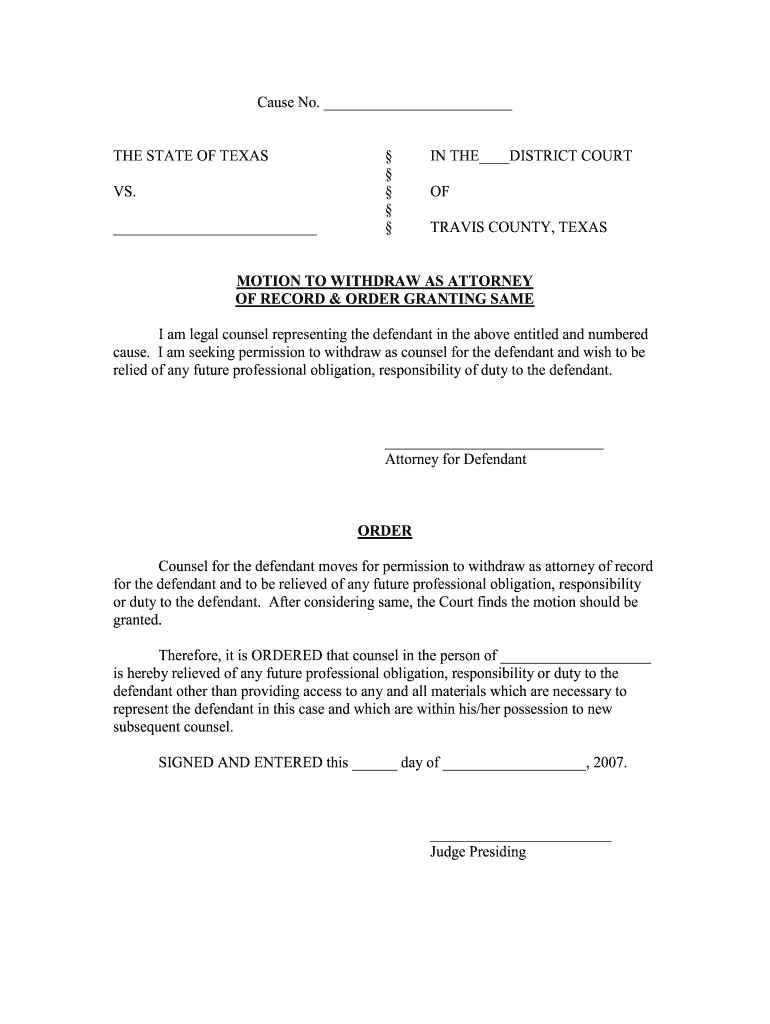

The motion to withdraw as counsel is a formal request made by an attorney to the court, seeking permission to discontinue representation of a client. This motion is often necessary when an attorney can no longer effectively represent the client due to various reasons, such as a breakdown in communication, ethical conflicts, or the client's failure to comply with legal obligations. In Texas, this motion must adhere to specific legal standards and procedures to be considered valid by the court.

Steps to complete the motion to withdraw as counsel

Completing the motion to withdraw as counsel involves several key steps:

- Gather necessary information about the case, including the client's name, case number, and relevant details.

- Clearly state the reasons for withdrawal in the motion, ensuring they comply with ethical guidelines.

- Include any required supporting documents, such as notices to the client or proof of communication.

- Review the motion for accuracy and completeness before submission.

- File the motion with the appropriate court and serve it to the client and any other involved parties.

Legal use of the motion to withdraw as counsel

In Texas, the legal use of the motion to withdraw as counsel is governed by the Texas Rules of Civil Procedure and the Texas Disciplinary Rules of Professional Conduct. Attorneys must ensure that their reasons for withdrawal are valid and do not adversely affect the client's interests. Common legal grounds for withdrawal include a conflict of interest, non-payment of fees, or the client's engagement in illegal activities. It is essential to follow the proper legal protocol to avoid potential penalties or complications.

State-specific rules for the motion to withdraw as counsel

Each state has its own rules regarding the motion to withdraw as counsel. In Texas, attorneys must comply with Rule 10 of the Texas Rules of Civil Procedure, which outlines the requirements for withdrawal. This includes providing adequate notice to the client and ensuring that the withdrawal does not prejudice the client's case. Additionally, attorneys must file a motion with the court and may need to attend a hearing, depending on the circumstances of the withdrawal.

Examples of using the motion to withdraw as counsel

Examples of situations where an attorney may file a motion to withdraw as counsel include:

- The client fails to pay legal fees after multiple reminders.

- There is a significant breakdown in communication between the attorney and the client.

- The attorney discovers a conflict of interest that was not initially apparent.

- The client insists on pursuing a course of action that the attorney believes is unethical or illegal.

Form submission methods for the motion to withdraw as counsel

The motion to withdraw as counsel can typically be submitted through various methods, depending on the court's requirements. In Texas, attorneys may file the motion online through the court's electronic filing system, submit it by mail, or deliver it in person. It is crucial to check the specific filing guidelines for the court handling the case to ensure compliance with submission protocols.

Quick guide on how to complete motion to withdraw as counsel sample form

Effortlessly finalize and submit your Motion To Withdraw Motion

Comprehensive resources for digital document interchange and approval are crucial for optimizing processes and the consistent growth of your forms. When handling legal documents and endorsing a Motion To Withdraw Motion, the right signing solution can conserve signNow time and reduce paper usage with every submission.

Locate, complete, modify, endorse, and distribute your legal documents with airSlate SignNow. This platform features everything necessary to create efficient paper submission workflows. Its vast library of legal forms and user-friendly interface will assist you in promptly locating your Motion To Withdraw Motion, while the editing tool equipped with our signature functionality will enable you to complete and authorize it right away.

Endorse your Motion To Withdraw Motion in a few straightforward steps

- Access the Motion To Withdraw Motion you require in our library through search or catalog options.

- Examine the form details and preview it to verify it meets your requirements and local regulations.

- Select Get form to proceed to editing.

- Complete the form using the extensive toolbar.

- Verify the information you entered and click the Sign option to validate your document.

- Choose from three methods to affix your signature.

- Finalize the modifications, save the document to your files, and then download it to your device or share it right away.

Simplify each phase of your document preparation and authorization with airSlate SignNow. Explore a more streamlined online solution that has considered all aspects of managing your documents.

Create this form in 5 minutes or less

FAQs

-

I need help filling out this IRA form to withdraw money. How do I fill this out?

I am confused on the highlighted part.

-

Is it necessary to fill out form 15G to withdraw PF?

Greeting !!!Below are basic details for Form 15G or form 15HForm 15G or form 15H is submitted to request income provider for not deducting TDS for prescribed income. In that form, declaration maker declares that his estimated taxable income for the same year is Nil.If you fulfill following conditions, submit form 15G / form 15H:1. Your estimated tax liability for the current year is NIL and2. Your interest for financial year does not exceed basic exemption limit + relief under section 87A.Only resident Indian can submit form 15G / form 15H. NRI cannot submit those forms. Also note that individual and person can submit form 15G/ H and company and firm cannot submit those forms. However, AOP and HUF can submit those forms.Consequences of wrongly submitting form 15G or form 15H:If your estimated income from all the sources is more than thebasic exemption limit ( + relief under section 87A if applicable), don’t submitform 15G or form 15H to income provider. Wrongly submission of form 15G / form15H will attract section 277 of income tax act.Be Peaceful !!!

-

How do you prove ineffective counsel in a motion to withdraw a criminal plea deal?

It is very difficult. To succeed you have to prove a two part test: (1) that your lawyer gave you advice or services that fell below what should be expected of an average lawyer in that jurisdiction; and (2) that had your lawyer provided adequate representation the matter would have probably turned out more favorably for you.This is an extremely tough standard to meet. Proving the first prong is hard, because judges usually ask criminal litigants if they have any complaints about their lawyers before accepting plea bargains. With a transcript of the litigant swearing under oath he is happy with his lawyer, it is very tough for him to come back later and successfully argue that his lawyer’s performance was deficient. Further, even if you can get past prong (1), satisfying prong (2) basically requires proof that you are factually innocent of the crime.I have seen it done successfully before, but only under rare extenuating circumstances.

-

To withdraw PF, how to fill form 15G? Specifically the field numbered "23"

Greeting …I will explain PART 1 of form 15G point wise.Name : write name as per pan card.PAN : write your PAN number.Assessment year: For current year , it is assessment year 2016-17. Don’t make mistake in writing it. It is next to the current financial year. ( No matter about your year of PF withdrawal, assessment year is 2016-17 because you are submitting form for current year ( 2015-16’s estimated income)Flat/ Door/ Block no. : Current Address details .Name of premises: Current Address details.Status : Individual/ HUF/ AOP as applicability to you.Assessed in which ward circle : Details about your income tax ward you were assessed last time. You can know your income tax ward and circle from this link- know your juridictional AO. Just enter your PAN no. and you can find the details.Road : current address details.Area : current address details.AO code : write as per link provided in point 7.Town : current address.State : Current state.PIN : pin code number.Last assessed year in which assessed : Last year generally if you were assessed in last year. 2015-16EmailTelephone NO.Present ward circle : Same if no change after issue of pan card. ( as per point 7)Residential status: Resident.Name of business/ occupation : Your business or job details.Present AO code : as per point 7 if no change in ward/ circle of income tax.Juridictional chief commissioner of income tax ( if not assessed of income tax earlier) : leave it blank.Estimated total income: You are required to enter estimated total income of current year. Do sum of the total income from all sources and tick the relevant boxes.The amount should be from following sources: Interest on securities , Interest on sum other than securities ( interest on FD etc.), Interest on mutual fund units., withdrawals of NSC.Dividend on shares,Estimated total income of the current year should be entered. The income mentioned in column 22 should be included in it .PF income ( if taxable) and other income (business, salary etc.). The amount is taxable income means total income less deductions available.In this column, you are required to give details of investment you have made. For different form of investment different schedules are given.Be Peaceful !!!

-

Is it necessary to fill out Form 15G/Form 15H if my service is less than 5 years? I need to withdraw the amount.

Purposes for which Form 15G or Form 15H can be submitted. While these forms can be submitted to banks to make sure TDS is not deducted on interest, there a few other places too where you can submit them. TDS on EPF withdrawal – TDS is deducted on EPF balances if withdrawn before 5 years of continuous service.

Create this form in 5 minutes!

How to create an eSignature for the motion to withdraw as counsel sample form

How to create an electronic signature for your Motion To Withdraw As Counsel Sample Form online

How to make an electronic signature for the Motion To Withdraw As Counsel Sample Form in Chrome

How to generate an electronic signature for signing the Motion To Withdraw As Counsel Sample Form in Gmail

How to make an electronic signature for the Motion To Withdraw As Counsel Sample Form straight from your mobile device

How to make an electronic signature for the Motion To Withdraw As Counsel Sample Form on iOS devices

How to create an electronic signature for the Motion To Withdraw As Counsel Sample Form on Android

People also ask

-

What is a motion to withdraw as counsel in Texas?

A motion to withdraw as counsel in Texas is a formal request submitted to the court by an attorney wishing to withdraw from representing a client. This document is essential in maintaining proper legal procedures and can often be completed using a motion to withdraw as counsel Texas PDF template.

-

How can I create a motion to withdraw as counsel Texas PDF?

You can create a motion to withdraw as counsel Texas PDF using airSlate SignNow's user-friendly document editor. By utilizing our templates, you can easily fill in the necessary details and convert them into a PDF format ready for submission to the court.

-

What features does airSlate SignNow offer for handling legal documents?

AirSlate SignNow provides powerful features such as electronic signatures, document templates, and automated workflows that simplify the process of preparing legal documents like the motion to withdraw as counsel Texas PDF. Our platform ensures compliance and security at every step.

-

Is airSlate SignNow cost-effective for small law firms?

Yes, airSlate SignNow is a cost-effective solution for small law firms looking to manage their legal documents efficiently. With customizable pricing plans, it allows firms to streamline processes like creating a motion to withdraw as counsel Texas PDF without breaking the bank.

-

Can I get support for legal document preparation from airSlate SignNow?

Absolutely! AirSlate SignNow offers robust customer support to assist users in preparing their legal documents, including guidance on how to draft a motion to withdraw as counsel Texas PDF properly. Our team is available to help you with any inquiries.

-

Does airSlate SignNow integrate with other applications?

Yes, airSlate SignNow seamlessly integrates with various applications including Google Drive and Dropbox, making it easy to manage all your legal documents in one place. You can effortlessly upload your motion to withdraw as counsel Texas PDF for quick access and sharing.

-

What are the benefits of using airSlate SignNow for legal documents?

Using airSlate SignNow for legal documents brings numerous benefits such as increased efficiency, enhanced security, and superior compliance. Our platform ensures that your motion to withdraw as counsel Texas PDF is handled with the utmost care while providing ease of use.

Get more for Motion To Withdraw Motion

Find out other Motion To Withdraw Motion

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter