D30 Form

What is the D30 Form

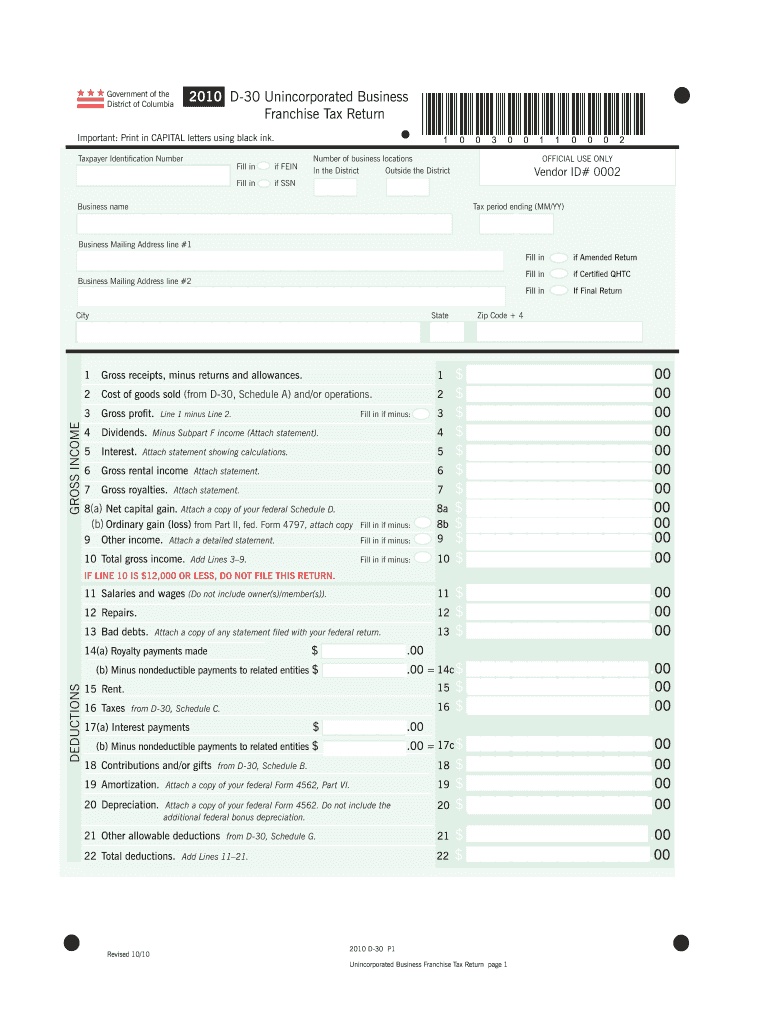

The D30 Form is a tax document used primarily by unincorporated businesses in Washington, D.C. It is designed to report income, deductions, and other relevant financial information to the Office of Tax and Revenue. This form is essential for businesses that operate without formal incorporation, such as sole proprietorships and partnerships. Completing the D30 Form accurately ensures compliance with local tax regulations and helps in determining the tax liability for the business.

How to use the D30 Form

Using the D30 Form involves several steps to ensure that all necessary information is reported correctly. First, gather all financial records, including income statements and expense receipts. Next, fill out the form with accurate data regarding your business operations, including gross income, allowable deductions, and any credits. It is important to review the completed form for accuracy before submission, as errors can lead to delays or penalties. Once finalized, the form can be submitted either online or via mail, depending on your preference.

Steps to complete the D30 Form

Completing the D30 Form requires careful attention to detail. Follow these steps to ensure proper completion:

- Gather all necessary documentation, including income records and expense receipts.

- Download the D30 Form from the official website or access it through your tax software.

- Fill out the form, starting with your business name and address.

- Report your gross income in the designated section.

- List all allowable deductions to reduce your taxable income.

- Calculate your tax liability based on the provided instructions.

- Review the completed form for accuracy and completeness.

- Submit the form by the deadline, either electronically or by mail.

Legal use of the D30 Form

The D30 Form is legally binding when completed and submitted in accordance with D.C. tax laws. It must be signed by the business owner or an authorized representative to validate the information provided. Digital signatures are accepted, provided they comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and other relevant regulations. Ensuring that the form is filled out correctly and submitted on time helps avoid potential legal issues and penalties associated with non-compliance.

Filing Deadlines / Important Dates

Filing deadlines for the D30 Form are crucial for maintaining compliance with tax regulations. Typically, the form is due on the fifteenth day of the fourth month following the end of the tax year. For businesses operating on a calendar year, this means the D30 Form is generally due by April 15. It is important to stay informed about any changes to deadlines, as local tax authorities may adjust them based on specific circumstances or events. Late submissions may incur penalties and interest on any taxes owed.

Required Documents

To complete the D30 Form accurately, certain documents are required. These include:

- Financial statements, including profit and loss statements.

- Receipts for business expenses that may be deductible.

- Previous tax returns, if applicable, for reference.

- Any relevant documentation supporting claimed credits or deductions.

Having these documents ready will facilitate a smoother completion process and help ensure that all necessary information is reported.

Quick guide on how to complete d30 form

Complete D30 Form effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed materials, allowing you to obtain the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage D30 Form on any platform using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

The easiest way to modify and eSign D30 Form effortlessly

- Locate D30 Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature with the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method to share your form, whether by email, text message (SMS), invitation link, or download it to your PC.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign D30 Form to ensure smooth communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the d30 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the dc form d30 and why is it important?

The dc form d30 is a crucial document for businesses operating in Washington, D.C., used to report specific tax information. It's important as it ensures compliance with local tax laws and helps avoid potential penalties. By utilizing airSlate SignNow, you can easily manage the eSignature process for your dc form d30.

-

How does airSlate SignNow facilitate the completion of the dc form d30?

airSlate SignNow allows users to electronically sign and send the dc form d30 with a simple and user-friendly interface. The platform streamlines the entire process, minimizing the time spent on paperwork and improving overall efficiency. With airSlate SignNow, your documents remain secure while being easily accessible.

-

What features does airSlate SignNow offer for managing the dc form d30?

airSlate SignNow provides features such as customizable templates, automated reminders, and secure cloud storage specifically designed for documents like the dc form d30. These features enhance the signing experience and ensure that your important forms are handled efficiently. Additionally, you can track the status of your documents in real-time.

-

Can I integrate airSlate SignNow with my existing workflow for the dc form d30?

Yes, airSlate SignNow offers various integrations with popular applications that can enhance your workflow involving the dc form d30. By connecting with tools you already use, such as CRM or accounting software, you can seamlessly manage your documents. This integration capability simplifies the signing and submission process.

-

What is the pricing structure for airSlate SignNow when handling the dc form d30?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses handling documents like the dc form d30. Pricing varies based on features and the number of users, ensuring that you can find the best fit for your organization. A free trial is also available to explore its capabilities before committing.

-

What are the benefits of using airSlate SignNow for the dc form d30?

Using airSlate SignNow for the dc form d30 brings numerous benefits, including improved efficiency, cost savings, and enhanced compliance with D.C. tax regulations. The platform simplifies document management and provides a secure environment for eSignatures. These advantages make it an ideal solution for businesses looking to streamline their operations.

-

Is airSlate SignNow compliant with legal requirements for the dc form d30?

Absolutely, airSlate SignNow is compliant with rigorous legal standards for electronic signatures, ensuring that your dc form d30 holds the same legal weight as a handwritten signature. This compliance assures users that their documents are valid and secure. Trust in airSlate SignNow to help you meet all legal obligations for your essential documents.

Get more for D30 Form

- Piaa form 2013

- Kaiser disabled dependent application per lacity form

- Aflac accidental injury claim form 2008 2019

- Humana dental claim form 2004

- Mutual of omaha formulary forms 2012

- Federal bcbs basic overseas claim form 2012

- Advocate physician partners appeal form

- Instructions dhs 1139h 0408 early and periodic screening diagosis and treatment epsdt skilled nursing and personal care form

Find out other D30 Form

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free

- How To eSignature Wyoming LLC Operating Agreement

- eSignature California Commercial Lease Agreement Template Myself

- eSignature California Commercial Lease Agreement Template Easy

- eSignature Florida Commercial Lease Agreement Template Easy

- eSignature Texas Roommate Contract Easy

- eSignature Arizona Sublease Agreement Template Free

- eSignature Georgia Sublease Agreement Template Online