Form 3555 California

What is the Form 3555 California

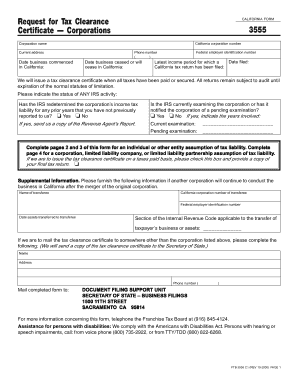

The Form 3555 California is a document used primarily for tax purposes, specifically related to the California state tax system. This form is essential for individuals and businesses to report various types of income and calculate their tax liabilities accurately. It is designed to ensure compliance with California tax laws and regulations, making it a crucial part of the tax filing process for residents and entities operating within the state.

How to use the Form 3555 California

Using the Form 3555 California involves filling out the required sections accurately to reflect your financial situation. Taxpayers should gather all necessary financial documents, such as income statements and deductions, before starting. The form typically includes sections for reporting income, deductions, and credits. Once completed, it can be submitted electronically or via mail, depending on the preferences of the taxpayer and the requirements set forth by the California tax authority.

Steps to complete the Form 3555 California

Completing the Form 3555 California involves several key steps:

- Gather all relevant financial documents, including W-2s, 1099s, and receipts for deductions.

- Begin filling out the form by entering personal information, including your name, address, and Social Security number.

- Report your income accurately in the designated sections, ensuring that all sources of income are included.

- Detail any deductions or credits you are eligible for, as these can significantly impact your tax liability.

- Review the completed form for accuracy before submitting it to ensure compliance with California tax laws.

Legal use of the Form 3555 California

The legal use of the Form 3555 California is governed by state tax laws, which require accurate reporting of income and adherence to deadlines. When filled out correctly, the form serves as a legal declaration of your financial status to the California tax authorities. It is crucial to ensure that all information is truthful and complete, as inaccuracies can lead to penalties or legal repercussions.

Key elements of the Form 3555 California

Key elements of the Form 3555 California include sections for personal identification, income reporting, deductions, and credits. Each section is designed to capture specific financial information that impacts your overall tax liability. Understanding these elements is vital for ensuring that the form is completed correctly and submitted on time.

Filing Deadlines / Important Dates

Filing deadlines for the Form 3555 California are typically aligned with the federal tax filing schedule. Taxpayers should be aware of the specific due dates, which can vary based on individual circumstances, such as whether an extension has been filed. It is essential to adhere to these deadlines to avoid penalties and interest on unpaid taxes.

Quick guide on how to complete form 3555 california

Complete Form 3555 California effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly without interruptions. Manage Form 3555 California on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Form 3555 California with ease

- Locate Form 3555 California and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which only takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you wish to deliver your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Alter and eSign Form 3555 California and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 3555 california

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 3555, and how is it used?

The form 3555 is a crucial document used by businesses for various customer-related transactions. It typically requires detailed information and signatures to ensure compliance and streamline processes. Using the form 3555 with airSlate SignNow allows you to eSign and send this document seamlessly.

-

How can I electronically sign form 3555 using airSlate SignNow?

You can easily eSign the form 3555 using airSlate SignNow's user-friendly interface. Just upload your document, add the necessary fields for signatures, and send it for signing. Our platform simplifies the signing process, making it quick and efficient.

-

What features does airSlate SignNow offer for managing form 3555?

airSlate SignNow offers various features for managing form 3555, including customizable templates, automatic reminders, and secure cloud storage. These tools help streamline your document workflow and ensure that you never miss a deadline for form 3555 submissions.

-

Can I track the status of my form 3555 once sent for eSignature?

Yes, with airSlate SignNow, you can track the status of your form 3555 at any stage. Our platform provides real-time notifications and updates, so you know when the document is viewed and signed. This feature enhances transparency and communication.

-

What are the pricing options for using airSlate SignNow with form 3555?

airSlate SignNow offers flexible pricing plans to accommodate various business needs when working with form 3555. You can choose from monthly or annual subscriptions, with no hidden fees. Our pricing is competitive, making it an affordable choice for businesses of any size.

-

Does airSlate SignNow integrate with other software for form 3555?

Absolutely! airSlate SignNow integrates seamlessly with a variety of software applications, allowing you to automate workflows related to form 3555. Popular integrations include CRM platforms and cloud storage solutions, enhancing your document management processes.

-

What security measures does airSlate SignNow implement for form 3555?

Security is a top priority for airSlate SignNow when handling form 3555. Our platform uses advanced encryption methods and complies with industry standards to protect your sensitive information. This ensures that your documents remain safe and confidential.

Get more for Form 3555 California

- Judicial nominating commission personal reference inquiry form

- Questionnaire valeur locative 2013 2016 2017 c est demain gech demain ge form

- Construction demand for arbitration american arbitration association form

- Wa 51 form

- Application for readmission hawaii pacific university hpu form

- Delegation of authority form 2958 treasury

- If your answer is no the attorney generals office civil rights unit will form

- Remplissable remplissable remplissable remplissable remplissable remplissable remplissable remplissable remplissable 405408965 form

Find out other Form 3555 California

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form

- Help Me With eSign Kansas Business Operations PPT

- How Can I eSign Mississippi Car Dealer Form

- Can I eSign Nebraska Car Dealer Document

- Help Me With eSign Ohio Car Dealer Document

- How To eSign Ohio Car Dealer Document

- How Do I eSign Oregon Car Dealer Document

- Can I eSign Oklahoma Car Dealer PDF

- How Can I eSign Oklahoma Car Dealer PPT

- Help Me With eSign South Carolina Car Dealer Document

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document