Letter of Credit Dbs Form

What is the Letter of Credit DBS

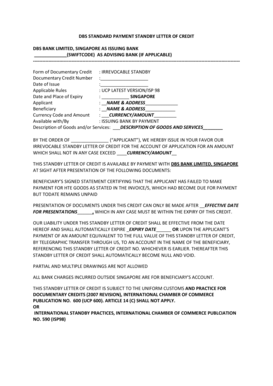

The Letter of Credit DBS is a financial instrument issued by a bank that guarantees payment to a seller on behalf of a buyer, provided that the seller meets specified conditions. This document is commonly used in international trade to mitigate risks associated with non-payment. It serves as a promise from the bank to pay the seller a specified amount upon presentation of required documents, such as shipping and insurance papers. Understanding the purpose and functionality of this letter is essential for businesses engaged in trade, as it helps facilitate transactions and build trust between parties.

How to Use the Letter of Credit DBS

Using the Letter of Credit DBS involves several steps that ensure both the buyer and seller fulfill their obligations. Initially, the buyer applies for the letter through their bank, providing necessary details about the transaction. Once issued, the seller must present specific documents to the bank, which may include invoices, shipping documents, and insurance certificates. The bank then verifies these documents against the terms outlined in the letter. If everything aligns, the bank releases the payment to the seller. This process not only protects the seller but also assures the buyer that payment will only be made when conditions are met.

Steps to Complete the Letter of Credit DBS

Completing the Letter of Credit DBS requires careful attention to detail. The following steps outline the process:

- Application: The buyer submits an application to their bank, detailing the transaction specifics.

- Issuance: The bank reviews the application and issues the Letter of Credit, which is sent to the seller's bank.

- Document Preparation: The seller prepares required documents as per the terms of the letter.

- Submission: The seller submits the documents to their bank for verification.

- Payment Release: Upon successful verification, the seller's bank forwards the documents to the buyer's bank, triggering payment.

Key Elements of the Letter of Credit DBS

Several key elements must be included in the Letter of Credit DBS to ensure its effectiveness:

- Parties Involved: Clearly identify the buyer, seller, and banks involved.

- Amount: Specify the exact monetary amount guaranteed by the letter.

- Expiration Date: Include a date by which the seller must present the required documents.

- Conditions: Outline the specific conditions that must be met for payment to be released.

- Document Requirements: List the documents the seller must provide to receive payment.

Legal Use of the Letter of Credit DBS

The legal use of the Letter of Credit DBS is governed by specific regulations and practices that ensure its validity. Under U.S. law, the letter must comply with the Uniform Commercial Code (UCC), which outlines the rights and obligations of parties involved in commercial transactions. Additionally, the letter should adhere to the International Chamber of Commerce (ICC) rules, particularly the Uniform Customs and Practice for Documentary Credits (UCP). Compliance with these legal frameworks not only legitimizes the document but also protects the interests of all parties involved.

Examples of Using the Letter of Credit DBS

Practical examples can illustrate how the Letter of Credit DBS functions in real-world scenarios:

- International Trade: A U.S. importer purchases goods from a manufacturer in Asia. The importer requests a Letter of Credit from their bank, ensuring the manufacturer receives payment upon shipment.

- Real Estate Transactions: A buyer uses a Letter of Credit to secure financing for a property purchase, providing assurance to the seller that funds are available.

Quick guide on how to complete letter of credit dbs

Finalize Letter Of Credit Dbs with ease on any device

Digital document management has become increasingly favored among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents quickly without any holdups. Handle Letter Of Credit Dbs on any device with the airSlate SignNow apps for Android or iOS and simplify any document-related process today.

How to modify and electronically sign Letter Of Credit Dbs effortlessly

- Obtain Letter Of Credit Dbs and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and holds the same legal significance as a traditional wet ink signature.

- Review the information and click the Done button to save your updates.

- Choose how you would like to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Shed the worries of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from your preferred device. Edit and electronically sign Letter Of Credit Dbs and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the letter of credit dbs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a representation letter to DBS?

A representation letter to DBS is a formal document that communicates specific information or requests to the Development Bank of Singapore. Knowing how to write a representation letter to DBS is crucial for ensuring your message is clear and concise, which can facilitate smoother communication and faster responses from the bank.

-

What features does airSlate SignNow offer for writing letters?

AirSlate SignNow offers various features that simplify the process of drafting letters, including templates and customizable fields. When learning how to write a representation letter to DBS, these tools ensure your letter adheres to professional standards while saving you time and effort.

-

How can airSlate SignNow help me in the eSigning process?

AirSlate SignNow streamlines the eSigning process, allowing you to quickly and securely sign documents online. This capability is especially beneficial when you need to know how to write a representation letter to DBS, as you can prepare and send the letter for eSignature without unnecessary delays.

-

Is there a cost associated with using airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans to fit different budgets and needs. When considering how to write a representation letter to DBS, the cost-effectiveness of our solution becomes apparent, as it allows you to manage your communications efficiently without breaking the bank.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! AirSlate SignNow integrates seamlessly with numerous applications such as CRM systems and document management platforms. This feature can simplify how to write a representation letter to DBS by enabling you to pull in necessary data directly from other tools, making the process smoother.

-

What are the benefits of using airSlate SignNow for businesses?

Using airSlate SignNow offers businesses enhanced efficiency, security, and professionalism in document handling. If you're looking to understand how to write a representation letter to DBS, leveraging our platform will help ensure your communications are not only effective but also well-organized and secure.

-

How user-friendly is the airSlate SignNow platform?

AirSlate SignNow is designed for ease of use, with an intuitive interface that allows users of any skill level to navigate the platform effortlessly. Whether you're learning how to write a representation letter to DBS or managing multiple documents, you'll find that our user-friendly design enhances your overall experience.

Get more for Letter Of Credit Dbs

Find out other Letter Of Credit Dbs

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors