Formsf530026pdf

What is the Formsf530026pdf

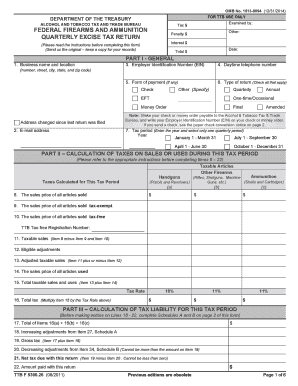

The Formsf530026pdf is a specific document used primarily for tax purposes in the United States. It is designed to collect essential information related to tax filings, ensuring that individuals and businesses comply with IRS regulations. This form may be required for various tax-related processes, including reporting income, claiming deductions, or providing necessary documentation for audits. Understanding the purpose and requirements of this form is crucial for accurate and timely tax submissions.

How to use the Formsf530026pdf

Using the Formsf530026pdf involves several key steps to ensure that all required information is accurately provided. First, gather all necessary documentation, such as income statements and previous tax returns, which will aid in completing the form. Next, fill out the form carefully, ensuring that all fields are completed as required. After filling it out, review the information for accuracy. Finally, submit the form according to the specified guidelines, whether online or via mail, depending on the instructions provided by the IRS.

Steps to complete the Formsf530026pdf

Completing the Formsf530026pdf can be straightforward if you follow these steps:

- Gather necessary documents, including income statements and tax identification numbers.

- Download the form from an official source to ensure you have the latest version.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide details regarding your income and deductions as required by the form.

- Double-check all entries for accuracy and completeness.

- Sign and date the form where indicated.

- Submit the form via the appropriate method as instructed by the IRS.

Legal use of the Formsf530026pdf

The legal use of the Formsf530026pdf hinges on its compliance with IRS regulations. When filled out correctly, this form serves as a legally binding document that can be used in tax filings. It is essential to ensure that all information is accurate and truthful, as discrepancies can lead to penalties or legal issues. The form must be submitted within the designated deadlines to maintain its legal validity.

Filing Deadlines / Important Dates

Filing deadlines for the Formsf530026pdf are critical to ensure compliance with tax regulations. Typically, individuals and businesses must submit their forms by April 15 for the previous tax year. However, extensions may be available under certain circumstances. It is important to keep track of these dates to avoid late fees and potential penalties. Always consult the IRS website or a tax professional for the most current deadlines.

Required Documents

To complete the Formsf530026pdf, several documents may be required, including:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Previous year’s tax return for reference

- Documentation for any deductions or credits claimed

Having these documents on hand will facilitate a smoother completion of the form and ensure that all necessary information is accurately reported.

Quick guide on how to complete formsf530026pdf

Prepare Formsf530026pdf effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents promptly without delays. Manage Formsf530026pdf on any device using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Formsf530026pdf with ease

- Locate Formsf530026pdf and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device of your choosing. Modify and eSign Formsf530026pdf and facilitate excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the formsf530026pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Formsf530026pdf and how does it work with airSlate SignNow?

Formsf530026pdf is a specific document format that can be easily managed using airSlate SignNow. With our platform, you can automate workflows, eSign documents, and send Formsf530026pdf files seamlessly. This ensures that your document management process is both efficient and compliant.

-

How much does it cost to use airSlate SignNow for Formsf530026pdf?

airSlate SignNow offers competitive pricing plans suitable for various business sizes. Our subscription includes full access to features related to Formsf530026pdf management, ensuring you get great value for your investment. Contact us for a customized quote based on your needs.

-

Can I integrate airSlate SignNow with other software for managing Formsf530026pdf?

Yes, airSlate SignNow provides robust integration options with various software platforms. This allows you to streamline processes involving Formsf530026pdf within your existing workflows, enhancing productivity and collaboration. Check our integrations page for more details.

-

What features does airSlate SignNow offer for Formsf530026pdf document management?

With airSlate SignNow, you can create, edit, and eSign Formsf530026pdf documents easily. Our platform includes features like templates, document sharing, and real-time tracking. These tools are designed to simplify the management of your Formsf530026pdf while maintaining security.

-

Is it easy to eSign Formsf530026pdf documents with airSlate SignNow?

Absolutely! airSlate SignNow makes eSigning Formsf530026pdf documents quick and straightforward. Users can sign documents digitally from any device, ensuring a hassle-free experience that accelerates the signing process.

-

What are the benefits of using airSlate SignNow for Formsf530026pdf?

Using airSlate SignNow for Formsf530026pdf offers numerous benefits, including improved efficiency and reduced paper waste. The digital signing process accelerates transactions while keeping all documents organized in one place. This not only saves time but also helps businesses maintain compliance.

-

Can I access my Formsf530026pdf documents on mobile devices with airSlate SignNow?

Yes, airSlate SignNow is fully optimized for mobile devices. This means you can access, eSign, and manage your Formsf530026pdf documents on the go, ensuring you never miss an important signing opportunity or document update.

Get more for Formsf530026pdf

Find out other Formsf530026pdf

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors