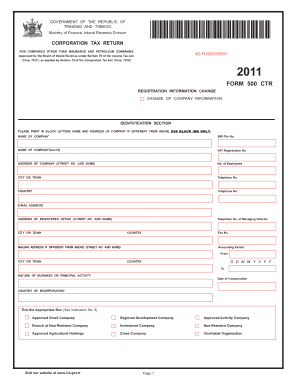

Form 500 Ctr

What is the Form 500 CTR?

The Form 500 CTR is a specific document used for reporting certain transactions to the Internal Revenue Service (IRS). This form is essential for compliance with federal tax regulations, particularly for businesses and individuals engaged in activities that trigger reporting requirements. Understanding the purpose and requirements of the Form 500 CTR is crucial for ensuring accurate reporting and avoiding potential penalties.

How to use the Form 500 CTR

Using the Form 500 CTR involves several key steps. First, gather all necessary information related to the transactions that need to be reported. This includes details such as the date of the transaction, the parties involved, and the amounts exchanged. Next, accurately fill out the form, ensuring that all information is complete and correct. After completing the form, it should be submitted according to the specified guidelines, either online or via mail, depending on the requirements set by the IRS.

Steps to complete the Form 500 CTR

Completing the Form 500 CTR requires careful attention to detail. Here are the steps to follow:

- Gather all relevant transaction information.

- Obtain the latest version of the Form 500 CTR from the IRS website or authorized sources.

- Fill in the required fields, including your name, address, and the details of the transactions.

- Review the form for accuracy and completeness.

- Submit the form according to the IRS guidelines, ensuring it is sent by the deadline.

Legal use of the Form 500 CTR

The legal use of the Form 500 CTR is governed by IRS regulations. It is important to ensure that the form is filled out correctly and submitted on time to avoid any legal repercussions. Failure to comply with the reporting requirements can lead to penalties, including fines or additional scrutiny from tax authorities. Therefore, understanding the legal implications and adhering to the guidelines is essential for all users of the Form 500 CTR.

Filing Deadlines / Important Dates

Filing deadlines for the Form 500 CTR are critical to ensure compliance with IRS regulations. Typically, the form must be submitted by a specific date each year, which may vary based on the type of transaction being reported. It is advisable to check the IRS guidelines for the exact deadlines applicable to your situation. Keeping track of these dates helps avoid late filing penalties and ensures that all required information is reported in a timely manner.

Form Submission Methods (Online / Mail / In-Person)

The Form 500 CTR can be submitted through various methods, depending on the preferences of the filer and the requirements set by the IRS. Common submission methods include:

- Online submission through the IRS e-filing system.

- Mailing a paper copy of the form to the designated IRS address.

- In-person submission at local IRS offices, if applicable.

Choosing the right method can streamline the filing process and ensure that the form is received on time.

Quick guide on how to complete form 500 ctr

Effortlessly Prepare Form 500 Ctr on Any Device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Manage Form 500 Ctr on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Modify and eSign Form 500 Ctr with Ease

- Find Form 500 Ctr and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which only takes seconds and holds the same legal authority as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred delivery method for your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your preferred device. Edit and eSign Form 500 Ctr and guarantee effective communication at every step of your form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 500 ctr

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Trinidad Form 500CTR 2018?

The Trinidad Form 500CTR 2018 is a tax form used by businesses in Trinidad to report certain financial transactions. It is crucial for maintaining compliance with taxation laws and ensuring proper documentation of financial activities.

-

How can airSlate SignNow help with the Trinidad Form 500CTR 2018?

airSlate SignNow provides an efficient way to eSign and send documents like the Trinidad Form 500CTR 2018. Our platform simplifies the signing process, making it easier for businesses to complete and submit this important tax document quickly and efficiently.

-

What features does airSlate SignNow offer for the Trinidad Form 500CTR 2018?

With airSlate SignNow, you can easily create, edit, and eSign the Trinidad Form 500CTR 2018. Our features include templates, real-time collaboration, and automated workflows, all designed to streamline the process of handling tax forms.

-

Is airSlate SignNow a cost-effective solution for managing the Trinidad Form 500CTR 2018?

Yes, airSlate SignNow is a cost-effective solution for managing the Trinidad Form 500CTR 2018. Our competitive pricing plans ensure that businesses of all sizes can afford our services while still gaining access to essential eSigning features.

-

Can I integrate airSlate SignNow with other tools to manage the Trinidad Form 500CTR 2018?

Absolutely! airSlate SignNow offers a variety of integrations with popular business applications. This allows you to seamlessly manage your workflow, ensuring that the Trinidad Form 500CTR 2018 is effortlessly incorporated into your existing systems.

-

What are the benefits of using airSlate SignNow for the Trinidad Form 500CTR 2018?

Using airSlate SignNow for the Trinidad Form 500CTR 2018 enhances efficiency and accuracy in document management. The platform reduces processing time, minimizes errors, and boosts overall productivity by ensuring smooth eSigning and document workflows.

-

Is it easy to use airSlate SignNow for the Trinidad Form 500CTR 2018?

Yes, airSlate SignNow is designed for ease of use. The intuitive interface allows users to easily navigate the platform, making it simple to find, fill, and eSign the Trinidad Form 500CTR 2018 without any technical expertise.

Get more for Form 500 Ctr

- Ruminant submission formpdf purdue university

- Behavioral health services telephone 1 800 454 3730fax 1 800 505 1193 form

- Psychological testing providers amerigroup form

- Workshops seminars and parenting classesor family to form

- Surgical pathologybiopsy form

- Cf925 new client information form

- Companyemployer contact information and occupational

- Patient information from another organization

Find out other Form 500 Ctr

- Sign Wisconsin Insurance Living Will Now

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement