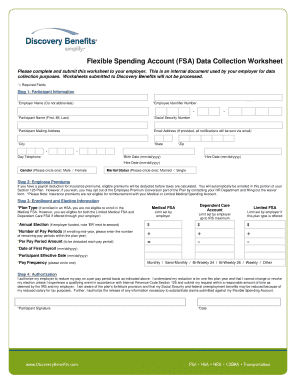

Flexible Spending Account FSA Data Collection Worksheet Benefits Form

What is the Flexible Spending Account FSA Data Collection Worksheet Benefits

The Flexible Spending Account (FSA) Data Collection Worksheet Benefits is a crucial document that helps individuals manage their healthcare and dependent care expenses. This worksheet allows employees to track eligible expenses, ensuring they maximize their FSA contributions. By organizing this information, users can effectively plan their spending and reimbursement requests throughout the year.

How to use the Flexible Spending Account FSA Data Collection Worksheet Benefits

Utilizing the FSA Data Collection Worksheet Benefits involves several straightforward steps. First, gather all relevant receipts and documentation for eligible expenses. Next, fill out the worksheet by entering each expense, including the date, amount, and a brief description. This organized approach simplifies the reimbursement process and ensures compliance with IRS regulations. Regularly updating the worksheet helps maintain accurate records and prevents overspending.

Steps to complete the Flexible Spending Account FSA Data Collection Worksheet Benefits

Completing the FSA Data Collection Worksheet Benefits involves a systematic approach. Start by listing all eligible expenses incurred during the plan year. For each entry, include the following details:

- Date: When the expense was incurred.

- Amount: The total cost of the expense.

- Description: A brief note on what the expense was for.

Once all expenses are documented, review the worksheet for accuracy. This ensures that all entries are valid and eligible for reimbursement under the FSA guidelines.

Legal use of the Flexible Spending Account FSA Data Collection Worksheet Benefits

The legal use of the FSA Data Collection Worksheet Benefits is governed by IRS regulations. To ensure compliance, it is essential to only include expenses that meet the eligibility criteria outlined by the IRS. This includes healthcare costs and dependent care expenses that qualify for reimbursement. Maintaining accurate records is vital, as improper claims can lead to penalties or denial of reimbursement requests.

IRS Guidelines

The IRS provides specific guidelines regarding the use of Flexible Spending Accounts. According to IRS regulations, expenses must be incurred during the plan year and must be for qualified medical or dependent care services. It is important to refer to IRS Publication 502 for healthcare expenses and Publication 503 for dependent care expenses to ensure compliance and maximize benefits.

Eligibility Criteria

Eligibility for using the FSA Data Collection Worksheet Benefits typically requires participation in an employer-sponsored FSA plan. Employees must enroll during the open enrollment period and may need to meet specific criteria set by their employer. Additionally, eligible expenses must align with IRS definitions to qualify for reimbursement, ensuring that participants can effectively utilize their FSA funds.

Quick guide on how to complete flexible spending account fsa data collection worksheet benefits

Finish Flexible Spending Account FSA Data Collection Worksheet Benefits seamlessly on any device

Web-based document management has become widely adopted by businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the right format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle Flexible Spending Account FSA Data Collection Worksheet Benefits on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign Flexible Spending Account FSA Data Collection Worksheet Benefits effortlessly

- Obtain Flexible Spending Account FSA Data Collection Worksheet Benefits and then click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and then click on the Done button to preserve your changes.

- Select your delivery method for the form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Leave behind concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Flexible Spending Account FSA Data Collection Worksheet Benefits and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the flexible spending account fsa data collection worksheet benefits

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Flexible Spending Account FSA Data Collection Worksheet Benefits?

The Flexible Spending Account FSA Data Collection Worksheet Benefits is a structured tool that helps you effectively organize and document your FSA claims. It ensures you capture all necessary expenses, maximizing your FSA reimbursements. This worksheet simplifies your claims process, providing clear guidance for users.

-

How can the Flexible Spending Account FSA Data Collection Worksheet Benefits improve my FSA management?

Using the Flexible Spending Account FSA Data Collection Worksheet Benefits allows for a streamlined approach to managing your FSA. By keeping your medical expenses organized and easily accessible, you can avoid missing out on potential savings. This tool enhances your FSA experience by increasing the accuracy of your claims.

-

Are there any costs associated with using the Flexible Spending Account FSA Data Collection Worksheet Benefits?

The Flexible Spending Account FSA Data Collection Worksheet Benefits is included as part of the airSlate SignNow service package, which offers competitive pricing. By using our easy-to-integrate solutions, you can enjoy comprehensive features without unexpected costs. We recommend reviewing our pricing plans to find the right fit for your business needs.

-

What features does the Flexible Spending Account FSA Data Collection Worksheet Benefits offer?

The Flexible Spending Account FSA Data Collection Worksheet Benefits includes essential features such as easy data entry, automatic calculations, and customizable templates. These elements help users manage their claims effectively. Moreover, the worksheet is designed to integrate smoothly with other airSlate SignNow tools, enhancing your overall document management experience.

-

Can the Flexible Spending Account FSA Data Collection Worksheet Benefits be integrated with other software?

Yes, the Flexible Spending Account FSA Data Collection Worksheet Benefits is designed to integrate seamlessly with various accounting and HR systems. This allows for easy data synchronization and enhances your workflow efficiency. Integration with existing tools ensures that users can maintain an organized approach to their FSA claims.

-

Who can benefit from the Flexible Spending Account FSA Data Collection Worksheet Benefits?

The Flexible Spending Account FSA Data Collection Worksheet Benefits is ideal for employees, HR departments, and businesses looking to streamline their FSA management. It provides assistance in documenting eligible expenses for all users, ensuring they maximize their benefits. Any organization offering an FSA can leverage this tool for improved clarity and efficiency.

-

How does the Flexible Spending Account FSA Data Collection Worksheet Benefits help with compliance?

Utilizing the Flexible Spending Account FSA Data Collection Worksheet Benefits helps maintain compliance by ensuring accurate documentation of eligible expenses. Keeping track of receipts and claims is essential for IRS guidelines. This worksheet simplifies the process, aiding users in demonstrating compliance with FSA requirements.

Get more for Flexible Spending Account FSA Data Collection Worksheet Benefits

- Group price sheet for boulders dinner theatre seating goozmo form

- Blank california birth certificate template 2017 2019 form

- Es 3100 1 2013 2019 form

- Kansas certificate of immunizations kdhe form

- New revised louisiana central registry form 2013 2019

- Lcr 1034a criminal history self disclosure form

- Cr 143 2017 2019 form

- Forms to fill for the court marriage 2019

Find out other Flexible Spending Account FSA Data Collection Worksheet Benefits

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document