Institution of Purely Public Charity Property Tax Exemption Co Ramsey Mn Form

What is the Institution of Purely Public Charity Property Tax Exemption Co Ramsey Mn

The Institution of Purely Public Charity Property Tax Exemption in Ramsey, Minnesota, is designed to provide property tax relief to organizations that operate for charitable purposes. This exemption applies to properties owned by institutions that meet specific criteria, ensuring that the properties are utilized for the public good. The aim is to support charitable organizations by reducing their financial burdens, allowing them to allocate more resources toward their missions.

Eligibility Criteria

To qualify for the Institution of Purely Public Charity Property Tax Exemption, organizations must meet several eligibility criteria. These typically include:

- The organization must be a nonprofit entity.

- It must operate primarily for charitable purposes.

- The property must be used exclusively for the exempt purpose.

- The organization must demonstrate that it provides a public benefit.

Each organization should carefully review these criteria to ensure compliance before applying for the exemption.

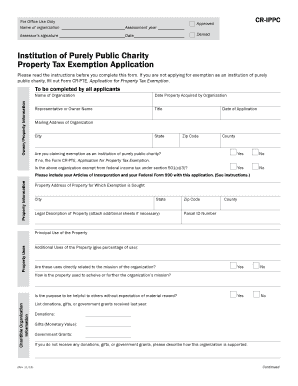

Steps to Complete the Institution of Purely Public Charity Property Tax Exemption Co Ramsey Mn

Completing the application for the Institution of Purely Public Charity Property Tax Exemption involves several key steps:

- Gather necessary documentation, including proof of nonprofit status and a description of the charitable activities.

- Complete the application form accurately, ensuring all required fields are filled out.

- Submit the application to the appropriate local tax authority in Ramsey.

- Await confirmation of the exemption status from the tax authority.

Each step is crucial to ensure that the application is processed smoothly and efficiently.

Required Documents

When applying for the Institution of Purely Public Charity Property Tax Exemption, organizations must provide specific documents to support their application. Commonly required documents include:

- Proof of nonprofit status, such as IRS determination letters.

- Financial statements demonstrating the organization’s charitable activities.

- A detailed description of how the property is used for charitable purposes.

- Any additional documentation requested by the local tax authority.

Providing complete and accurate documentation can significantly affect the approval process.

Legal Use of the Institution of Purely Public Charity Property Tax Exemption Co Ramsey Mn

The legal use of the Institution of Purely Public Charity Property Tax Exemption is governed by state laws and regulations. Organizations must ensure that they adhere to these legal requirements to maintain their exempt status. This includes using the property solely for charitable purposes and complying with any reporting or renewal requirements set by local authorities. Failure to comply with these regulations may result in the loss of the exemption.

Form Submission Methods

Organizations can submit their application for the Institution of Purely Public Charity Property Tax Exemption through various methods. Typically, these methods include:

- Online submission via the local tax authority's website.

- Mailing a physical copy of the application to the tax office.

- In-person submission at the local tax authority's office.

Each method has its own advantages, and organizations should choose the one that best fits their needs and capabilities.

Quick guide on how to complete institution of purely public charity property tax exemption co ramsey mn

Effortlessly Prepare Institution Of Purely Public Charity Property Tax Exemption Co Ramsey Mn on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a superb environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any delays. Manage Institution Of Purely Public Charity Property Tax Exemption Co Ramsey Mn on any platform using airSlate SignNow’s Android or iOS apps and simplify any document-related task today.

The Easiest Way to Alter and eSign Institution Of Purely Public Charity Property Tax Exemption Co Ramsey Mn with Ease

- Obtain Institution Of Purely Public Charity Property Tax Exemption Co Ramsey Mn and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Choose how you wish to share your form—via email, SMS, or invite link, or download it to your computer.

Eliminate concerns over lost or mislaid documents, tedious form searching, or mistakes that require printing new document versions. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Institution Of Purely Public Charity Property Tax Exemption Co Ramsey Mn to ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the institution of purely public charity property tax exemption co ramsey mn

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 'Institution Of Purely Public Charity Property Tax Exemption Co Ramsey Mn'?

The 'Institution Of Purely Public Charity Property Tax Exemption Co Ramsey Mn' refers to a specific exemption for nonprofit organizations in Ramsey County, Minnesota. This exemption allows qualifying entities to be exempted from property taxes, promoting public charity efforts. Organizations must meet certain criteria to qualify and should consult local regulations for details.

-

How can airSlate SignNow help organizations applying for this exemption?

airSlate SignNow streamlines document preparation and signing processes, making it easier for organizations applying for the 'Institution Of Purely Public Charity Property Tax Exemption Co Ramsey Mn.' Our platform allows users to prepare necessary forms, collect eSignatures, and manage documents efficiently, ensuring a smooth application process.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers features like eSignature collection, document templates, and automated workflows that simplify document management for organizations. This includes tools specifically beneficial for nonprofits seeking the 'Institution Of Purely Public Charity Property Tax Exemption Co Ramsey Mn.' Efficient document handling enhances compliance and saves time.

-

Is airSlate SignNow cost-effective for nonprofits applying for property tax exemptions?

Yes, airSlate SignNow is designed as a cost-effective solution for nonprofits, including those applying for the 'Institution Of Purely Public Charity Property Tax Exemption Co Ramsey Mn.' We offer various pricing plans that cater to different budgets, ensuring organizations can access essential eSigning tools without excessive costs.

-

Are there integrations available with airSlate SignNow for other software?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications, enhancing efficiency for organizations pursuing the 'Institution Of Purely Public Charity Property Tax Exemption Co Ramsey Mn.' This includes integrations with popular CRM systems, cloud storage services, and project management tools, allowing for a smoother workflow.

-

What benefits do organizations receive from using airSlate SignNow?

Organizations using airSlate SignNow can enjoy faster document turnaround times, improved collaboration, and reduced paper usage. These benefits are especially important for those applying for the 'Institution Of Purely Public Charity Property Tax Exemption Co Ramsey Mn.' By leveraging our platform, nonprofits can focus more on their mission rather than administrative tasks.

-

What kind of support does airSlate SignNow provide to users?

We offer comprehensive support to airSlate SignNow users, including dedicated customer service and extensive online resources. For organizations navigating the 'Institution Of Purely Public Charity Property Tax Exemption Co Ramsey Mn,' our support team is available to assist with any questions or technical issues that may arise during the document signing process.

Get more for Institution Of Purely Public Charity Property Tax Exemption Co Ramsey Mn

- Cays foundation form

- Cv transcelerate template form

- Library employment application form

- Preschool application form pdf

- Dari mart application form

- Employer affidavit state of ny county student affairs studentaffairs stonybrook form

- Ppe competency checklist form

- Personal leave request form mattress firm benefits

Find out other Institution Of Purely Public Charity Property Tax Exemption Co Ramsey Mn

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT