MO PTC Property Tax Credit Claim Missouri Department of Revenue Dor Mo Form

What is the MO PTC Property Tax Credit Claim?

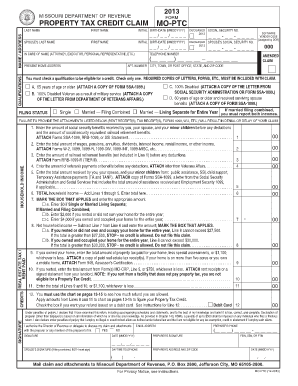

The MO PTC Property Tax Credit Claim is a form provided by the Missouri Department of Revenue. It allows eligible individuals to claim a credit against their property taxes. This credit is designed to assist those who may be financially burdened by property taxes, including senior citizens, disabled individuals, and certain low-income residents. Understanding the purpose and eligibility criteria for this form is crucial for those seeking financial relief through property tax credits.

Steps to Complete the MO PTC Property Tax Credit Claim

Completing the MO PTC form involves several important steps to ensure accuracy and compliance. First, gather all necessary documentation, including proof of income and property tax payments. Next, fill out the form with accurate personal information, including your name, address, and Social Security number. Be sure to complete the sections regarding your income and property details. After filling out the form, review it for any errors before submitting it to the Missouri Department of Revenue. Following these steps will help ensure a smooth application process.

Eligibility Criteria for the MO PTC Property Tax Credit Claim

To qualify for the MO PTC Property Tax Credit Claim, applicants must meet specific eligibility criteria. Generally, applicants must be at least sixty-five years old, or be a person with a disability. Additionally, the applicant's total household income must fall below a certain threshold, which is updated annually. It is also essential that the property for which the credit is claimed is the applicant's primary residence. Understanding these criteria is vital for determining if you can benefit from this tax credit.

Required Documents for the MO PTC Property Tax Credit Claim

When applying for the MO PTC Property Tax Credit Claim, specific documents are required to support your application. These typically include proof of income, such as tax returns or W-2 forms, and documentation of property tax payments, like receipts or statements from the local tax authority. Additionally, if applicable, proof of age or disability status may be required. Having these documents ready will facilitate a smoother application process and help ensure that your claim is processed efficiently.

Form Submission Methods for the MO PTC Property Tax Credit Claim

The MO PTC Property Tax Credit Claim can be submitted through various methods to accommodate applicants' preferences. You can file the form online through the Missouri Department of Revenue's website, which offers a convenient and efficient way to submit your claim. Alternatively, you may choose to print the form and mail it directly to the appropriate department. In-person submissions are also an option at designated local offices. Understanding these submission methods can help you choose the best approach for your situation.

Legal Use of the MO PTC Property Tax Credit Claim

The legal use of the MO PTC Property Tax Credit Claim is governed by Missouri state law. To ensure that your claim is valid, it is essential to comply with all legal requirements outlined by the Missouri Department of Revenue. This includes accurately reporting your income and property tax payments, as well as adhering to deadlines for submission. Failure to meet these legal standards may result in delays or denial of your claim. Being aware of these regulations helps protect your rights as a taxpayer and ensures that you receive any eligible credits.

Quick guide on how to complete mo ptc property tax credit claim missouri department of revenue dor mo

Complete MO PTC Property Tax Credit Claim Missouri Department Of Revenue Dor Mo effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your papers swiftly without delays. Manage MO PTC Property Tax Credit Claim Missouri Department Of Revenue Dor Mo on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to alter and eSign MO PTC Property Tax Credit Claim Missouri Department Of Revenue Dor Mo with ease

- Locate MO PTC Property Tax Credit Claim Missouri Department Of Revenue Dor Mo and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize crucial sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to share your form—via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device of your choice. Modify and eSign MO PTC Property Tax Credit Claim Missouri Department Of Revenue Dor Mo and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mo ptc property tax credit claim missouri department of revenue dor mo

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is mo ptc and how does it work with airSlate SignNow?

mo ptc refers to our unique approach in streamlining the document signing process using airSlate SignNow. It allows users to send and eSign documents seamlessly, from any device. With mo ptc, you can manage your documents in a cost-effective manner while maintaining compliance and security.

-

What pricing options are available for airSlate SignNow's mo ptc?

airSlate SignNow offers flexible pricing plans to suit various business needs, including options for individuals and teams. The mo ptc feature comes included in all plans, ensuring you have access to all the essential tools for document management and eSigning. You can choose a monthly or annual subscription based on your budget preferences.

-

What features does airSlate SignNow offer with mo ptc?

With mo ptc, airSlate SignNow provides features such as template creation, real-time tracking, and advanced security measures. The platform is designed to simplify the eSigning process, making it efficient for users to create, send, and manage their documents. Moreover, mo ptc includes integrations with popular applications to enhance productivity.

-

What are the benefits of using airSlate SignNow's mo ptc for my business?

Using mo ptc with airSlate SignNow improves your business efficiency by reducing the time spent on paper documents and manual signatures. This results in quicker turnaround times for contracts and agreements, helping you close deals faster. Additionally, the platform is user-friendly, making it accessible for all team members.

-

Can airSlate SignNow's mo ptc integrate with other software tools?

Yes, airSlate SignNow's mo ptc integrates seamlessly with various software tools, including CRM systems, project management software, and cloud storage services. These integrations enhance your workflow by allowing you to manage your documents and data in one centralized location. This capability maximizes productivity and minimizes the need for manual data entry.

-

Is airSlate SignNow’s mo ptc compliant with legal standards?

Absolutely, airSlate SignNow’s mo ptc is designed to comply with legal standards for electronic signatures, ensuring that your documents are legally binding. The platform adheres to international regulations such as the ESIGN Act and UETA, providing peace of mind for businesses. With robust security features, you can trust that your information is secure and compliant.

-

What kind of customer support is offered for airSlate SignNow's mo ptc users?

airSlate SignNow provides comprehensive customer support for mo ptc users, including live chat, email assistance, and an extensive knowledge base. Our support team is available to help answer any questions and resolve issues promptly. This ensures that you can maximize the benefits of using our platform without interruptions.

Get more for MO PTC Property Tax Credit Claim Missouri Department Of Revenue Dor Mo

Find out other MO PTC Property Tax Credit Claim Missouri Department Of Revenue Dor Mo

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed